Question: Please help me complete this question. I have updated the full information on this question. The excel screenshot below is the table of data. Enable

Please help me complete this question. I have updated the full information on this question. The excel screenshot below is the table of data.

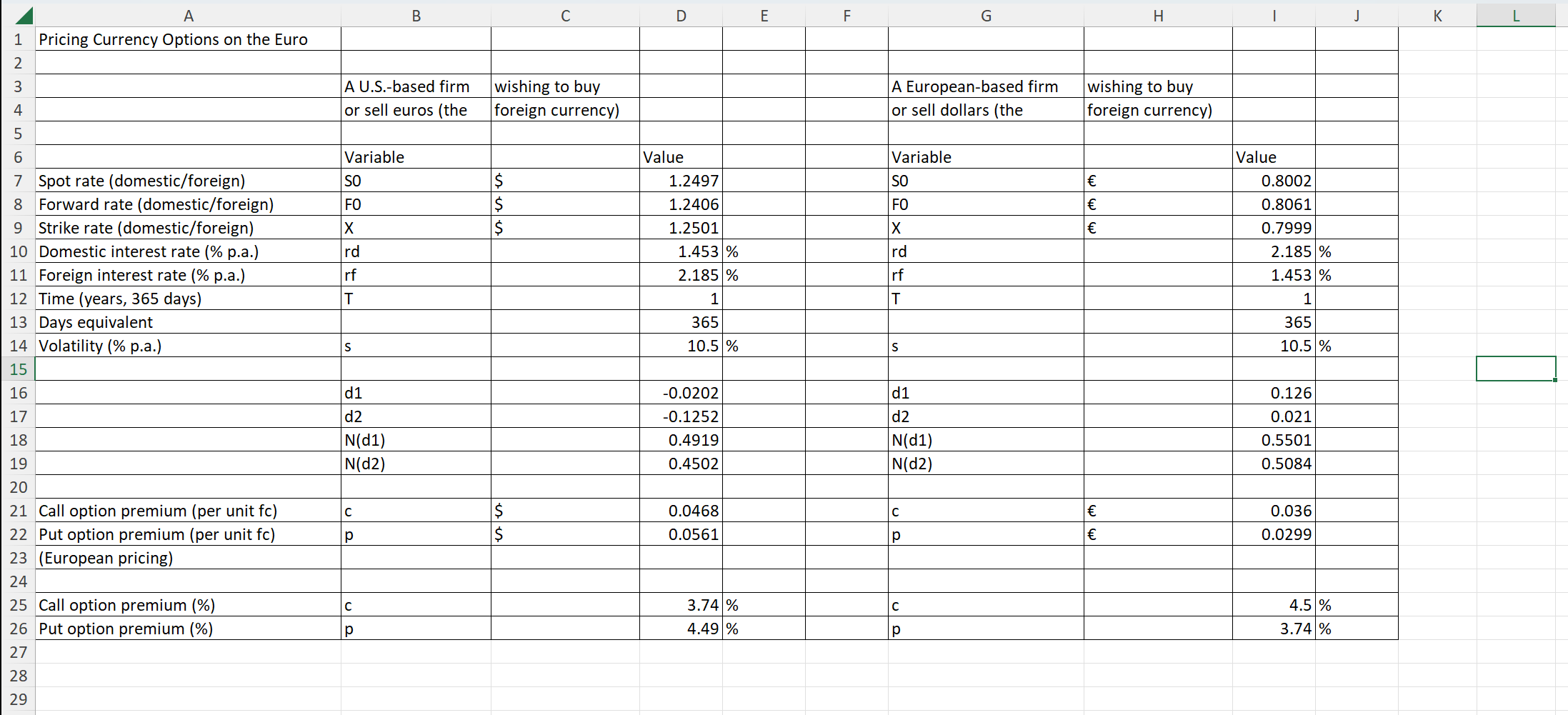

Enable GingerCannot connect to Ginger Check your internet connection or reload the browserDisable in this text fieldRephraseRephrase current sentence2Edit in Ginger U.S. Dollar/Euro. The table, _ , indicates that a 1-year call option on euros at a strike rate of $1.2501/ will cost the buyer $0.0468/, or 3.74%. But that assumed a volatility of 10.500% when the spot rate was $1.2497/. What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2481/? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2481 would be $. (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts