Question: Please help me complete this problem in its entirety, thank you in advance! 6 17 0 10 11 12 13 14 15 16 17 10

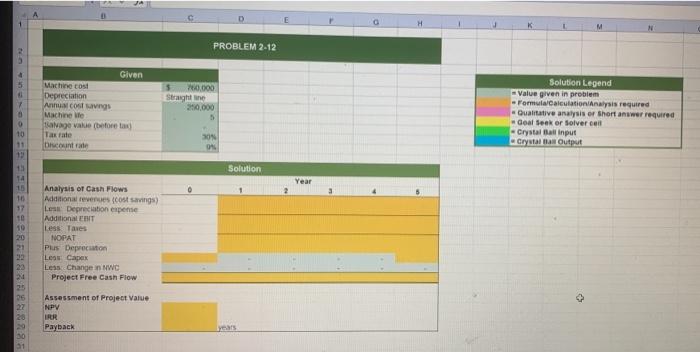

6 17 0 10 11 12 13 14 15 16 17 10 19 20 Analysis of Cash Flows Additional revenues (cost savings) Less Depreciation expense Additional EBIT Less Taxes NOPAT Plus Depreciation Less Capex 23 Less Change in MWC 24 Project Free Cash Flow 21 2887288285 26 20 20 Given 31 Machine cost Depreciation Annual cost savings Machine life talvage value (before tax) Tax rate Discount rate Assessment of Project Value NPV IRR Payback PROBLEM 2-12 260.000 Straight ine 250,000 30% 0% Solution years Year H M Solution Legend Value given in problem Formula/Calculation/Analysis required Qualitative analysis or Short answer required Goal Seek or solver ceil Crystal Ball Input Crystal Ball Output

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts