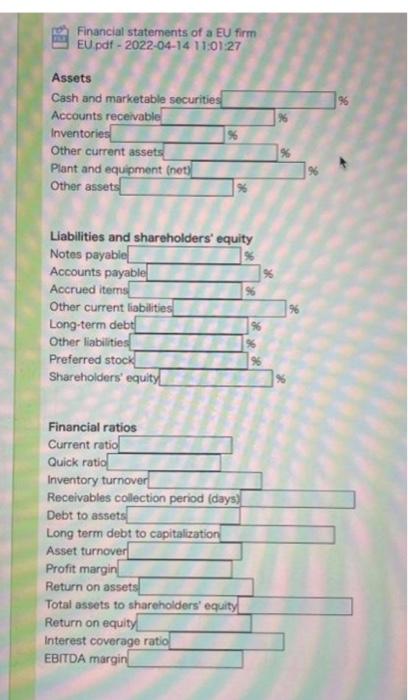

Question: Please help me complete the first chapter picture using the 2019 data. Please keep the answer in two decimal places. Materials Financial statements of a

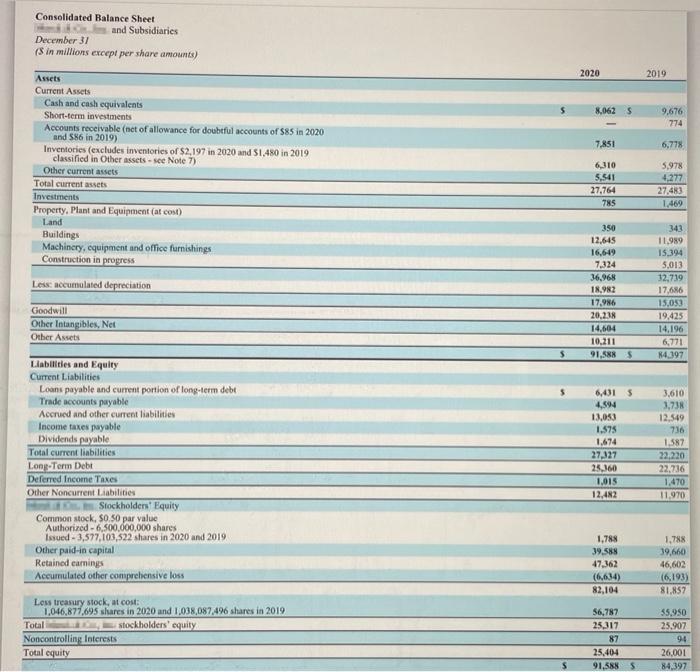

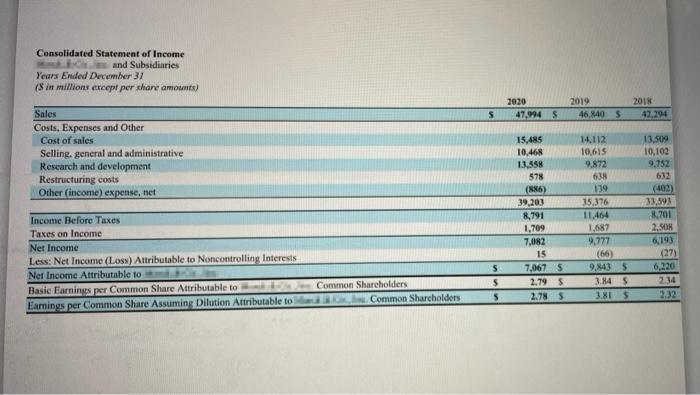

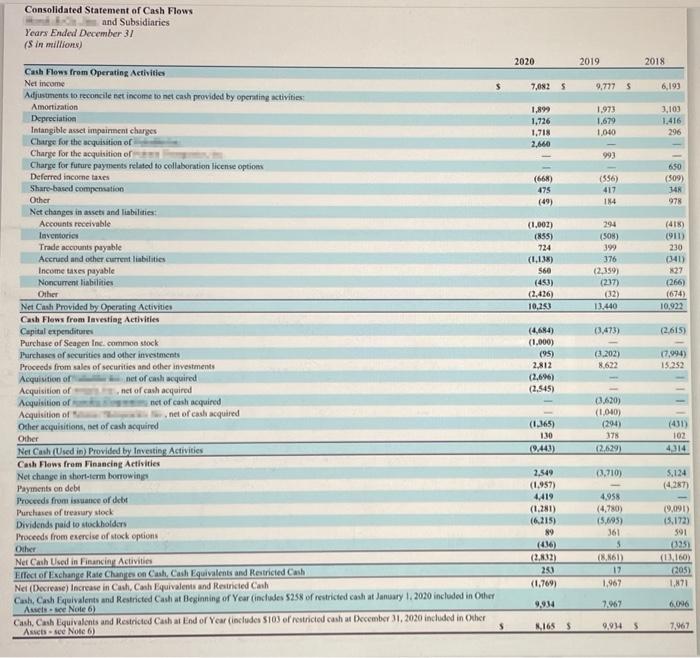

Financial statements of a EU firm EU pdf - 2022-04-14 11:01:27 Assets Cash and marketable securities Accounts receivable Inventories Other current assets Plant and equipment (net) Other assets! Liabilities and shareholders' equity Notes payable Accounts payable Accrued items Other current liabilities Long-term debt Other liabilities Preferred stock Shareholders' equity 96 96 Financial ratios Current ratio Quick ratio Inventory turnover! Receivables collection period (days) Debt to assets Long term debt to capitalization Asset turnover Profit margin Return on assets Total assets to shareholders' equity Return on equity Interest coverage ratio EBITDA margin Consolidated Balance Sheet and Subsidiaries December 31 (sin millions except per share amounts) 2020 2019 5 8,0625 9,676 774 7.851 6,778 Assets Current Assets Cash and cash equivalents Short-term investments Accounts receivable (net of allowance for doubtful accounts of $85 in 2020 and 586 in 2019) Inventories (excludes inventories of $2,197 in 2020 and 51.480 in 2019 classified in Other assets - see Note 7) Other current assets Total current assets Investments Property, Plant and Equipment (al cost) Land Buildings Machinery, equipment and office furnishings Construction in progress 6.310 5,541 27,764 785 5,978 4.277 27.483 1.469 Les accumulated depreciation 350 12,645 16,649 7,324 36,968 18,982 17,986 20.238 14,604 10.211 91,588 $ 341 11.989 15,394 5.013 12,719 17,686 15.053 19,425 14.196 6,771 N4197 Goodwill Other Intangibles, Net Other Assets $ Llabilities and Equity Current Liabilities Loans payable and current portion of long-term debt Trade accounts payable Accrued and other current liabilities Income taxes payable Dividends payable Total current liabilities Long-Term Debt Deferred Income Taxes Other Noncurrent Liabilities Stockholders' Equity Common stock, $0.50 par value Authorized - 6,500,000,000 shares Issued - 3,577,103,522 shares in 2020 and 2019 Other paid-in capital Retained earnings Accumulated other comprehensive loss 6,431 5 4,594 13.053 1.575 1.674 27.327 25,160 3.610 3,738 12.549 736 1.587 22,220 22,736 1.470 11.970 1.013 12.482 1,788 39.588 47.362 1.788 39,660 46,602 (6,193) 81,857 82,104 Less treasury stock, at cost: 1,046,877.695 shares in 2020 and 1,038,087,496 shares in 2019 Total stockholders' equily Noncontrolling Interests Total equity 56,787 25317 87 25,404 91,5885 55,950 25.907 94 26,001 84.397 Consolidated Statement of Income and Subsidiaries Years Ended December 31 (in millions except per share amounts) 2020 47.994 S 2019 46,840 S 2013 42,294 s Sales Costs, Expenses and Other Cost of sales Selling, general and administrative Research and development Restructuring costs Other (income) expense, net 13,509 10,102 9.752 Income Before Taxes Taxes on Income Net Income Less: Net Income (Loss) Attributable to Noncontrolling Interests Net Income Attributable to Basic Earnings per Common Share Attributable to Common Shareholders Earnings per Common Share Assuming Dilution Attributable to Common Shareholders 15,485 10,468 13.558 578 (886) 39,200 8,791 1.709 7,082 15 7,0675 2.795 2.78 5 14,112 10,615 9.872 638 139 35,376 11,464 1.687 2.777 (66) 9,843 5 3.84 5 3.815 (402) 33,593 3,701 2,50 6,193 (27) 6,220 2.14 2.32 $ s 5 Consolidated Statement of Cash Flows and Subsidiaries Years Ended December 31 (s in millions) 2020 2019 2018 7,082 5 9,777 $ 6,193 1,899 1,726 1,718 2.660 1.973 1.679 1.000 3,103 1.416 296 993 (668) 475 (49) (556) 417 184 650 (509) 348 978 294 (508) (1,007) (855) 724 (1.13) 560 (453) (2.426) 10,253 376 (2,359) (237) (4189 (911) 230 0341) 827 (266) (674) 10.922 (2) 13.440 (3,473) (2.615) Cash Flows from Operating Activities Net income Adjustments to reconcile net income to net cash provided by operating activities Amortization Depreciation Intangible asset impairment charges Charge for the acquisition of Charge for the acquisition or Charge for future payments related to collaboration license options Deferred income taxes Share-based compensation Other Net changes in assets and liabilities Accounts receivable Inventories Trade accounts payable Accrued and other current liabilities Income taxes payable Noncurrent liabilities Other Net Cash Provided by Operating Activities Cash Flows from Investing Activities Capital expenditures Purchase of Seagen Inc. common stock Purchases of securities and other investments Proceeds from sales of securities and other investments Acquisition of net of cash equired Acquisition of net of cash acquired Acquisition of net of cash acquired Acquisition of net of cash acquired Other acquisitions, set of cash acquired Other Net Cash (Used inProvided by Investing Activities Cash Flows from Financing Activities Net change in short-term borrowings Payments on debt Proceeds from issuance of debt Purchases of treasury stock Dividends paid to stockholders Proceeds from exercise of nock option Other Net Cash Used in Financing Activities Effect of Exchange Rate Changes on Cash, Cash Equivalents and Restricted Cash Nel (Decrease) Increase in Cash, Cash Equivalents and Restricted Canh Cash Cash Equivalents and Restricted Cash at Beginning of Year (includes 5258 of restricted cash at January 1.2020 included in Other Aucts.se Note 6) Cash Cash Equivalents and Restricted Cash at End of Year (includes $103 of restricted cash at December 31, 2020 included in Other Acte Note 6) (4.684) (1.000) (95) 2.812 (2.626) (2.545) 0.202) 8.622 (7.994) 15.252 (1.165) 1.30 (9.443) 0.620) (1.040) (294) 378 12.129 (431) 102 4314 0.710) 5.124 (4.287) 2,549 (1.957) 4419 (1.281) (6.215) 89 (436) (2,832) 253 (1.769) 19.091) 05.172) 591 4.958 (4,780) (5.095) 361 5 (8.861) 17 1,967 (1160 (205) 1,171 5 K.1655 9,9345 7,667

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts