Question: please help me do this question if you have time thank you! 1. Valuation of Firms The private equity firm Greylock Group LLC is looking

please help me do this question if you have time thank you!

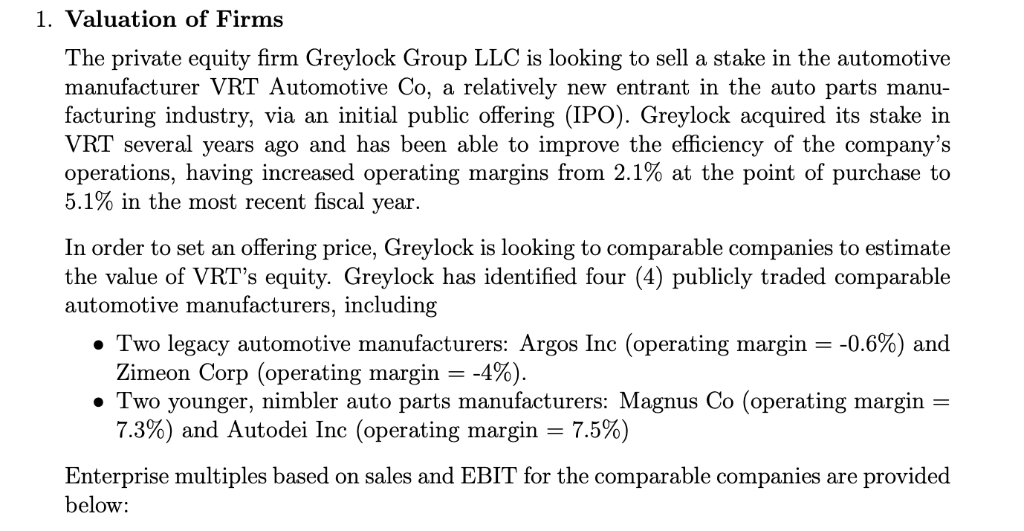

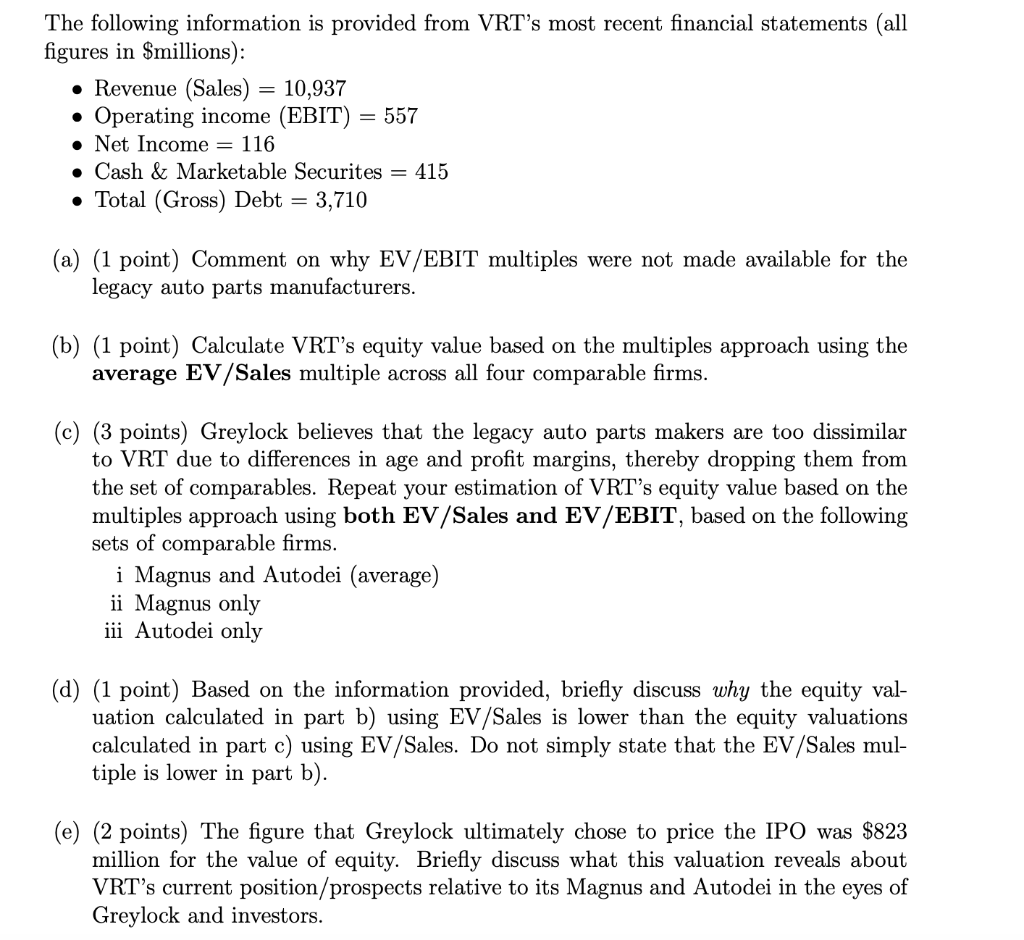

1. Valuation of Firms The private equity firm Greylock Group LLC is looking to sell a stake in the automotive manufacturer VRT Automotive Co, a relatively new entrant in the auto parts manu- facturing industry, via an initial public offering (IPO). Greylock acquired its stake in VRT several years ago and has been able to improve the efficiency of the company's operations, having increased operating margins from 2.1% at the point of purchase to 5.1% in the most recent fiscal year In order to set an offering price, Greylock is looking to comparable companies to estimate the value of VRT's equity. Greylock has identified four (4) publicly traded comparable automotive manufacturers, including Two legacy automotive manufacturers. Argos Inc (operating margin =-0.6%) and imeon Corp (operating margin =-4%) Two younger, nimbler auto parts manufacturers: Magnus Co (operating margin 7.3%) and Autodel Inc (operating margin-7.5%) Enterprise multiples based on sales and EBIT for the comparable companies are provided below The following information is provided from VRT's most recent financial statements (all figures in Smillions) . Revenue (Sales)-10,937 . Operating income (EBIT)-557 Net Income- 116 Cash & Marketable Securites -415 Total (Gross) Debt = 3,710 (a) (1 point) Comment on why EV/EBIT multiples were not made available for the legacy auto parts manufacturers (b) (1 point) Calculate VRT's equity value based on the multiples approach using the average EV/Sales multiple across all four comparable firms. (c) (3 points) Greylock believes that the legacy auto parts makers are too dissimilar to VRT due to differences in age and profit margins, thereby dropping them from the set of comparables. Repeat your estimation of VRT's equity value based on the multiples approach using both EV/Sales and EV/EBIT, based on the following sets of comparable firms. i Magnus and Autodei (average) ii Magnus only iii Autodei only (d) (1 point) Based on the information provided, briefly discuss why the equity val uation calculated in part b) using EV/Sales is lower than the equity valuations calculated in part c) using EV/Sales. Do not simply state that the EV/Sales mul- tiple is lower in part b) (e) (2 points) The figure that Greylock ultimately chose to price the IPO was S823 million for the value of equity. Briefly discuss what this valuation reveals about VRT's current position/prospects relative to its Magnus and Autodei in the eyes of Greylock and investors 1. Valuation of Firms The private equity firm Greylock Group LLC is looking to sell a stake in the automotive manufacturer VRT Automotive Co, a relatively new entrant in the auto parts manu- facturing industry, via an initial public offering (IPO). Greylock acquired its stake in VRT several years ago and has been able to improve the efficiency of the company's operations, having increased operating margins from 2.1% at the point of purchase to 5.1% in the most recent fiscal year In order to set an offering price, Greylock is looking to comparable companies to estimate the value of VRT's equity. Greylock has identified four (4) publicly traded comparable automotive manufacturers, including Two legacy automotive manufacturers. Argos Inc (operating margin =-0.6%) and imeon Corp (operating margin =-4%) Two younger, nimbler auto parts manufacturers: Magnus Co (operating margin 7.3%) and Autodel Inc (operating margin-7.5%) Enterprise multiples based on sales and EBIT for the comparable companies are provided below The following information is provided from VRT's most recent financial statements (all figures in Smillions) . Revenue (Sales)-10,937 . Operating income (EBIT)-557 Net Income- 116 Cash & Marketable Securites -415 Total (Gross) Debt = 3,710 (a) (1 point) Comment on why EV/EBIT multiples were not made available for the legacy auto parts manufacturers (b) (1 point) Calculate VRT's equity value based on the multiples approach using the average EV/Sales multiple across all four comparable firms. (c) (3 points) Greylock believes that the legacy auto parts makers are too dissimilar to VRT due to differences in age and profit margins, thereby dropping them from the set of comparables. Repeat your estimation of VRT's equity value based on the multiples approach using both EV/Sales and EV/EBIT, based on the following sets of comparable firms. i Magnus and Autodei (average) ii Magnus only iii Autodei only (d) (1 point) Based on the information provided, briefly discuss why the equity val uation calculated in part b) using EV/Sales is lower than the equity valuations calculated in part c) using EV/Sales. Do not simply state that the EV/Sales mul- tiple is lower in part b) (e) (2 points) The figure that Greylock ultimately chose to price the IPO was S823 million for the value of equity. Briefly discuss what this valuation reveals about VRT's current position/prospects relative to its Magnus and Autodei in the eyes of Greylock and investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts