Question: Please Help me as soon as possible nad Please make sure the answer is correct! An industrial engineer proposed the purchase of RFID Fixed-Asset Tracking

Please Help me as soon as possible nad Please make sure the answer is correct!\

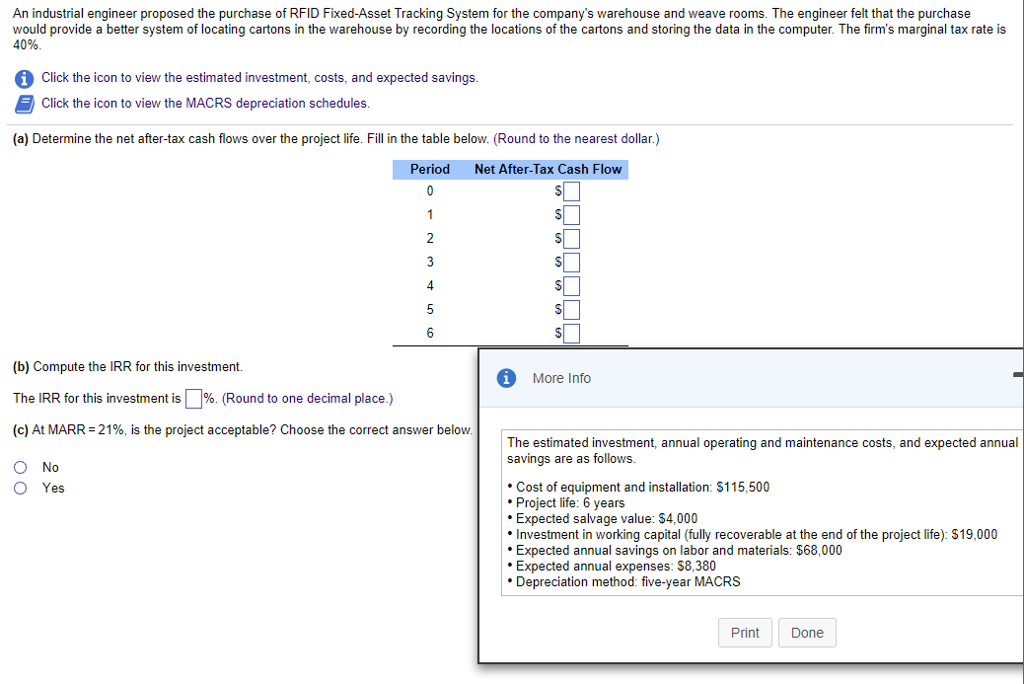

An industrial engineer proposed the purchase of RFID Fixed-Asset Tracking System for the company's warehouse and weave rooms. The engineer felt that the purchase would provide a better system of locating cartons in the warehouse by recording the locations of the cartons and storing the data in the computer. The firm's marginal tax rate is 40% 1 Click the icon to view the estimated investment, costs, and expected savings Click the icon to view the MACRS depreciation schedules (a) Determine the net after-tax cash flows over the project life. Fill in the table below. (Round to the nearest dollar.) Period Net After-Tax Cash Flow (b) Compute the IRR for this investment. The IRR for this investment is 96 (Round to one decimal place ) (c) At MARR 21%, is the project acceptable? Choose the correct answer below More Info The estimated investment, annual operating and maintenance costs, and expected annual savings are as follows. No Cost of equipment and installation: $115,500 Project life: 6 years Expected salvage value: $4,000 Investment in working capital (fully recoverable at the end of the project life): $19,000 Expected annual savings on labor and materials: $68,000 Expected annual expenses: $8,380 Depreciation method: five-year MACRS es Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts