Question: PLEASE HELP ME !!! ASAP !!! THSNK YOU !!! 1.) Compute the company's contribution margin in total dollars and per unit dollars under the 3

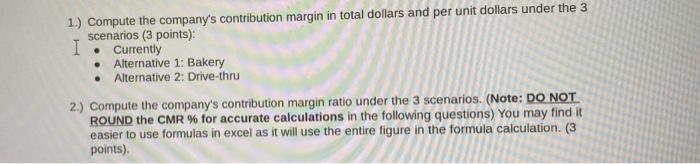

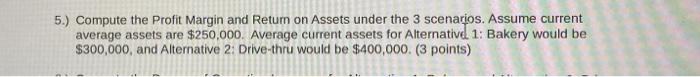

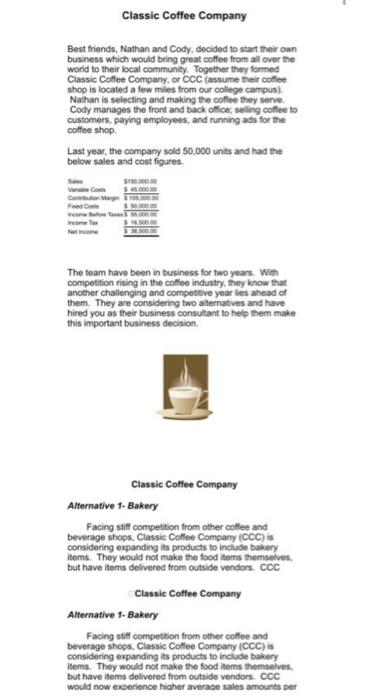

1.) Compute the company's contribution margin in total dollars and per unit dollars under the 3 scenarios ( 3 points): - Currently - Alternative 1: Bakery - Alternative 2: Drive-thru 2.) Compute the company's contribution margin ratio under the 3 scenarios. (Note: DO NOT ROUND the CMR % for accurate calculations in the following questions) You may find it easier to use formulas in excel as it will use the entire figure in the formula calculation. (3 points). 5.) Compute the Profit Margin and Retum on Assets under the 3 scenarios. Assume current average assets are $250,000. Average current assets for Alternative. 1: Bakery would be $300,000, and Alternative 2: Drive-thru would be $400,000. (3 points) 8.) Assume that the company expects customer sales to increase by 20% next year. There will be no change in sales prices. Compute the net income for each of the three scenarios (assume a 30% tax rate). (6 points) 9.) Compute the sales units required if the company wishes to generate a Target Income Before Taxes of $100,000 for all 3 scenarios. ( 6 points) 10.) What would the net income be under Altemative 1-Bakery and Alternative 2-Drive-Thru if CCC was unable to increase sales in units (sales units remain the same as last year)? (4 points). Best friends, Nathan and Cody, decided to stant their own business which would bring great coffoe from all over the world to their local communify. Together they formed Classic Collee Company, or CCC (assume their cottee shop is located a few miles from our college campus). Nathan is selecting and making the coffee they serve. Cody manages the front and back office, seling coffee to customers, paying employees, and nunning ads for the coffee shop. Last year, the company sold 50.000 units and had the below sales and cost figures. The team have been in business for two years. With competition rising in the coffee industry, they know that another challenging and compettive yoar lies ahead of them. They are considering two allernatives and have hired you as their business consulant to help them make this important business decision. Classic Coffee Company Alternative 1. Bakery Facing stiff competition from other coflee and beverage shops. Classic Coffee Company (CCC) is considering expanding its products to include bakery items. They would not make the food items themselves. but have items delivered from outside vendors. CCC Classic Coffee Company Alternative 1. Bakery Facing otill competion from other collee and beverage shops. Classic Coflee Company (CCC) as considering expanding is products to include bakery items. They would not make the food items themseives. but have items delivered from outtide vendors. CCC would now exberience hiaher avorace sales amounts ber Ciassic Cotitee Company Alternative 1- Bakery Facing stif compettion from other coflee and bewvrage shops, Classic Cofied Company (CCC) is considering expanding its products io include bakery items. They would not make the food isems themsolves. but have items delivered from outside vendors. CCC would now experience higher average 1 ales amounts per customer since beverage sales may be acoonpanied with food sales. This would. however, increase the compary/s variable costs since it would noed to punchase the food liems from outside vendors. The following data pertains to adding the bakory option: - Total saies in the number of units would increase 25\%s with the added bakery option. - The average sales price per unit would increase trom the curront $3.00 is 5500 when food sales aro added is the coffee shop. - The variable cost per unit would increase to 5250 por unit to acoount for the added cost of bakery itens. - There would be an incroase in fixed costs of S25.000 for advertising to inform the public of this change. Afternative 2-Drive Thru CCC is thinking about having a drive-tru installed. Having this amenity would help the collee shop increase its customer base, allowing them to reach a greater number of customers. This added convenience would permit CCC to slightly increase the price of its average colfee and would not increase the per unit variable costs for the company. The following data pertains to adding the drive-thru option: - This altemative is exclusive of altemative 1 - Total sales in the number of units would increase by 130% from last year. - The construction of the drive-thru would increase fixed costs by $130,000 - which represents onetime construction and installation costs. - This altemative would alow CCC to increase their average sales price to 5320 a cup of collee and their variable cost per unit would remain the same at $0.90 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts