Question: PLEASE HELP ME ASNWER ALL QUESTION!!! THEY ARE FORMATTED AS SUBQUESTIONS AND I CANNOT SUBMIT WITHOUT ANSWERING ALL! Which of the following is FALSE regarding

PLEASE HELP ME ASNWER ALL QUESTION!!! THEY ARE FORMATTED AS SUBQUESTIONS AND I CANNOT SUBMIT WITHOUT ANSWERING ALL!

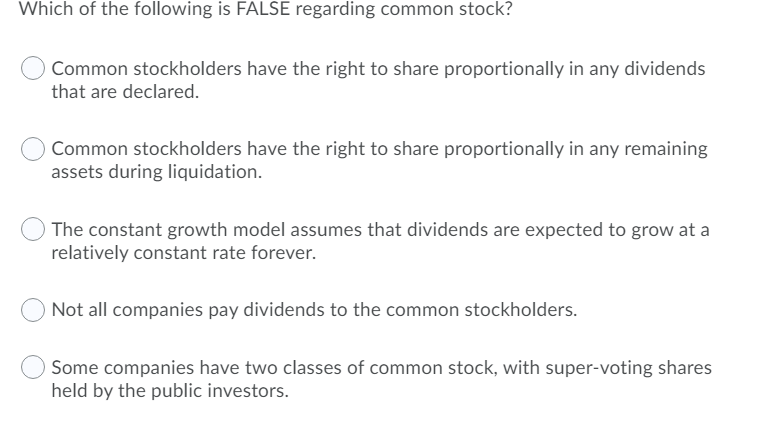

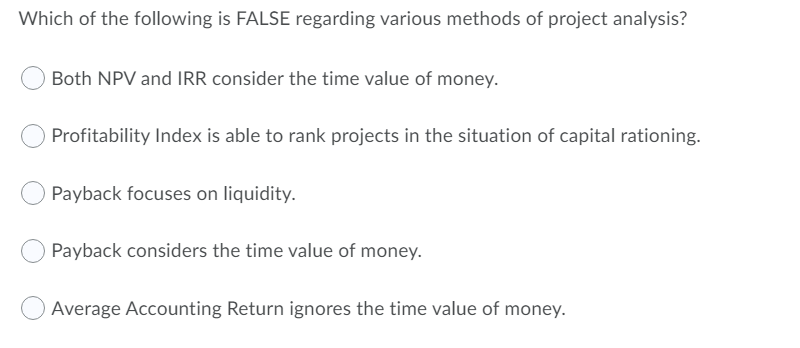

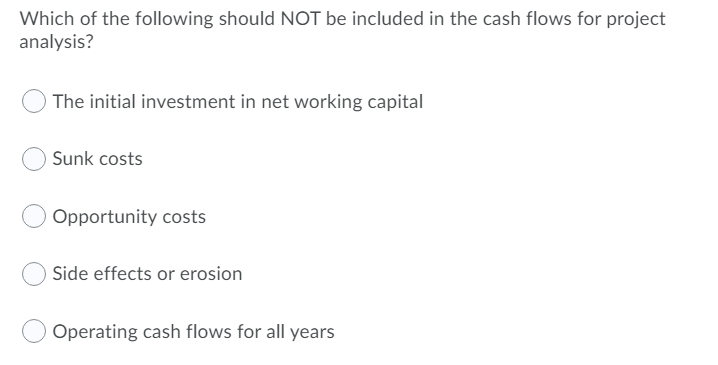

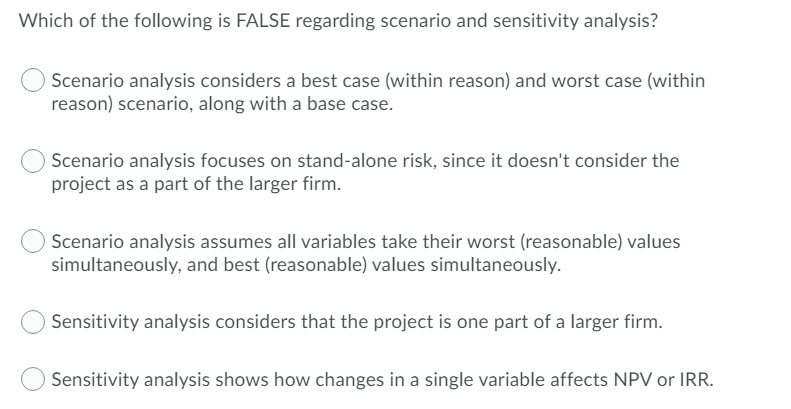

Which of the following is FALSE regarding common stock? Common stockholders have the right to share proportionally in any dividends that are declared. Common stockholders have the right to share proportionally in any remaining assets during liquidation. The constant growth model assumes that dividends are expected to grow at a relatively constant rate forever. Not all companies pay dividends to the common stockholders. Some companies have two classes of common stock, with super-voting shares held by the public investors. Which of the following is FALSE regarding various methods of project analysis? Both NPV and IRR consider the time value of money. Profitability Index is able to rank projects in the situation of capital rationing. Payback focuses on liquidity. Payback considers the time value of money. Average Accounting Return ignores the time value of money. Which of the following should NOT be included in the cash flows for project analysis? The initial investment in net working capital Sunk costs Opportunity costs Side effects or erosion Operating cash flows for all years Which of the following is FALSE regarding scenario and sensitivity analysis? Scenario analysis considers a best case (within reason) and worst case (within reason) scenario, along with a base case. Scenario analysis focuses on stand-alone risk, since it doesn't consider the project as a part of the larger firm. Scenario analysis assumes all variables take their worst (reasonable) values simultaneously, and best (reasonable) values simultaneously. Sensitivity analysis considers that the project is one part of a larger firm. Sensitivity analysis shows how changes in a single variable affects NPV or IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts