Please help me calculate the following:

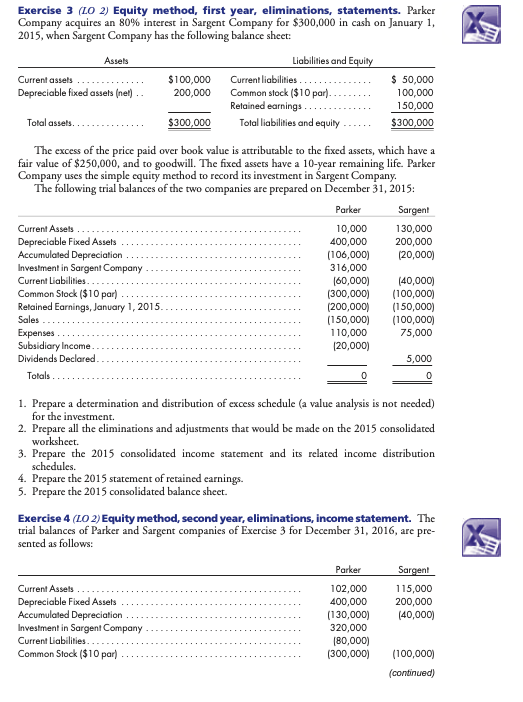

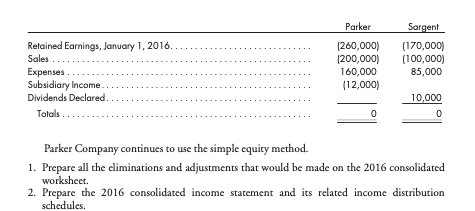

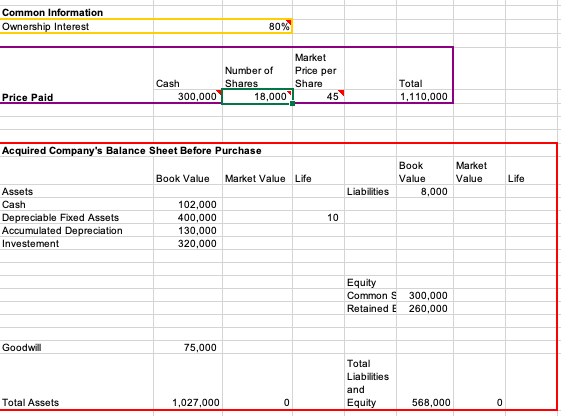

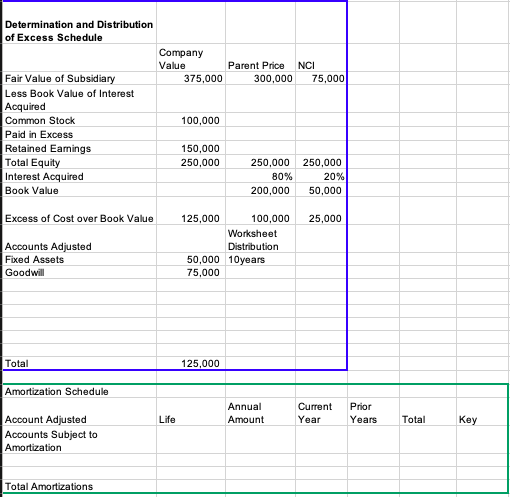

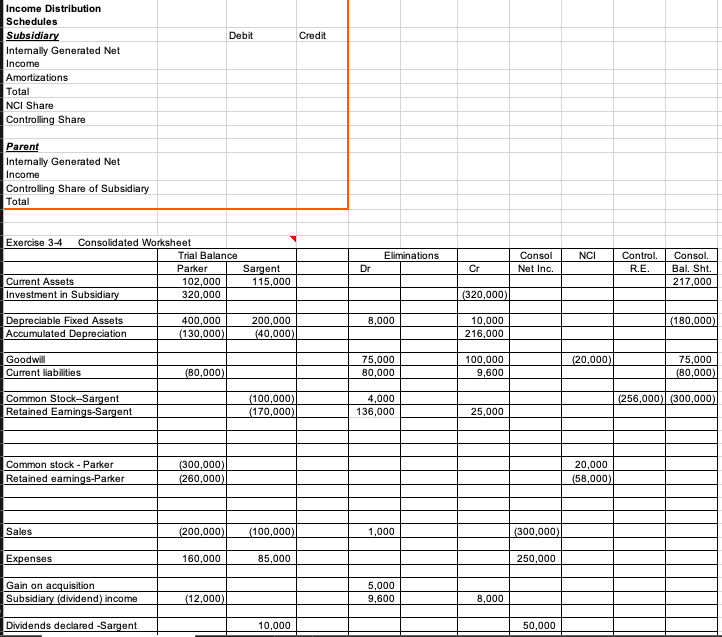

Exercise 3 (10 2) Equity method, first year, eliminations, statements. Parker Company acquires an 80% interest in Sargent Company for $300,000 in cash on January 1, 2015, when Sargent Company has the following balance sheet: Assets Liabilities and Equity Current assets . . . . . . . . . $100,000 Current liabilities $ 50,000 Depreciable fixed assets (net) . . 200,000 Common stock ($10 par)- 100,000 Relained earnings . . 150,000 Total assets. . . . $300,000 Total liabilities and equity . .. . . . $300,000 The excess of the price paid over book value is attributable to the fixed assets, which have a fair value of $250,000, and to goodwill. The fixed assets have a 10-year remaining life. Parker Company uses the simple equity method to record its investment in Sargent Company. The following trial balances of the two companies are prepared on December 31, 2015: Parker Sargent Current Assets . . . 10,000 130,000 Depreciable Fixed Assets 400,000 200,000 Accumulated Depreciation . . (106,000) (20,000) Investment in Sargent Company 316,000 Current Liabilities. . .. (60,000) (40,000) Common Stock ($10 par) . . . . . (300,000) (100,000) Retained Earnings, January 1, 2015. (200,000) (150,000) Sales (150,000) (100,000) Expenses . . 110,000 75,000 Subsidiary Income. (20,000) Dividends Declared. 5,000 Totals 1. Prepare a determination and distribution of excess schedule (a value analysis is not needed) for the investment. 2. Prepare all the eliminations and adjustments that would be made on the 2015 consolidated worksheet. 3. Prepare the 2015 consolidated income statement and its related income distribution schedules. 4. Prepare the 2015 statement of retained earnings. 5. Prepare the 2015 consolidated balance sheet. Exercise 4 (LO 2) Equity method, second year, eliminations, income statement. The trial balances of Parker and Sargent companies of Exercise 3 for December 31, 2016, are pre- sented as follows: Parker Sargent Current Assets . . . .- 102,000 115,000 Depreciable Fixed Assets 400,000 200,000 Accumulated Depreciation (130,000) (40,000) Investment in Sargent Company 320,000 Current Liabilities. . [80,000) Common Stock ($10 par) . . . . .. (300,000) (100,000) (continued)Parker Sargent Retained Earnings, January 1, 2016. ... (260,000) [170,000) Sales . . . . ... (200,000) (100,000) Expenses . 160,000 85,000 Subsidiary Income. .. (12,000) Dividends Declared. .. . 10,000 Totals . . ... 0 0 Parker Company continues to use the simple equity method. 1. Prepare all the eliminations and adjustments that would be made on the 2016 consolidated worksheet. 2. Prepare the 2016 consolidated income statement and its related income distribution schedules.Common Information Ownership Interest 80% Market Number of Price per Cash Shares Share Total Price Paid 300,000 18,000 45 1,110,000 Acquired Company's Balance Sheet Before Purchase Book Market Book Value Market Value Life Value Value Life Assets Liabilities 8,000 Cash 102,000 Depreciable Fixed Assets 400,000 10 Accumulated Depreciation 130,000 Investement 320,000 Equity Common $ 300,000 Retained E 260,000 Goodwill 75,000 Total Liabilities and Total Assets 1,027,000 Equity 568,000Determination and Distribution of Excess Schedule Company Value Parent Price NCI Fair Value of Subsidiary 375,000 300,000 75,000 Less Book Value of Interest Acquired Common Stock 100,000 Paid in Excess Retained Earnings 150,000 Total Equity 250,000 250,000 250,000 Interest Acquired 80% 20% Book Value 200,000 50,000 Excess of Cost over Book Value 125,000 100,000 25,000 Worksheet Accounts Adjusted Distribution Fixed Assets 50,000 10years Goodwill 75,000 Total 125,000 Amortization Schedule Annual Current Prior Account Adjusted Life Amount Year Years Total Key Accounts Subject to Amortization Total AmortizationsIncome Distribution Schedules Subsidiary Debit Credit Internally Generated Net Income Amortizations Total NCI Share Controlling Share Parent Internally Generated Net Income Controlling Share of Subsidiary Total Exercise 3-4 Consolidated Worksheet Trial Balance Eliminations Parker Consol NCI Sargent Dr Control. Cr Consol. Current Assets 102,000 115,000 Net Inc. R.E Bal. Sht. Investment in Subsidiary 20,000 (320,000) 217,000 Depreciable Fixed Assets 400,000 200,000 8,000 Accumulated Depreciation (130,000) 10,000 (40,000) 216,000 (180,000) Goodwill Current liabilities 75,000 (80,000) 100,000 (20,000) 80,000 75,000 9,600 80,000 Common Stock-Sargent (100,000) Retained Earnings-Sargent 4,000 (170,000) 136,000 (256,000) (300,000) 25,000 Common stock - Parker 300,000) Retained earnings-Parker 20,000 260,000) (58,000) Sales 200,000) (100,000) 1,000 (300,000) Expenses 160,000 85,000 250,000 Gain on acquisition Subsidiary (dividend ) income 5,000 (12,000) 9,600 8,000 Dividends declared -Sargent 10,000 50,000