Question: Please help me do this. I have the table Tax Rate Schedules at the bottom. Thank you Lance H. and Wanda B. Dean are married

Please help me do this. I have the table Tax Rate Schedules at the bottom.

Thank you

Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda owns her own business. They file a joint return.

Personal items:

Wages / Salaries: $105,000 (Includes both Lance and Wanda)

Interest Income: 1,100

Child support payments to John Allen: 8,000

Alimony payments to John Allen: 7,200

Lottery winnings: 870

Federal income tax withholding: 13,000

State income tax withheld: 4,500

Wanda was previously married to John Allen, they divorced several years ago (prior to 2018). Under the divorce decree, Wanda was obligated to pay alimony to John. She paid him $7,200 throughout the year, which agreed with the divorce decree.

Wanda is the owner of her own business. Throughout the year she earned $20,000 of taxable income from this business (taxed as an S-Corp). Additionally, Lance and Wanda had:

(1) Sale of LMN publically traded stock on 2/15/2021 for $4,000 (originally purchased for $8,000 on 8/15/2020)

(2) Sale of QRS publically traded stock on 10/15/2021 for $17,000 (originally purchased for $7,000 on 12/15/2019)

(3) Sale of a boat on 5/15/2021 for $10,000 used for personal recreation (originally purchased for $20,000 on 6/15/2016)

(4) Wanda inherited publically traded stock worth $30,000 from a deceased uncle on September 30, 2021

(5) Immediately after receiving this stock, Wanda sold it for $30,000. This stock was originally purchased by his uncle on January 15th, 2018 for $23,000

Prepare the 2021 Federal income tax return for Lance and Wanda Dean. This is an individual assignment. It is required that you submit both the (1) tax return and a (2) brief explanation for line items on the return.

Please submit the following forms: (1) Cover page with your name, (2) 1040, (3) Schedule 1, and (4) a written explanation for each line item by form/schedule.

The written explanation should be focused on calculations and explanations. I don't need a list of every single line, just lines with calculations. Make sure the explanations match the numbers on the actual forms, if they do not, I will deduct points. Normally, this tax return would require additional forms including schedule D, E, and form 8995. I do not want these additional forms prepared, I only want the forms listed above prepared. These additional forms would include the information that I expect to have in the explanations write-up (i.e. calculations, explanations, justifications, etc.).

Hints:

1) Gambling winnings are reported on Schedule 1 line 8b.

2) The income from Wanda's business will be reported on Schedule 1 line 5.

3) Capital gains/losses are reported on form 1040 line 7. Make sure to include a calculation.

4) The taxpayer has a tax refund. There should be something on line 34 Form 1040.

5) Assume the taxpayers have adequate health insurance (i.e. ignore any health insurance items on the returns).

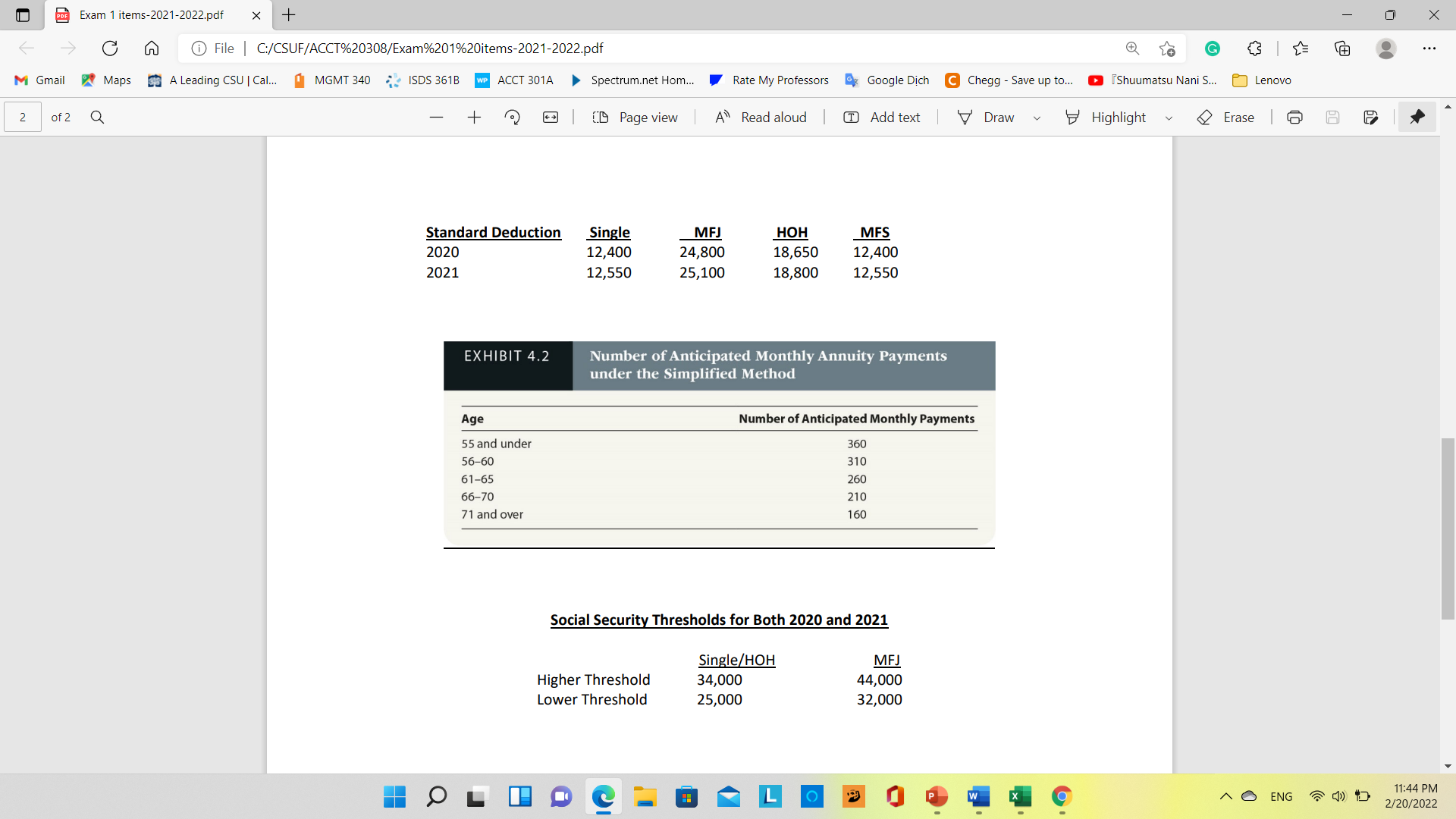

6) Do not forget the Qualified Business Income Deduction, line 13 form 1040. Assume Wanda qualifies for this deduction. In Chapter 15, we can discuss the rules in more detail. Assume that the QBID is a deduction equal to 20% of Qualified Business Income (QBI). With QBI being equal to net total of Schedule 1 line 5.

7) Take the standard deduction 8) S corps are not subject to Self-Employment Tax. 9) Don't forget to check the box for filing status (Single, MFJ, HOH, or MFS).

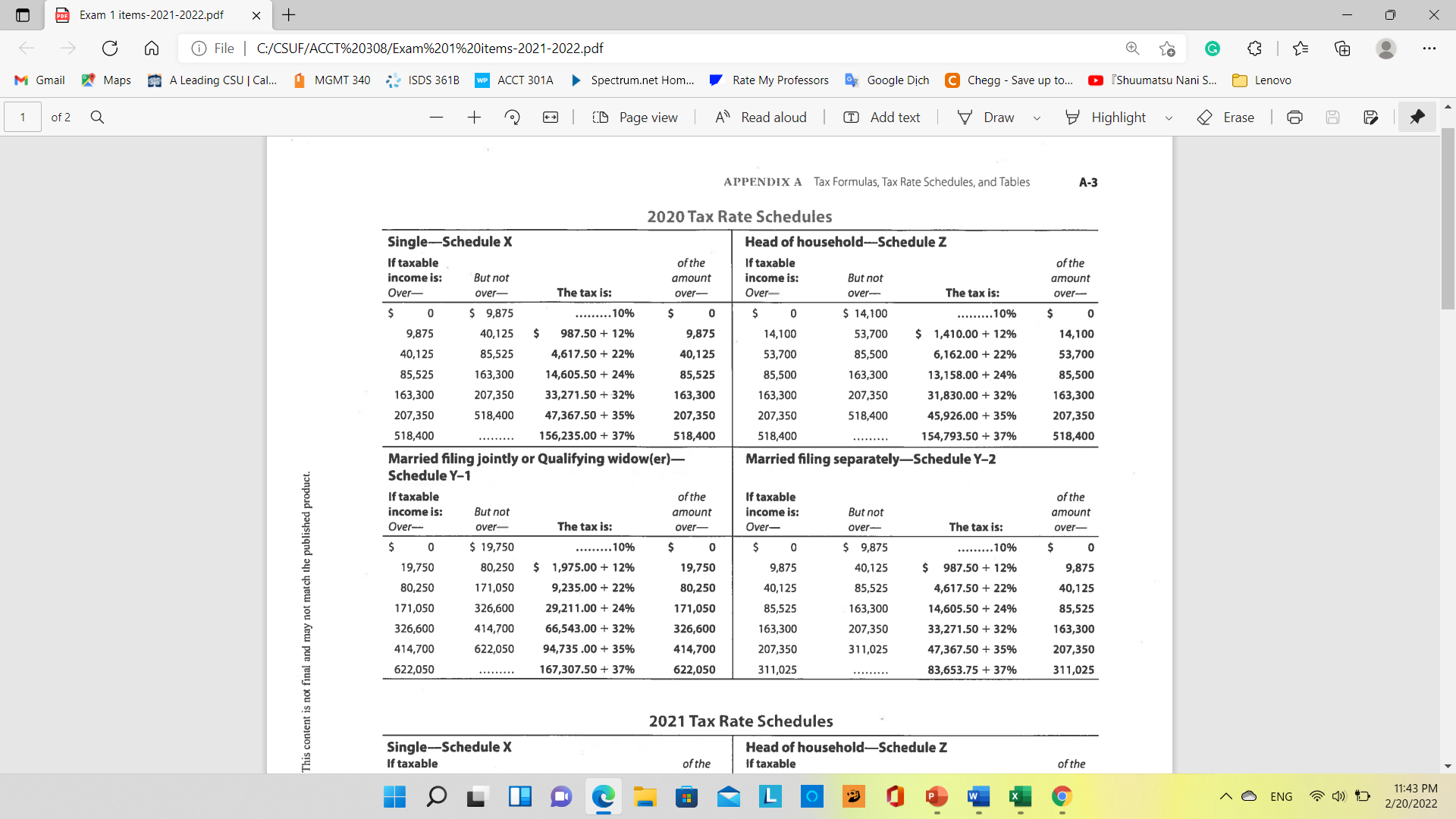

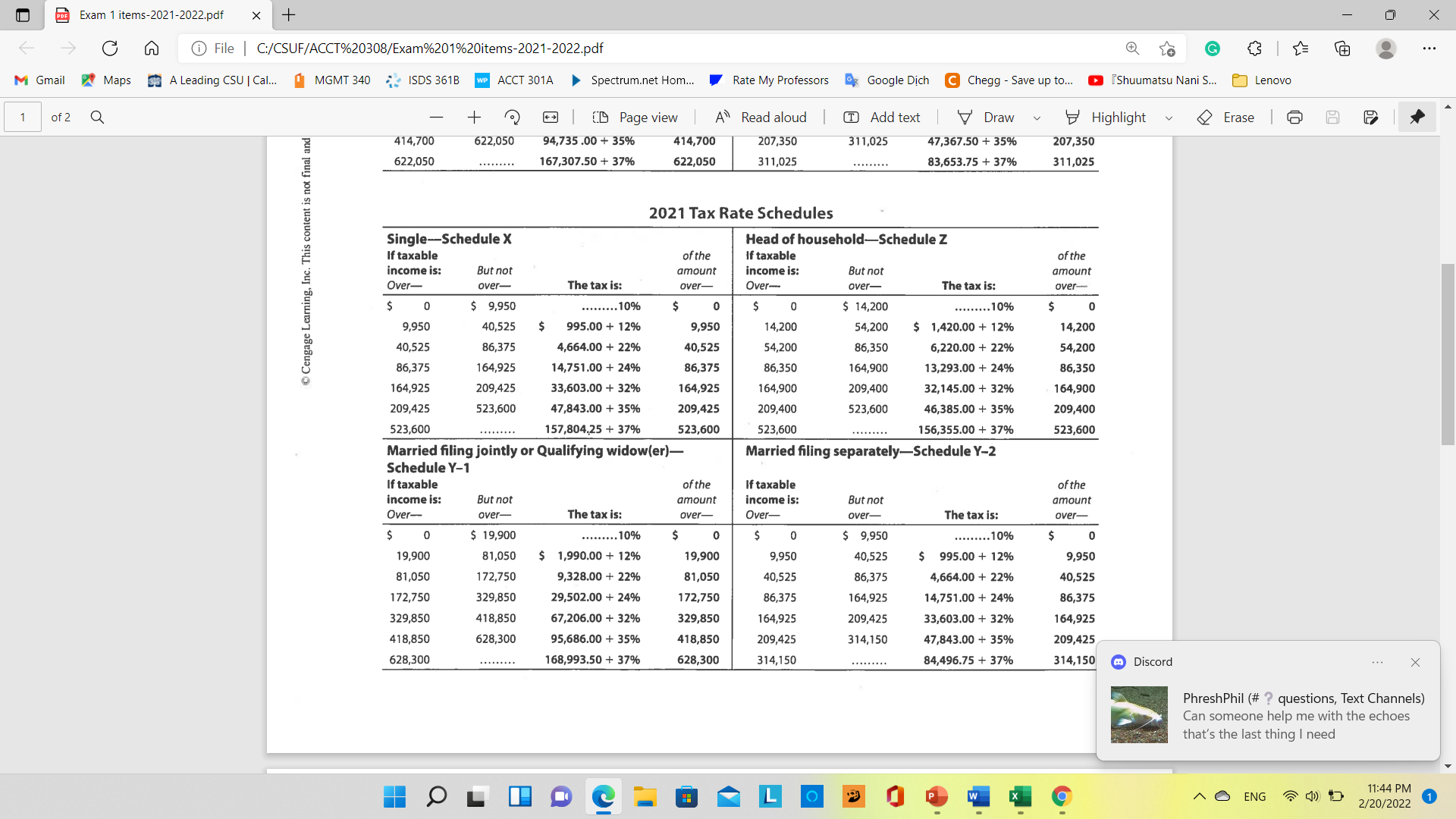

por Exam 1 items-2021-2022.pdf X + X A @ File | C:/CSUF/ACCT%20308/Exam%201%20items-2021-2022.pdf G . .. M Gmail Maps A Leading CSU | Cal... MGMT 340 ISDS 361B WP ACCT 301A Spectrum.net Hom... Rate My Professors Google Dich C Chegg - Save up to... Shuumatsu Nani S... Lenovo 1 + Page view | A Read aloud T Add text Draw Highlight Erase APPENDIX A Tax Formulas, Tax Rate Schedules, and Tables A-3 2020 Tax Rate Schedules Single-Schedule X Head of household-Schedule Z If taxable of the If taxable of the income is: But not amount income is: But not amount Over- over- The tax is: over- Over- over- The tax is: over- 0 $ 9,875 ...... 10% S 0 $ 14,100 ...... 10% S 9.875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 1,410.00 + 12% 14,100 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 53,700 85,525 163,300 14,605.50 + 24% 85,525 85,500 163,300 13,158.00 + 24% 85,500 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 163,300 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 207,350 518,400 . . . ...... 156,235.00 + 37% 518,400 518,400 ... ...... 154,793.50 + 37% 518,400 Married filing jointly or Qualifying widow(er)- Married filing separately-Schedule Y-2 Schedule Y-1 If taxable of the If taxable of the income is: But not amount income is: But not amount Over- over The tax is: over- Over- over- The tax is: over- 0 $ 19,750 . ....... 10% 9,875 ......... 10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 9,875 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 40,125 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 + 24% 85,525 This content is not final and may not match the published product. 326,600 414,700 66,543.00 + 32% 326,600 163,300 207,350 33,271.50 + 32% 163,300 414,700 622,050 94,735 .00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 207,350 622,050 . ........ 167,307.50 + 37% 622,050 311,025 . . . . ....+ 83,653.75 + 37% 311,025 2021 Tax Rate Schedules Single-Schedule X Head of household-Schedule Z If taxable of the If taxable of the L O P W X ~ O ENG @ () D 11:43 PM 2/20/2022por Exam 1 items-2021-2022.pdf X + X @ File | C:/CSUF/ACCT%20308/Exam%201%20items-2021-2022.pdf G . .. M Gmail Maps A Leading CSU | Cal... MGMT 340 _ ISDS 361B WP ACCT 301A Spectrum.net Hom... Rate My Professors Google Dich C Chegg - Save up to... Shuumatsu Nani S... [ Lenovo 1 + Q Page view A Read aloud T Add text V Draw Highlight v Erase 414,700 622,050 94,735 .00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 207,350 622,050 ......... 167,307.50 + 37% 622,050 311,025 .. .. ....+ 83,653.75 + 37% 311,025 2021 Tax Rate Schedules Single-Schedule X Head of household-Schedule Z If taxable of the If taxable of the Cengage Learning, Inc. This content is not final and income is: But not amount income is: But not amount Over- over- The tax is: over- Over- over- The tax is: over- 0 9,950 ......... 10% $ $ 14,200 .. ....... 10% 9,950 40,525 $ 995.00 + 12% 9,950 14,200 54,200 $1,420.00 + 12% 14,200 40,525 86,375 4,664.00 + 22% 40,525 54,200 86,350 6,220.00 + 22% 54,200 86,375 164,925 14,751.00 + 24% 86,375 86,350 164,900 13,293.00 + 24% 86,350 164,925 209,425 33,603.00 + 32% 164,925 164,900 209,400 32,145.00 + 32% 164,900 209,425 523,600 47,843.00 + 35% 209,425 209,400 523,600 46,385.00 + 35% 209,400 523,600 ......... 157,804.25 + 37% 523,600 523,600 . . ....... 156,355.00 + 37% 523,600 Married filing jointly or Qualifying widow(er)- Married filing separately-Schedule Y-2 Schedule Y-1 If taxable of the If taxable of the income is: But not amount income is: But not amount Over- over- The tax is: over- Over- over- The tax is: over- S 0 $ 19,900 ......... 10% 0 0 $ 9,950 ......... 10% S 19,900 81,050 1,990.00 + 12% 19,900 9.950 40,525 $ 995.00 + 12% 9,950 81,050 172,750 9,328.00 + 22% 81,050 40,525 86,375 4,664.00 + 22% 40,525 172,750 329,850 29,502.00 + 24% 172,750 86,375 164,925 14,751.00 + 24% 86,375 329,850 418,850 67,206.00 + 32% 329,850 164,925 209,425 33,603.00 + 32% 164,925 418,850 628,300 95,686.00 + 35% 418,850 209,425 314,150 47,843.00 + 35% 209,425 628,300 .. ....... 168,993.50 + 37% 628,300 314,150 ......... 84,496.75 + 37% 314,150 Discord . .. X PhreshPhil (# ? questions, Text Channels) Can someone help me with the echoes that's the last thing I need HOLIC BL O W X ~ ENG () D 11:44 PM 2/20/2022 1por Exam 1 items-2021-2022.pdf X + X A @ File | C:/CSUF/ACCT%20308/Exam%201%20items-2021-2022.pdf G . .. M Gmail Maps A Leading CSU | Cal... MGMT 340 ISDS 361B WP ACCT 301A Spectrum.net Hom... Rate My Professors Google Dich C Chegg - Save up to... Shuumatsu Nani S... Lenovo 2 of 2 + Page view | A Read aloud | T) Add text | Draw Highlight Erase Standard Deduction Single MFJ HOH MFS 2020 12,400 24,800 18,650 12,400 2021 12,550 25,100 18,800 12,550 EXHIBIT 4.2 Number of Anticipated Monthly Annuity Payments under the Simplified Method Age Number of Anticipated Monthly Payments 55 and under 360 56-60 310 61-65 260 66-70 210 71 and over 160 Social Security Thresholds for Both 2020 and 2021 Single/HOH MF Higher Threshold 34,000 44,000 Lower Threshold 25,000 32,000 O P W x ~ O ENG ~ () D 11:44 PM 2/20/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts