Question: Please help me calculate the missing information in the chart - sales revnue, gross profit, income before tax, income tax expense and net income. .

Please help me calculate the missing information in the chart sales revnue, gross profit, income before tax, income tax expense and net income. This is all the infromation I have!

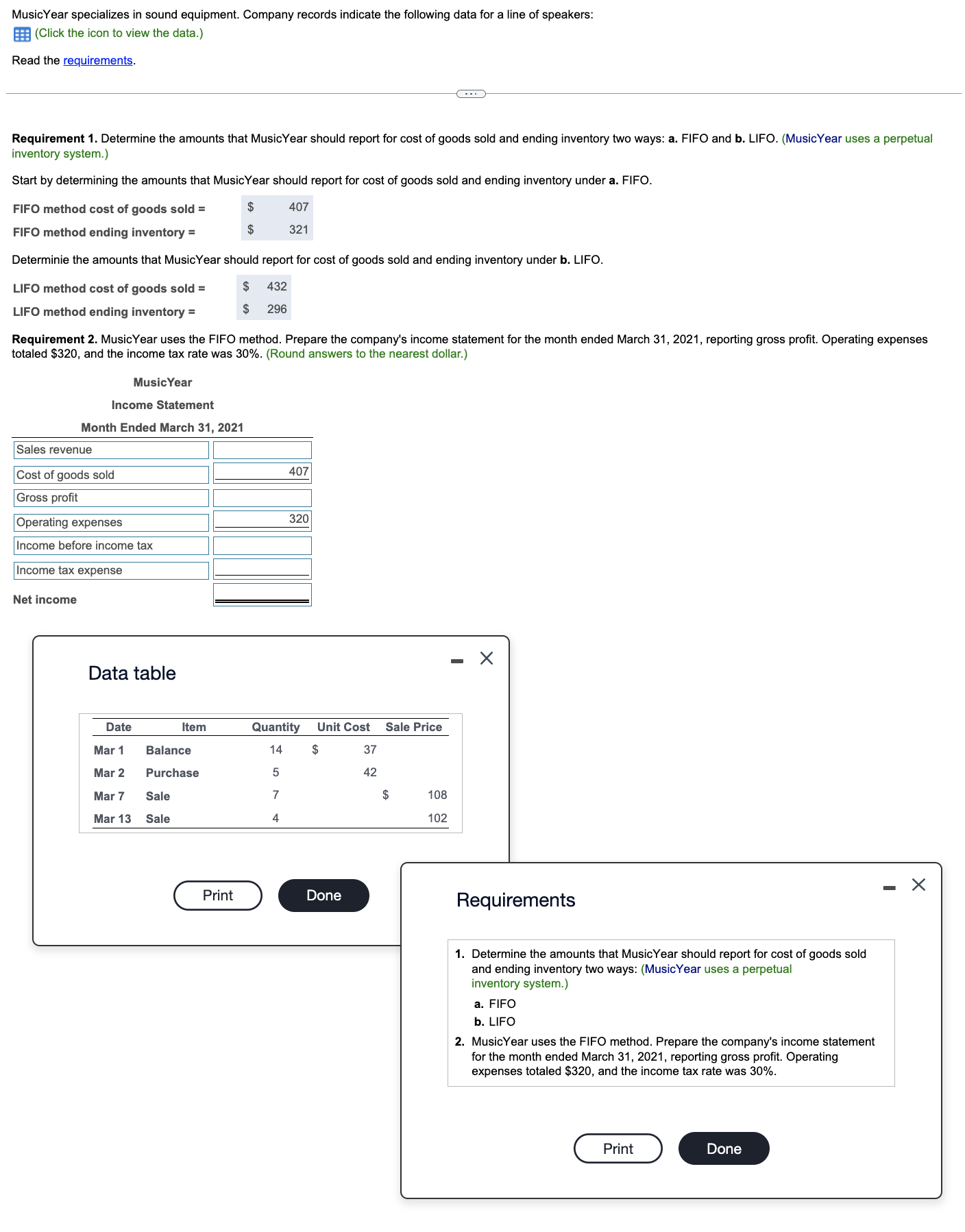

MusicYear specializes in sound equipment. Company records indicate the following data for a line of speakers:

Click the icon to view the data.

Read the requirements.

Requirement Determine the amounts that MusicYear should report for cost of goods sold and ending inventory two ways: a FIFO and b LIFO. MusicYear uses a perpetual inventory system.

Start by determining the amounts that MusicYear should report for cost of goods sold and ending inventory under a FIFO.

FIFO method cost of goods sold

FIFO method ending inventory

Determinie the amounts that MusicYear should report for cost of goods sold and ending inventory under b LIFO.

LIFO method cost of goods sold

LIFO method ending inventory

$

$

Requirement MusicYear uses the FIFO method. Prepare the company's income statement for the month ended March reporting gross profit. Operating expenses totaled $ and the income tax rate was Round answers to the nearest dollar.

MusicYear

Income Statement

Month Ended March

Data table

tableDateItem,Quantity,Unit Cost,,Sale PriceMar Balance,$Mar Purchase,Mar Sale,$Mar Sale,

Requirements

Determine the amounts that MusicYear should report for cost of goods sold and ending inventory two ways: MusicYear uses a perpetual inventory system.

a FIFO

b LIFO

MusicYear uses the FIFO method. Prepare the company's income statement for the month ended March reporting gross profit. Operating expenses totaled $ and the income tax rate was

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock