Question: please help me!! Exercise 19-6 Absorption costing income statement LO P2 Hayek Bikes prepares the income statement under variable costing for its managerial reports, and

please help me!!

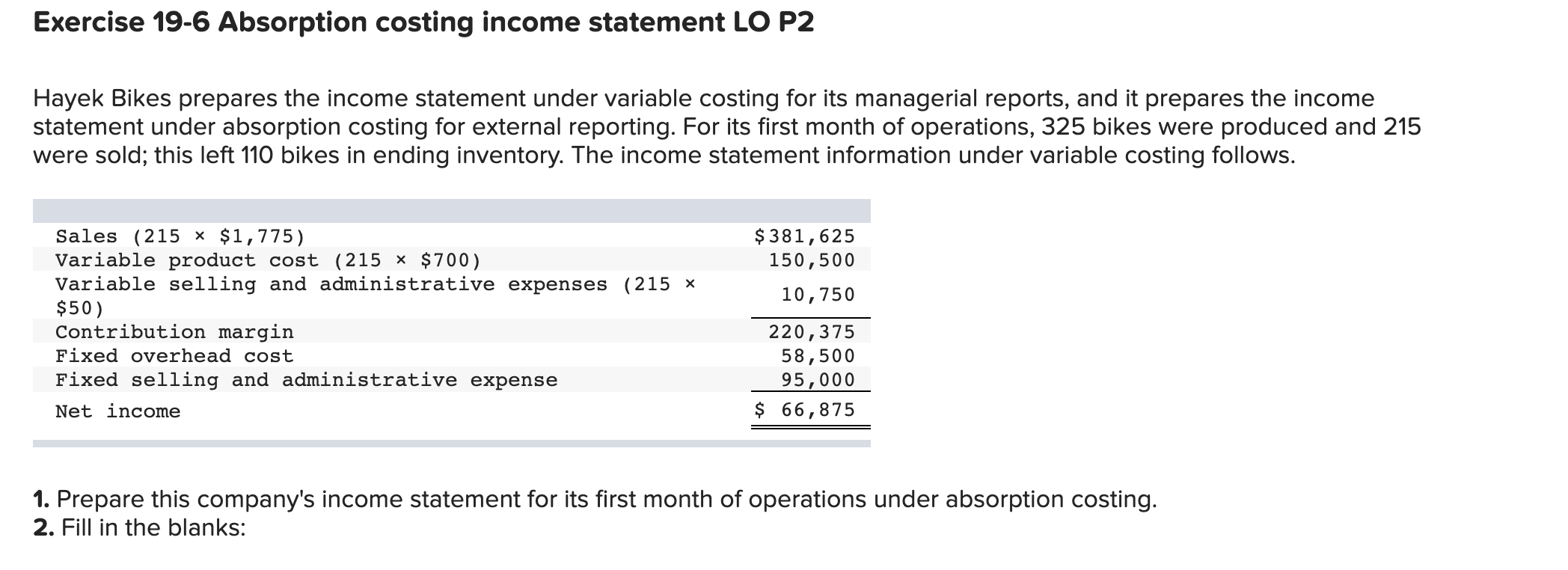

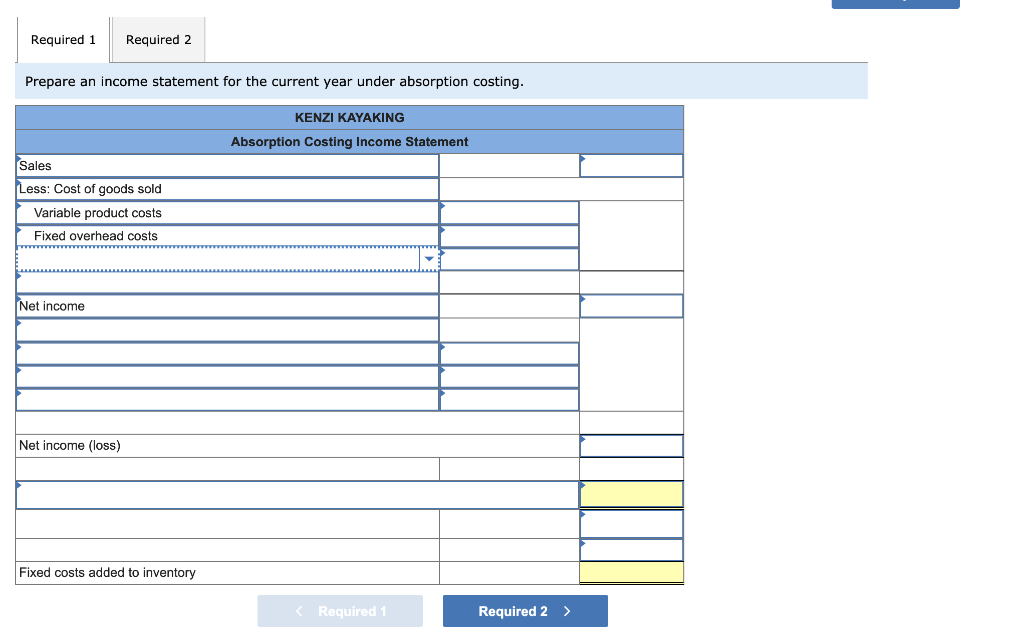

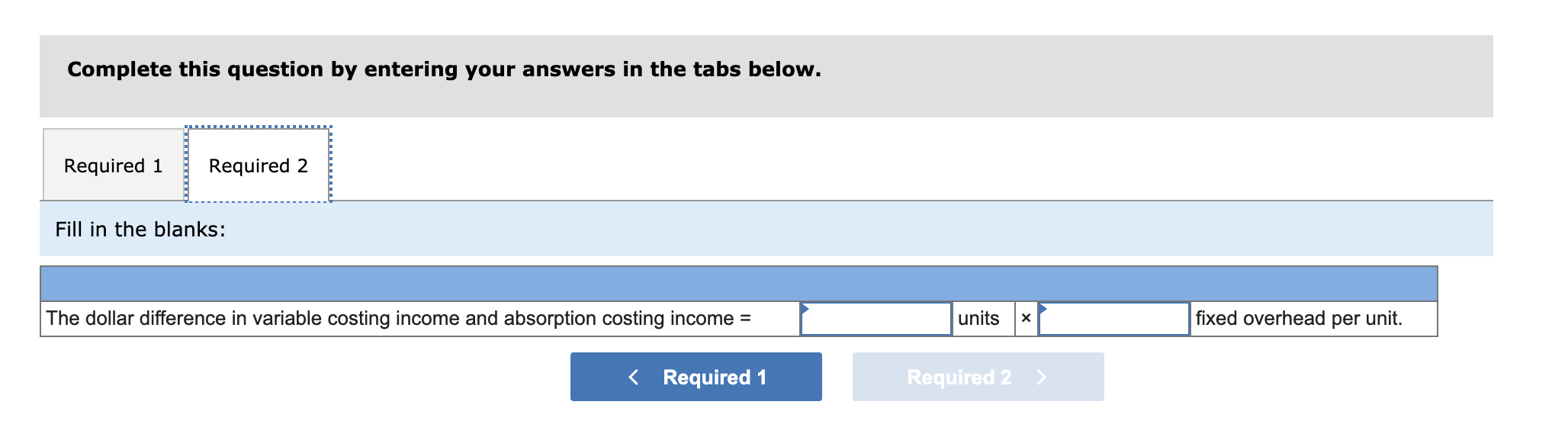

Exercise 19-6 Absorption costing income statement LO P2 Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 325 bikes were produced and 215 were sold; this left 110 bikes in ending inventory. The income statement information under variable costing follows. $381,625 150,500 10,750 Sales (215 * $1,775) Variable product cost (215 * $ 700) Variable selling and administrative expenses (215 x $50) Contribution margin Fixed overhead cost Fixed selling and administrative expense Net income 220,375 58,500 95,000 $ 66,875 1. Prepare this company's income statement for its first month of operations under absorption costing. 2. Fill in the blanks: Required 1 Required 2 Prepare an income statement for the current year under absorption costing. KENZI KAYAKING Absorption Costing Income Statement Sales Less: Cost of goods sold Variable product costs Fixed overhead costs Net income Net income (loss) Fixed costs added to inventory Complete this question by entering your answers in the tabs below. Required 1 Required 2 Fill in the blanks: The dollar difference in variable costing income and absorption costing income = units fixed overhead per unit.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts