Question: PLEASE HELP ME DO THIS PROJECT IN EXCEL. I took a screenshot of the assignment as it was given. This assignment is to create an

PLEASE HELP ME DO THIS PROJECT IN EXCEL. I took a screenshot of the assignment as it was given.

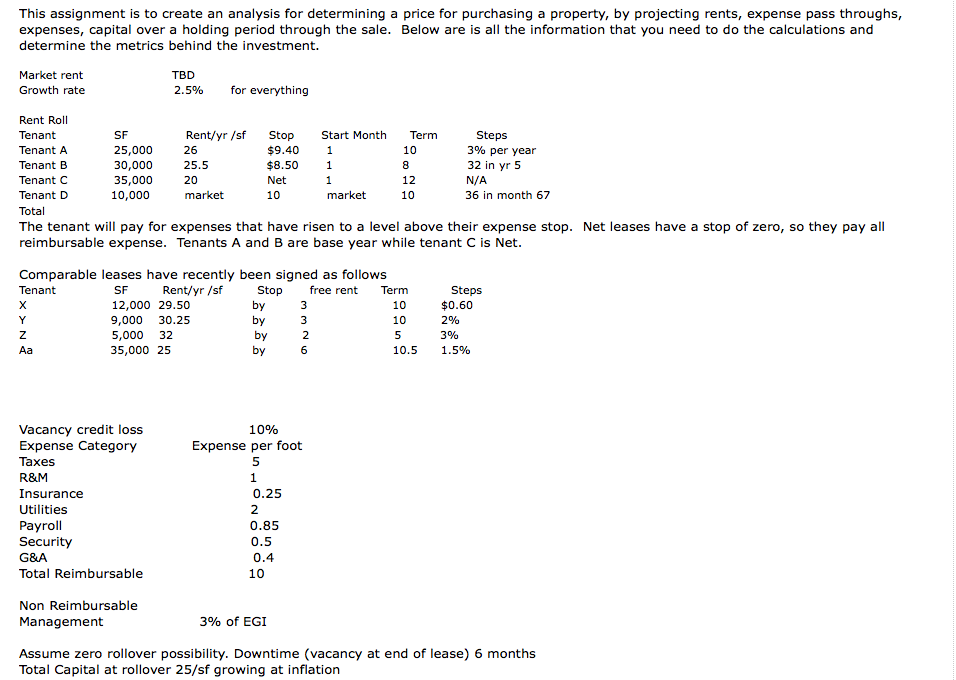

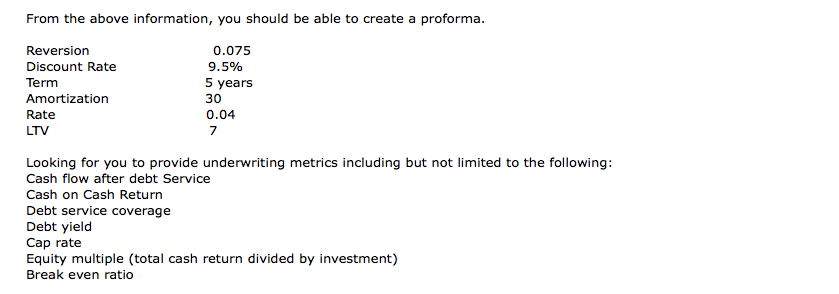

This assignment is to create an analysis for determining a price for purchasing a property, by projecting rents, expense pass throughs, expenses, capital over a holding period through the sale. Below are is all the information that you need to do the calculations and determine the metrics behind the investment. Market rent Growth rate TBD 2.5% for everything Rent Roll Tenant Tenant A Tenant B Tenant C Tenant D Total The tenant will pay for expenses that have risen to a level above their expense stop. Net leases have a stop of zero, so they pay al reimbursable expense. Tenants A and B are base year while tenant C is Net. SF 25,000 30,000 35,000 10,000 Rent/yr/sf Stop Start Month Term 26 25.5 20 market Steps 390 per year 32 in yr 5 N/A 36 in month 67 $9.40 1 $8.50 1 Net 10 8 12 10 market Comparable leases have recently been signed as follows Tenant SF 12,000 29.50 9,000 30.25 5,000 32 35,000 25 Rent/yr /sf Steps $0.60 2010 3% Stop free rent Term 10 10 2 10.5 1.5% 10% Vacancy credit loss Expense Category Taxes R&M Insurance Utilities Payroll Security G&A Total Reimbursable Expense per foot 0.25 2 0.85 0.5 10 Non Reimbursable Management 3% of EGI Assume zero rollover possibility. Downtime (vacancy at end of lease) 6 months Total Capital at rollover 25/sf growing at inflation This assignment is to create an analysis for determining a price for purchasing a property, by projecting rents, expense pass throughs, expenses, capital over a holding period through the sale. Below are is all the information that you need to do the calculations and determine the metrics behind the investment. Market rent Growth rate TBD 2.5% for everything Rent Roll Tenant Tenant A Tenant B Tenant C Tenant D Total The tenant will pay for expenses that have risen to a level above their expense stop. Net leases have a stop of zero, so they pay al reimbursable expense. Tenants A and B are base year while tenant C is Net. SF 25,000 30,000 35,000 10,000 Rent/yr/sf Stop Start Month Term 26 25.5 20 market Steps 390 per year 32 in yr 5 N/A 36 in month 67 $9.40 1 $8.50 1 Net 10 8 12 10 market Comparable leases have recently been signed as follows Tenant SF 12,000 29.50 9,000 30.25 5,000 32 35,000 25 Rent/yr /sf Steps $0.60 2010 3% Stop free rent Term 10 10 2 10.5 1.5% 10% Vacancy credit loss Expense Category Taxes R&M Insurance Utilities Payroll Security G&A Total Reimbursable Expense per foot 0.25 2 0.85 0.5 10 Non Reimbursable Management 3% of EGI Assume zero rollover possibility. Downtime (vacancy at end of lease) 6 months Total Capital at rollover 25/sf growing at inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts