Question: please help me figure this problem out! 13-5 On March 1, 2006, Tanger Resorts acquired real estate on which it planned to coustruct Determine a

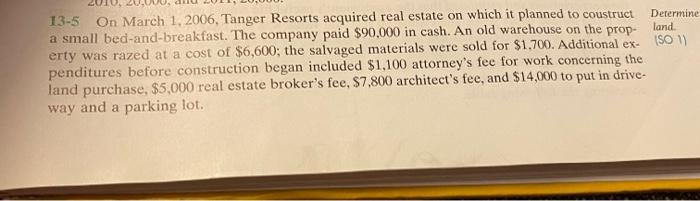

13-5 On March 1, 2006, Tanger Resorts acquired real estate on which it planned to coustruct Determine a small bed-and-breakfast. The company paid $90,000 in cash. An old warehouse on the prop- land erty was razed at a cost of $6,600; the salvaged materials were sold for $1.700. Additional ex- ISO 11 penditures before construction began included $1,100 attorney's fee for work concerning the land purchase, $5,000 real estate broker's fee, $7.800 architect's fee, and $14,000 to put in drive- way and a parking lot. 408 CHAPTER 13 Long-Term and Intangible Assets Instructions (a) Determine the amount to be reported as the cost of the land. (b) For each cost not used in part (a), indicate the account to be debited. 13-6 Waterways Tours uses the units-of-activity method in depreciating its tour boats. One Tanary 12006, at a cost of $148,000. Over its four-year useful

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts