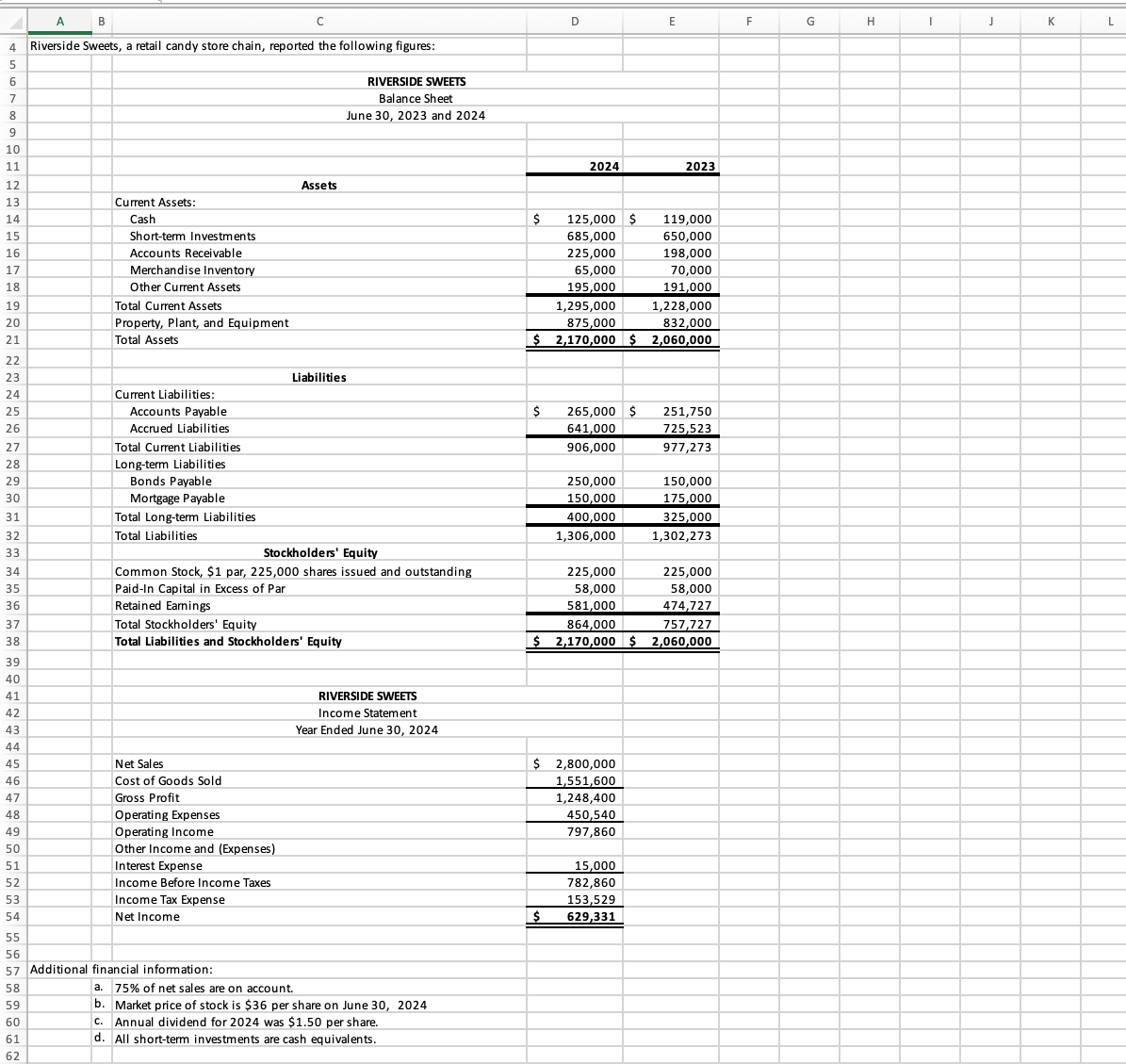

Question: Please help me fill in these charts. Riverside Sweets, a retail candy store chain, reported the following figures: RIVERSIDE SWEETS Additional financial information: a .

Please help me fill in these charts. Riverside Sweets, a retail candy store chain, reported the following figures:

RIVERSIDE SWEETS

Additional financial information:

a of net sales are on account.

b Market price of stock is $ per share on June

c Annual dividend for was $ per share.

d All shortterm investments are cash equivalents.

Perform a horizontal analysis on the balance sheets for and

Always use cell references and formulas where appropriate to receive full credit. If you copypaste from the Instructions tab you will be marked wrong. All values should be added as positive numbers.

RIVERSIDE SWEETS

RIVERSIDE SWEETS Balance Sheet June and Increa ecrease Amount Percentage Assets Current Assets: Cash $ $ Shortterm Investments Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets Property, Plant, and Equipment Total Assets $ $ Liabilities Current Liabilities: Accounts Payable $ $ Accrued Liabilities Total Current Liabilities Longterm Liabilities Bonds Payable Mortgage Payable Total Longterm Liabilities Total Liabilities Stockholders' Equity Common Stock, $ par, shares issued and outstanding PaidIn Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ $

HINTS

For cell references, begin the formula with an equals sign use the balance in this worksheet for your calculations, and press the enter key.

Perform a vertical analysis on the income statement.

Always use cell references and formulas where appropriate to receive full credit. If you copypaste from the Instructions tab you will be marked wrong. All values should be added as positive numbers.

HINTS

For cell references, begin the formula with an equals sign use the income statement in this worksheet for your calculations, and press the enter key.

Compute the following ratios. Do not round your calculations.

Always use cell references and formulas where appropriate to receive full credit. If you copypaste from the Instructions tab you will be marked wrong. All values should be added as positive numbers.

Working Capital

Current Ratio

AcidTest Quick Ratio

Cash Ratio

Accounts Receivable Turnover

Days' Sales in Receivables

Inventory Turnover

Days' Sales in Inventory

Gross Profit Percentage

Debt Ratio

Debt to Equity Ratio

TimesInterestEarned Ratio

Profit Margin Ratio

Rate of Return on Total Assets

Asset Turnover Ratio

Rate of Return on Common Stockholders' Equity

Earnings per Share EPS

PriceEarnings Ratio

Dividend Yield

Dividend Payout

HINTS

Cell Hint:

C Begin the formula with an equals sign use the balance in the horizontal analysis worksheet for your calculations, and press the enter key.

C Use the function SUM to calculate the numerator.

CVertical Analysis'!CHorizontal Analysis'!C'Horizontal Analysis'!D

C Assume days in a year and use the correct ratio in this worksheet for your calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock