Question: please help me feel the space 3. When XYZ Co. was established, 1,000 shares were issued to the founders at $100 each. Their business has

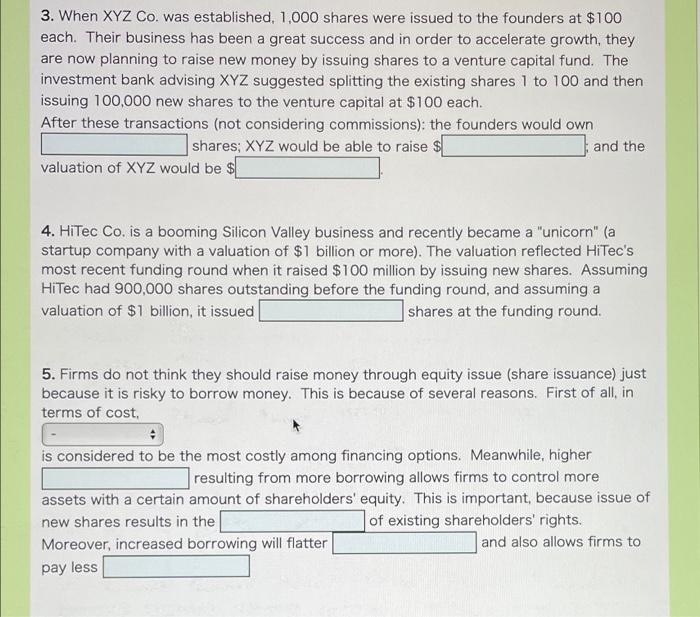

3. When XYZ Co. was established, 1,000 shares were issued to the founders at $100 each. Their business has been a great success and in order to accelerate growth, they are now planning to raise new money by issuing shares to a venture capital fund. The investment bank advising XYZ suggested splitting the existing shares 1 to 100 and then issuing 100,000 new shares to the venture capital at $100 each. After these transactions (not considering commissions): the founders would own shares; XYZ would be able to raise and the valuation of XYZ would be $L 4. HiTec Co. is a booming Silicon Valley business and recently became a "unicorn" (a startup company with a valuation of $1 billion or more). The valuation reflected HiTec's most recent funding round when it raised $ 100 million by issuing new shares. Assuming HiTec had 900,000 shares outstanding before the funding round, and assuming a valuation of $1 billion, it issued shares at the funding round. 5. Firms do not think they should raise money through equity issue (share issuance) just because it is risky to borrow money. This is because of several reasons. First of all, in terms of cost. is considered to be the most costly among financing options. Meanwhile, higher resulting from more borrowing allows firms to control more assets with a certain amount of shareholders' equity. This is important, because issue of new shares results in the of existing shareholders' rights. Moreover, increased borrowing will flatter and also allows firms to pay less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts