Question: Please help me Do Homework Roxane Morales Google Chrome secure ! https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkid-463573198&questionId=1&flushed-false&cld-4821 582¢ervin-yes HFT 4464 B51 Spring 2018 (1) Roxane Morales | 2/24/18 8:10 PM

Please help me

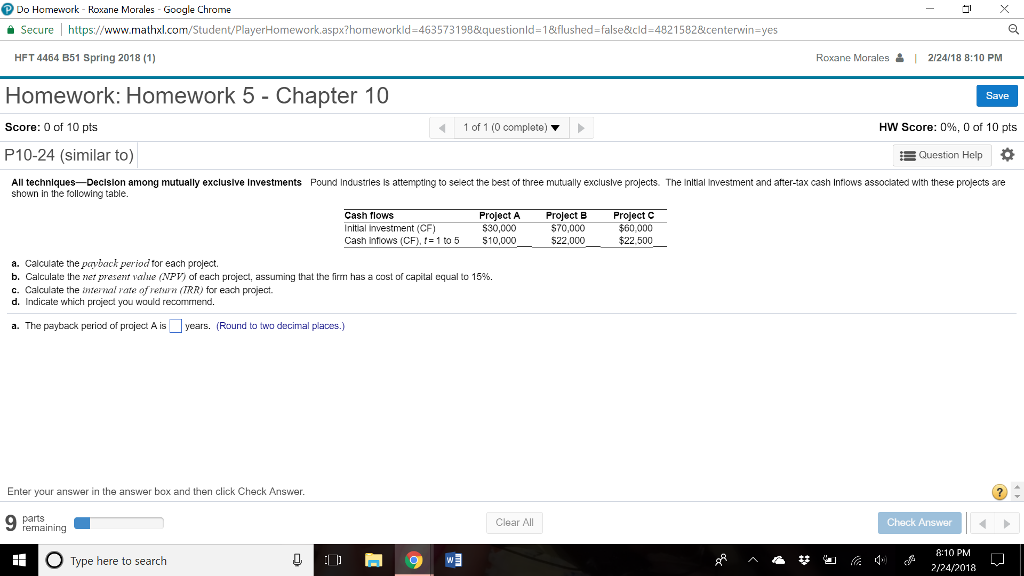

Do Homework Roxane Morales Google Chrome secure ! https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkid-463573198&questionId=1&flushed-false&cld-4821 582¢ervin-yes HFT 4464 B51 Spring 2018 (1) Roxane Morales | 2/24/18 8:10 PM Homework: Homework 5 - Chapter 10 Save Score: 0 of 10 pts 1 of 1 (0 complete HW Score: 0%, 0 of 10 pts P10-24 (similar to) Question Help All techniques-Decision among mutually excluslve Investments Pound Industrles is attempting to select the best of three mutually exclusive projects. The Inltal Inwestment and after-tax cash Inrlows assoclated with these projects are shown in the following table. Cash flows Initial Investment (CF) Cash intows (CF), t=1to5 Project A Project B $30,000 $70,000 522,000 Project c $60,000 $22.500 S10.000 a. Calculate the payback periodtor each project. b. Calculate the Net present vahe N PV, of cach proect assuming that the firm has a cost of capital equal to 15%. c. Calculate the iternal vate ofvetn (RRfor each project. d. Indicate which prcject you would recommend. The payback period of project A is years. (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer Clear All Check Answer 8:10 PM Type here to search 2/24/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts