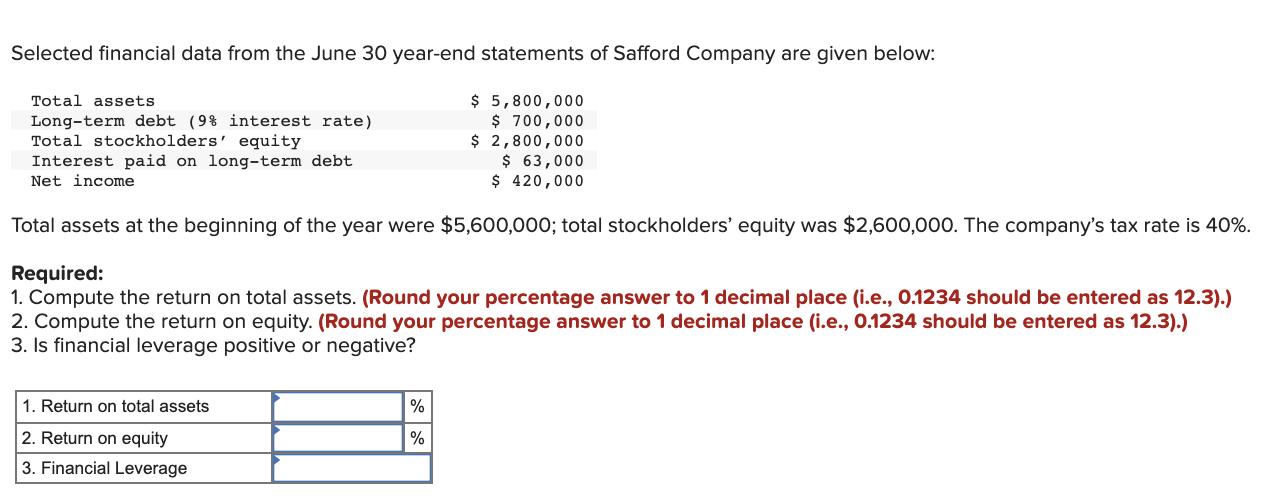

Question: Please help me fill in the blanks. Selected financial data from the June 30 year-end statements of Safford Company are given below: Total assets Long-term

Please help me fill in the blanks.

Please help me fill in the blanks.

Selected financial data from the June 30 year-end statements of Safford Company are given below: Total assets Long-term debt (9% interest rate) Total stockholders' equity Interest paid on long-term debt Net income $ 5,800,000 $ 700,000 $ 2,800,000 Total assets at the beginning of the year were $5,600,000; total stockholders' equity was $2,600,000. The company's tax rate is 40%. 1. Return on total assets 2. Return on equity 3. Financial Leverage $ 63,000 $ 420,000 Required: 1. Compute the return on total assets. (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) 2. Compute the return on equity. (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) 3. Is financial leverage positive or negative? % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts