Question: Please help me do the operating section of the statement of cash flows for these financial statement using indirect method River Cruises Supply Company Comparative

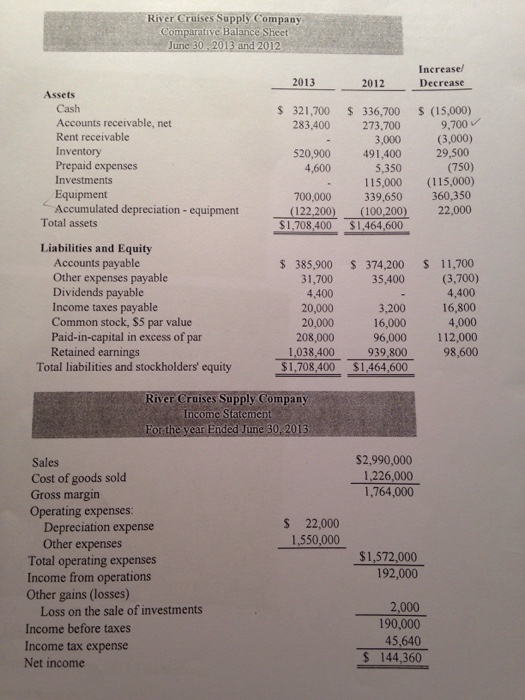

River Cruises Supply Company Comparative Balance Sheet June 30 Increase Decrease 2013 2013 2012 Assets Cash Accounts receivable, net Rent receivable Inventory Prepaid expenses Investments Equipment 321,700 336,700 (15,000) 9,700 273,700 3,000 491,400 5,350 283,400 (3,000) 29,500 (750) 115,000 (115,000) 360,350 22,000 520,900 4,600 700,000 339,650 Accumulated depreciation-equipment (122,200) (100,200) Total assets $1,708,400 $1,464,600 Liabilities and Equity Accounts payable Other expenses payable Dividends payable Income taxes payable Common stock, $5 par value Paid-in-capital in excess of par Retained earnings S 385,900 S 374,200 S 11,700 31,700 4.400 20,000 20,000 208,000 1,038,400 35,400 (3,700) 4,400 3,200 16,800 4,000 96,000 112,000 98,600 16,000 939,800 $1,708,400 $1,464,600 Total liabilities and stockholders' equity River Cruises Supply Company Income Statement $2,990,000 Sales Cost of goods sold Gross margin Operating expenses: 1,764,000 S 22,000 1,550,000 Depreciation expense Other expenses Total operating expenses Income from operations Other gains (losses) $1,572,000 192,000 Loss on the sale of investments Income before taxes Income tax expense Net income 2,000 190,000 45,640 S 144,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts