Question: please help me ASAP and write neatly Question 2 (40 marks 60 MINUTES) DFIDO Limited is a company involved in retailing of special event promotional

please help me ASAP and write neatly

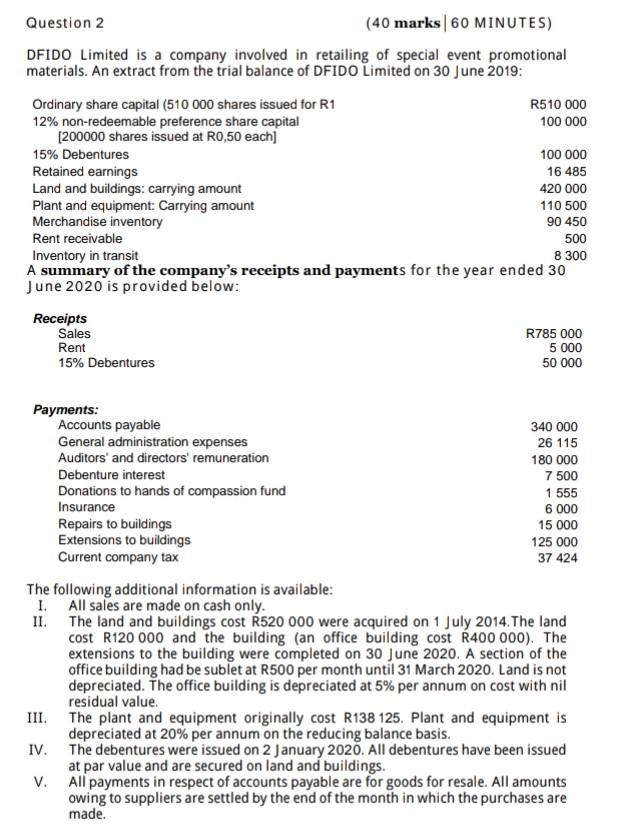

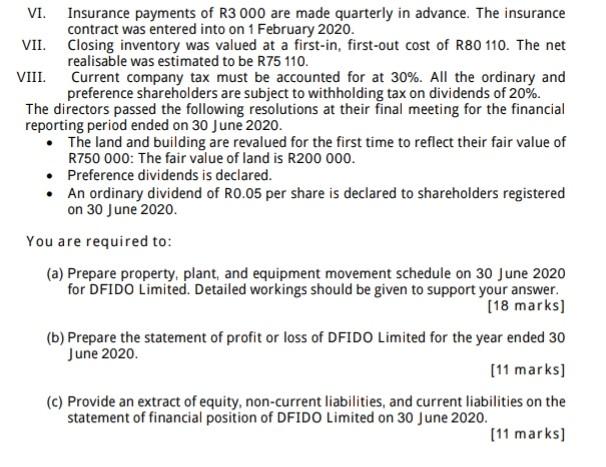

Question 2 (40 marks 60 MINUTES) DFIDO Limited is a company involved in retailing of special event promotional materials. An extract from the trial balance of DFIDO Limited on 30 June 2019: Ordinary share capital (510 000 shares issued for R1 R510 000 12% non-redeemable preference share capital 100 000 [200000 shares issued at R0,50 each] 15% Debentures 100 000 Retained earnings 16 485 Land and buildings: carrying amount 420 000 Plant and equipment: Carrying amount 110 500 Merchandise inventory 90 450 Rent receivable 500 Inventory in transit 8 300 A summary of the company's receipts and payments for the year ended 30 June 2020 is provided below: Receipts Sales R785 000 Rent 5 000 15% Debentures 50 000 Payments: Accounts payable 340 000 General administration expenses 26 115 Auditors' and directors' remuneration 180 000 Debenture interest 7 500 Donations to hands of compassion fund 1 555 Insurance 6 000 Repairs to buildings 15 000 Extensions to buildings 125 000 Current company tax 37 424 The following additional information is available: I. All sales are made on cash only. II. The land and buildings cost R520 000 were acquired on 1 July 2014. The land cost R120 000 and the building (an office building cost R400 000). The extensions to the building were completed on 30 June 2020. A section of the office building had be sublet at R500 per month until 31 March 2020. Land is not depreciated. The office building is depreciated at 5% per annum on cost with nil residual value. III. The plant and equipment originally cost R138 125. Plant and equipment is depreciated at 20% per annum on the reducing balance basis. IV. The debentures were issued on 2 January 2020. All debentures have been issued at par value and are secured on land and buildings. V. All payments in respect of accounts payable are for goods for resale. All amounts owing to suppliers are settled by the end of the month in which the purchases are made. VI. Insurance payments of R3 000 are made quarterly in advance. The insurance contract was entered into on 1 February 2020. VII. Closing inventory was valued at a first-in, first-out cost of R80 110. The net realisable was estimated to be R75 110. VIII. Current company tax must be accounted for at 30%. All the ordinary and preference shareholders are subject to withholding tax on dividends of 20%. The directors passed the following resolutions at their final meeting for the financial reporting period ended on 30 June 2020. The land and building are revalued for the first time to reflect their fair value of R750 000: The fair value of land is R200 000. Preference dividends is declared. An ordinary dividend of Ro.05 per share is declared to shareholders registered on 30 June 2020. You are required to: (a) Prepare property, plant, and equipment movement schedule on 30 June 2020 for DFIDO Limited. Detailed workings should be given to support your answer. [18 marks] (b) Prepare the statement of profit or loss of DFIDO Limited for the year ended 30 June 2020. [11 marks) (c) Provide an extract of equity, non-current liabilities, and current liabilities on the statement of financial position of DFIDO Limited on 30 June 2020. [11 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts