Question: Please help me do a balance sheet. The balance sheet i made did not match Question 4 of 20 -/36 View Policies Current Attempt in

Please help me do a balance sheet. The balance sheet i made did not match

Please help me do a balance sheet. The balance sheet i made did not match

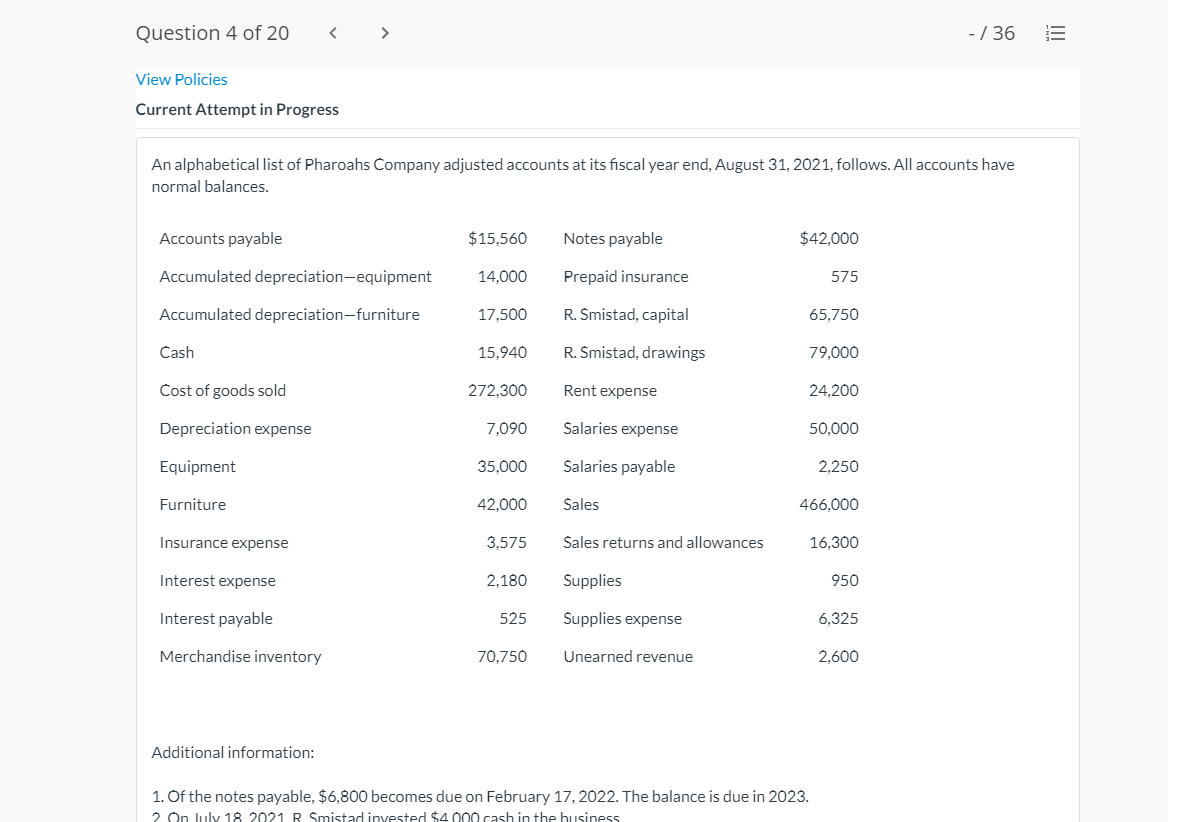

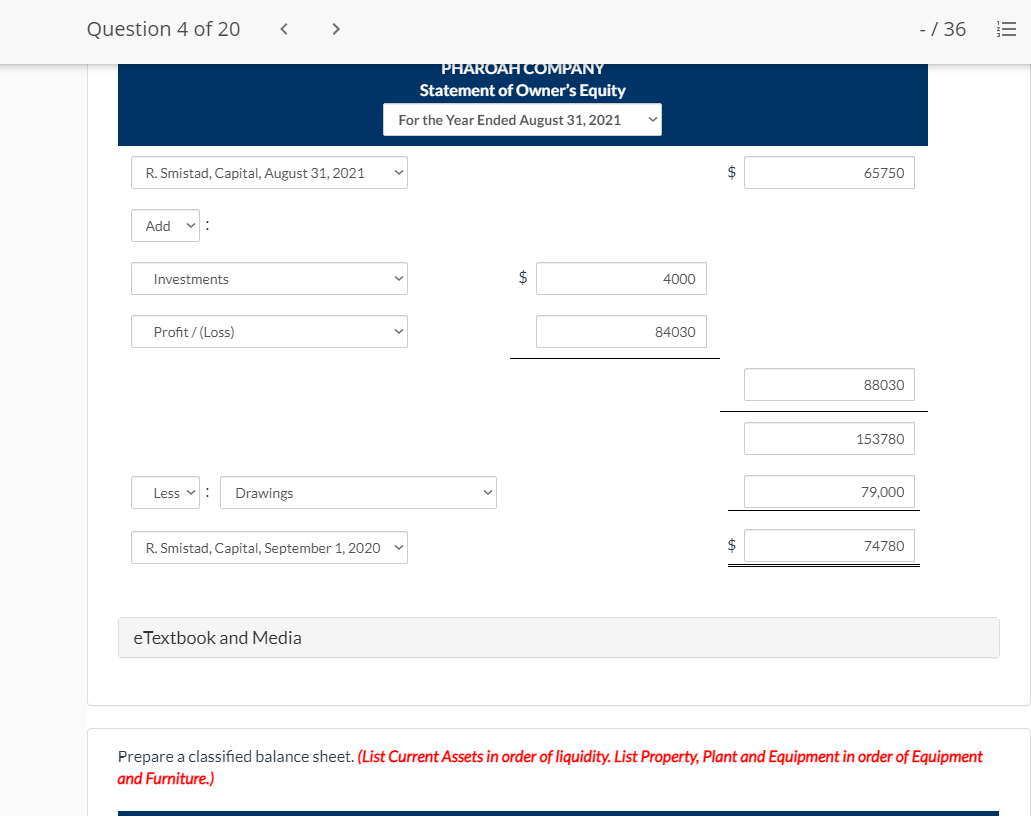

Question 4 of 20 -/36 View Policies Current Attempt in Progress An alphabetical list of Pharoahs Company adjusted accounts at its fiscal year end, August 31, 2021, follows. All accounts have normal balances. Accounts payable $15,560 Notes payable $42,000 Accumulated depreciation-equipment 14,000 Prepaid insurance 575 Accumulated depreciation-furniture 17,500 R. Smistad, capital 65,750 Cash 15,940 R. Smistad, drawings 79,000 Cost of goods sold 272,300 Rent expense 24,200 Depreciation expense 7,090 Salaries expense 50,000 Equipment 35,000 Salaries payable 2,250 Furniture 42.000 Sales 466,000 Insurance expense 3.575 Sales returns and allowances 16,300 Interest expense 2.180 Supplies 950 Interest payable 525 Supplies expense 6.325 Merchandise inventory 70,750 Unearned revenue 2,600 Additional information: 1. Of the notes payable, $6,800 becomes due on February 17, 2022. The balance is due in 2023. 2 On July 18 2021 R Smistad invested $4000 cash in the business Question 4 of 20 - /36 TIT PHAROAH COMPANY Statement of Owner's Equity For the Year Ended August 31, 2021 R. Smistad, Capital, August 31, 2021 65750 Add Investments $ 4000 Profit/(Loss) 84030 88030 153780 Less : Drawings 79,000 R. Smistad, Capital, September 1, 2020 $ 74780 e Textbook and Media Prepare a classified balance sheet. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Equipment and Furniture.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts