Question: Please help me ASAP. Thank you for your help! 5. Imagine there are two risky assets and the risk-free asset of the US bond in

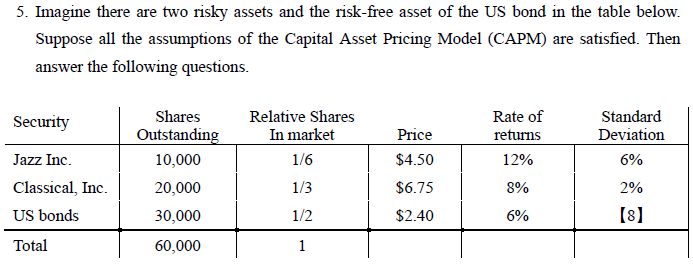

5. Imagine there are two risky assets and the risk-free asset of the US bond in the table below. Suppose all the assumptions of the Capital Asset Pricing Model (CAPM) are satisfied. Then answer the following questions. [D3]: Answer the equation of the Capital market line. D4]: Consider two cases that the covariance between the market portfolio and the stock of classic Inc. is (i) 0.002 and (ii) 0.001 in the above setting. Then, explain what is different between two cases and which case is more likely in the setting in the five lines. 5. Imagine there are two risky assets and the risk-free asset of the US bond in the table below. Suppose all the assumptions of the Capital Asset Pricing Model (CAPM) are satisfied. Then answer the following questions. [D3]: Answer the equation of the Capital market line. D4]: Consider two cases that the covariance between the market portfolio and the stock of classic Inc. is (i) 0.002 and (ii) 0.001 in the above setting. Then, explain what is different between two cases and which case is more likely in the setting in the five lines

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts