Question: Please help me figure out what's wrong in part 2. The textbook specifically says For purposes of homework, credit accumulated depreciation when recording an

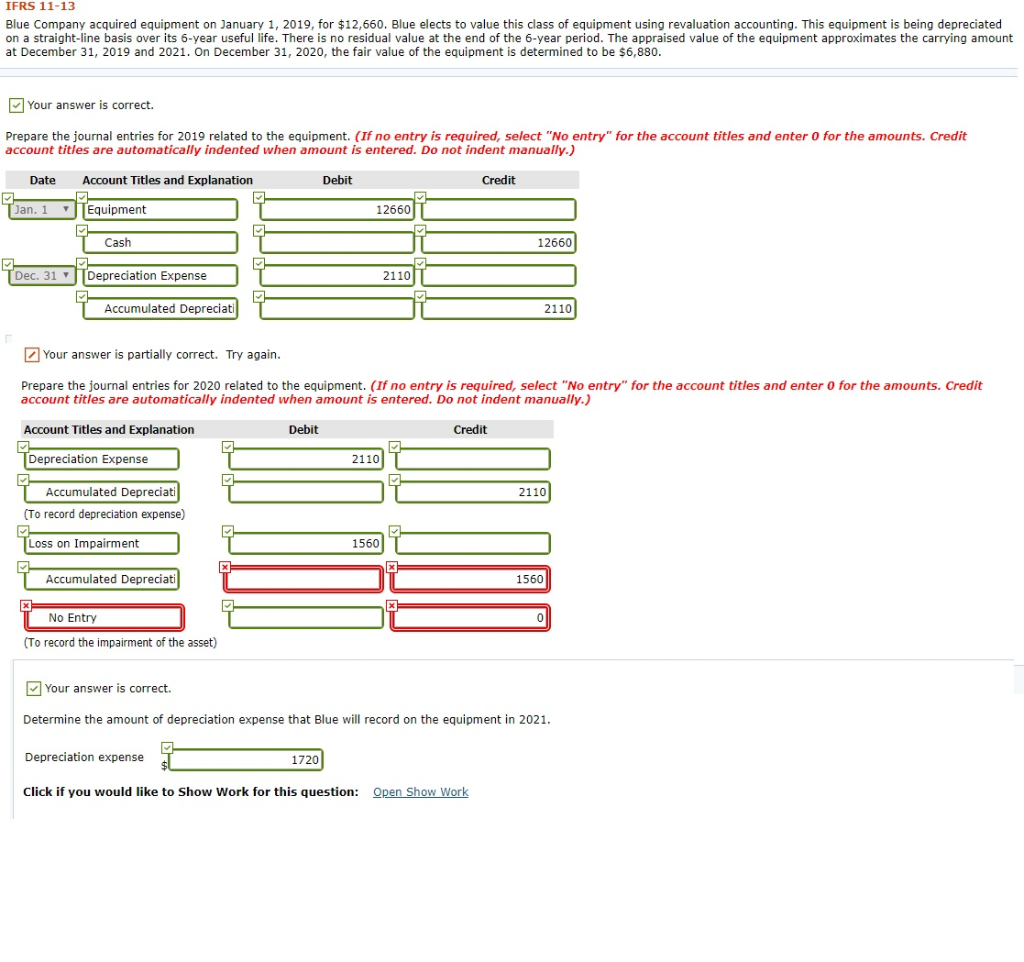

Please help me figure out what's wrong in part 2. The textbook specifically says "For purposes of homework, credit accumulated depreciation when recording an impairment for a depreciable asset."

Please help me figure out what's wrong in part 2. The textbook specifically says "For purposes of homework, credit accumulated depreciation when recording an impairment for a depreciable asset."

IFRS 11-13 Blue Company acquired equipment on January 1, 2019, for $12,660. Blue elects to value this class of equipment using revaluation accounting. This equipment is being depreciated on a straight-line basis over its 6-year useful life. There is no residual value at the end of the 6-year period. The appraised value of the equipment approximates the carrying amount at December 31, 2019 and 2021. On December 31, 2020, the fair value of the equipment is determined to be $6,880. Your answer is correct. Prepare the journal entries for 2019 related to the equipment. (If no entry is required, select "No entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Equipment 12660 Cash 12660 TDec. 31 Depreciation Expense T Accumulated Depreciati 2110 Your answer is partially correct. Try again. Prepare the journal entries for 2020 related to the equipment. (If no entry is required, select "No entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Depreciation Expense 2110 2 2110 | Accumulated Depreciati (To record depreciation expense) TLoss on Impairment | Accumulated Depreciati 1560 No Entry 1 L (To record the impairment of the asset) Your answer is correct. Determine the amount of depreciation expense that Blue will record on the equipment in 2021. Depreciation expense 1720 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts