Question: Please help me figure out what I am missing.. These are all the options to choose from: No journal entry required Accounts payable Accounts receivable

Please help me figure out what I am missing..

Please help me figure out what I am missing..

These are all the options to choose from:

No journal entry required

Accounts payable

Accounts receivable

Accrued Liabilities

Accumulated depreciation

Advertising expense

Buildings

Cash

Common stock

Cost of goods sold

Deferred rent revenue

Deferred sales revenue

Deferred service revenue

Depreciation expense

Dividends

Equipment

Gain on sale of investments

Insurance expense

Interest expense

Interest payable

Interest receivable

Interest revenue

Inventory

Land

Maintenance expense

Miscellaneous expense

Notes payable

Notes receivable

Office Equipment

Prepaid advertising

Prepaid insurance

Prepaid rent

Rent expense

Rent revenue

Retained earnings

Salaries expense

Salaries payable

Sales revenue

Service revenue

Supplies

Supplies expense

Utilities expense

Utilities payable

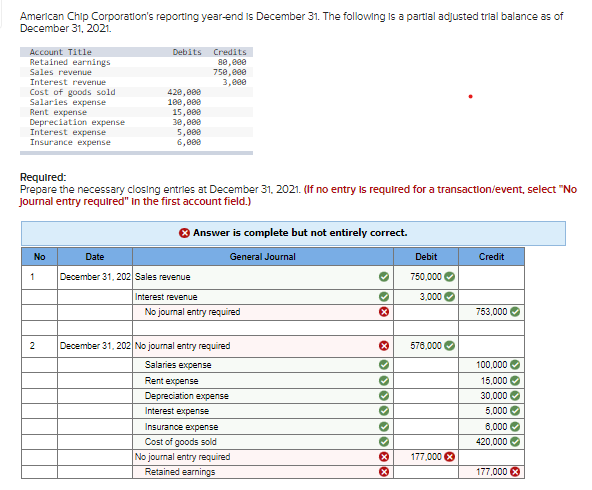

Amerlcan Chip Corporation's reporting year-end is December 31 . The following is a partlal adjusted trlal balance as of December 31 , 2021. Required: Prepare the necessary closing entrles at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts