Question: please help me do question 4, the second picture is the answer, please explain 4. Suppose that corporate A asset value is 128,000 today, corporate

please help me do question 4, the second picture is the answer, please explain

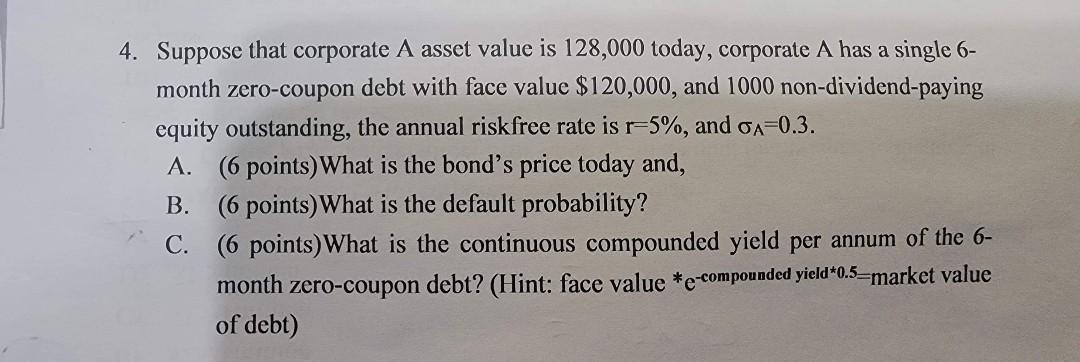

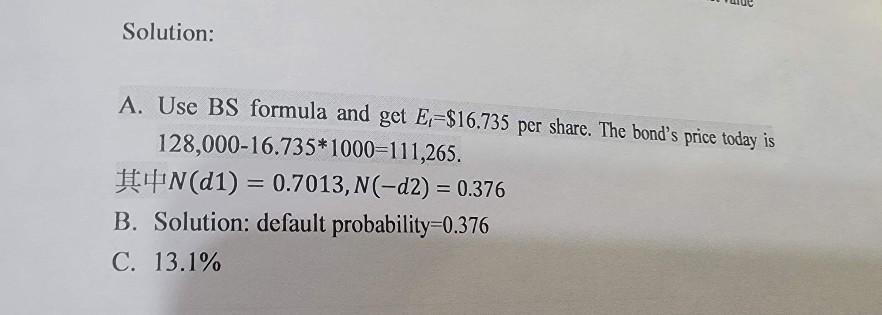

4. Suppose that corporate A asset value is 128,000 today, corporate A has a single 6- month zero-coupon debt with face value $120,000, and 1000 non-dividend paying equity outstanding, the annual riskfree rate is r-5%, and ox=0.3. A. (6 points) What is the bond's price today and, B. (6 points) What is the default probability? C. (6 points) What is the continuous compounded yield per annum of the 6- month zero-coupon debt? (Hint: face value *e-compounded yield*0.5=market value of debt) Solution: A. Use BS formula and get E=$16.735 per share. The bond's price today is 128,000-16.735*1000=111,265. (1) = 0.7013,N(-d2) = 0.376 B. Solution: default probability=0.376 C. 13.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts