Question: Please help me determine how to solve what I got wrong. Your answer is partially correct. Try again. At the beginning of 2013, Mazzaro Company

Please help me determine how to solve what I got wrong.

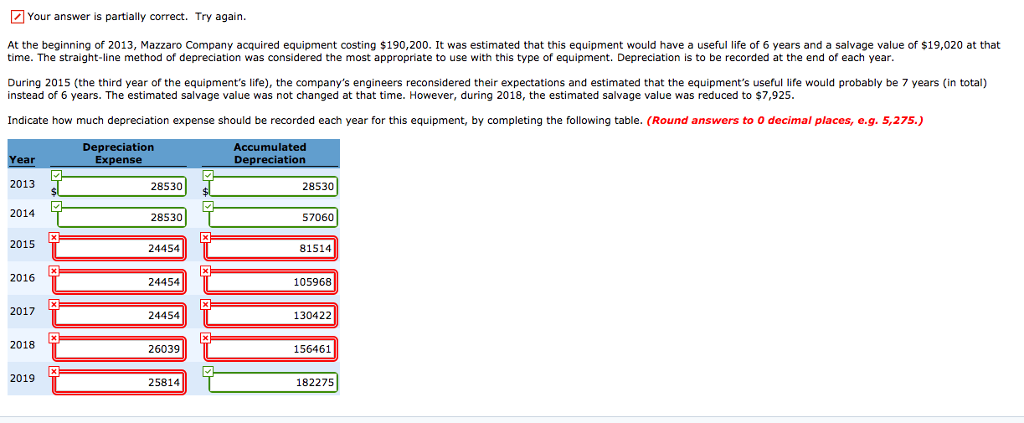

Your answer is partially correct. Try again. At the beginning of 2013, Mazzaro Company acquired equipment costing $190,200. It was estimated that this equipment would have a useful life of 6 years and a salvage value of $19,020 at that time. The straight-line method of depreciation was considered the most appropriate to use with this type of equipment. Depreciation is to be recorded at the end of each year. During 2015 (the third year of the equipment's life), the company's engineers reconsidered their expectations and estimated that the equipment's useful life would probably be 7 years (in total) instead of 6 years. The estimated salvage value was not changed at that time. However, during 2018, the estimated salvage value was reduced to $7,925 Indicate how much depreciation expense should be recorded each year for this equipment, by completing the following table. (Round answers to 0 decimal places, e.g. 5,275.) Deprec Accumulat Depreciation ear Expense 2013 28530 28530 24454 28530 2014 57060 2015 81514 2016 24454 105968 2017 24454 130422 2018 26039 156461 2019 25814 182275

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts