Question: Please help me complete the cash flow statement according to the requirements of the topic. Please pay special attention to check whether the data marked

Please help me complete the cash flow statement according to the requirements of the topic. Please pay special attention to check whether the data marked in yellow is correct. At the same time, please carefully read the answer prompts corresponding to each variable. Please make sure your answers are all correct and tell me The calculation formula and specific steps of each answer, thank you!

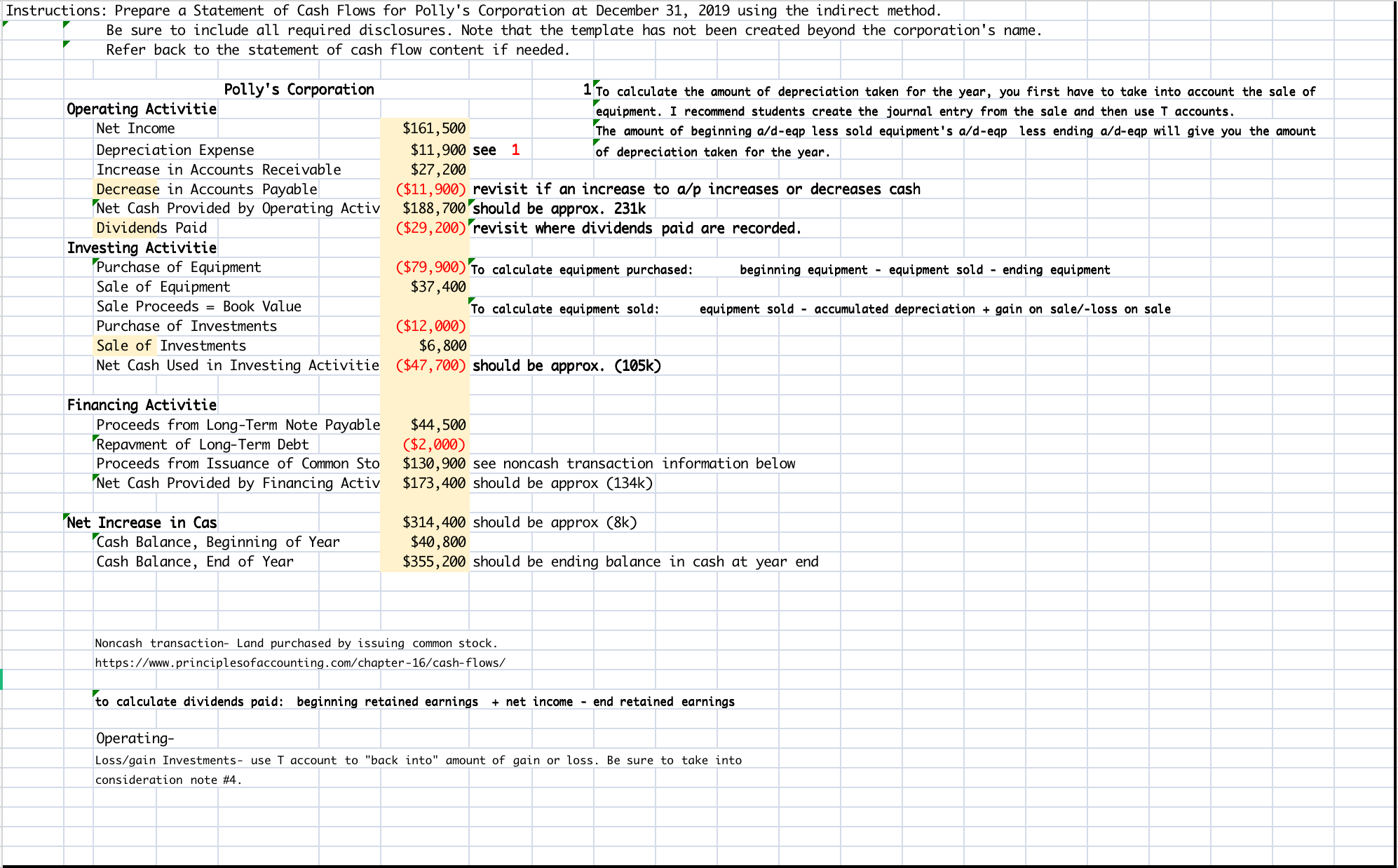

Instructions: Prepare a Statement of Cash Flows for Polly's Corporation at December 31 , 2019 using the indirect method. Be sure to include all required disclosures. Note that the template has not been created beyond the corporation's name. Refer back to the statement of cash flow content if needed. Polly's Corporation Operating Activitie Net Income Depreciation Expense Increase in Accounts Receivable Decrease in Accounts Payable Net Cash Provided by Operating Activ Dividends Paid Investing Activitie Purchase of Equipment Sale of Equipment Sale Proceeds \\( = \\) Book Value Purchase of Investments Sale of Investments Net Cash Used in Investing Activitie Financing Activitie Proceeds from Long-Term Note Payable Repavment of Long-Term Debt Proceeds from Issuance of Common Sto Net Cash Provided by Financing Activ Net Increase in Cas Cash Balance, Beginning of Year Cash Balance, End of Year 1 To calculate the amount of depreciation taken for the year, you first have to take into account the sale of equipment. I recommend students create the journal entry from the sale and then use \\( T \\) accounts. The amount of beginning \\( a / d \\)-eqp less sold equipment's a/d-eqp less ending a/d-eap will give you the amount of depreciation taken for the year. \\( \\$ 11,900 \\) see 1 \\( \\$ 27,200 \\) \\( (\\$ 11,900) \\) revisit if an increase to \\( a / p \\) increases or decreases cash \\( \\$ 188,700 \\) should be approx. 231k \\( (\\$ 29,200) \\) 'revisit where dividends paid are recorded. \\( (\\$ 79,900) \\) To calculate equipment purchased: beginning equipment - equipment sold - ending equipment \\( \\$ 37,400 \\) To calculate equipment sold: equipment sold - accumulated depreciation + gain on sale/-loss on sale \\( (\\$ 12,000) \\) \\( \\$ 6,800 \\) \\( (\\$ 47,700) \\) should be approx. (105k) \\( \\$ 44,500 \\) \\( (\\$ 2,000) \\) \\( \\$ 130,900 \\) see noncash transaction information below \\( \\$ 173,400 \\) should be approx (134k) \\( \\$ 314,400 \\) should be approx (8k) \\( \\$ 40,800 \\) \\( \\$ 355,200 \\) should be ending balance in cash at year end Noncash transaction- Land purchased by issuing common stock. https://www.principlesofaccounting.com/chapter-16/cash-flows/ to calculate dividends paid: beginning retained earnings + net income - end retained earnings Operating- Loss/gain Investments- use T account to \"back into\" amount of gain or loss. Be sure to take into consideration note \\#4. Instructions: Prepare a Statement of Cash Flows for Polly's Corporation at December 31 , 2019 using the indirect method. Be sure to include all required disclosures. Note that the template has not been created beyond the corporation's name. Refer back to the statement of cash flow content if needed. Polly's Corporation Operating Activitie Net Income Depreciation Expense Increase in Accounts Receivable Decrease in Accounts Payable Net Cash Provided by Operating Activ Dividends Paid Investing Activitie Purchase of Equipment Sale of Equipment Sale Proceeds \\( = \\) Book Value Purchase of Investments Sale of Investments Net Cash Used in Investing Activitie Financing Activitie Proceeds from Long-Term Note Payable Repavment of Long-Term Debt Proceeds from Issuance of Common Sto Net Cash Provided by Financing Activ Net Increase in Cas Cash Balance, Beginning of Year Cash Balance, End of Year 1 To calculate the amount of depreciation taken for the year, you first have to take into account the sale of equipment. I recommend students create the journal entry from the sale and then use \\( T \\) accounts. The amount of beginning \\( a / d \\)-eqp less sold equipment's a/d-eqp less ending a/d-eap will give you the amount of depreciation taken for the year. \\( \\$ 11,900 \\) see 1 \\( \\$ 27,200 \\) \\( (\\$ 11,900) \\) revisit if an increase to \\( a / p \\) increases or decreases cash \\( \\$ 188,700 \\) should be approx. 231k \\( (\\$ 29,200) \\) 'revisit where dividends paid are recorded. \\( (\\$ 79,900) \\) To calculate equipment purchased: beginning equipment - equipment sold - ending equipment \\( \\$ 37,400 \\) To calculate equipment sold: equipment sold - accumulated depreciation + gain on sale/-loss on sale \\( (\\$ 12,000) \\) \\( \\$ 6,800 \\) \\( (\\$ 47,700) \\) should be approx. (105k) \\( \\$ 44,500 \\) \\( (\\$ 2,000) \\) \\( \\$ 130,900 \\) see noncash transaction information below \\( \\$ 173,400 \\) should be approx (134k) \\( \\$ 314,400 \\) should be approx (8k) \\( \\$ 40,800 \\) \\( \\$ 355,200 \\) should be ending balance in cash at year end Noncash transaction- Land purchased by issuing common stock. https://www.principlesofaccounting.com/chapter-16/cash-flows/ to calculate dividends paid: beginning retained earnings + net income - end retained earnings Operating- Loss/gain Investments- use T account to \"back into\" amount of gain or loss. Be sure to take into consideration note \\#4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts