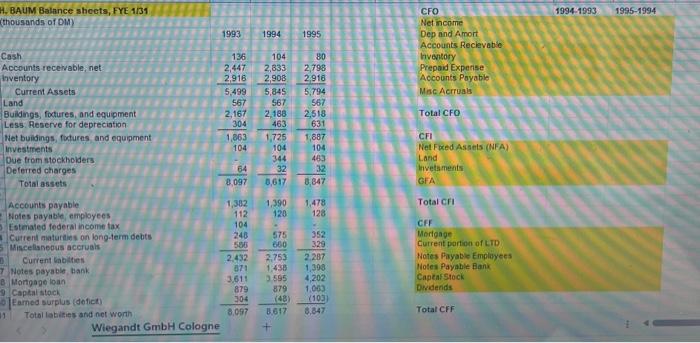

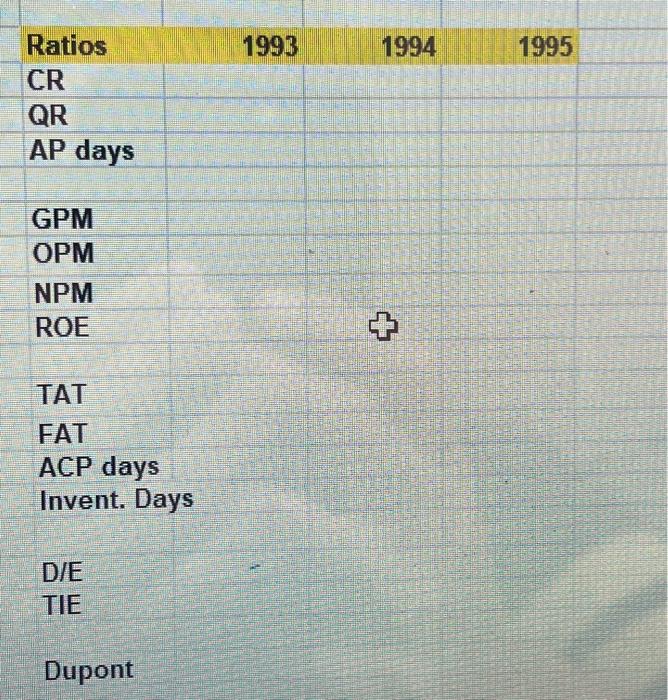

Question: Please help me fill it out. Also using Net sales as the Sales for the ratios Total fiabilties and net worth 8,0973048,617(46)8,847(103) Total CFF Exhibit

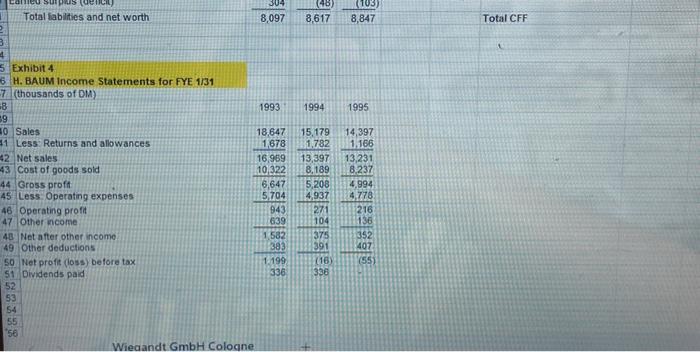

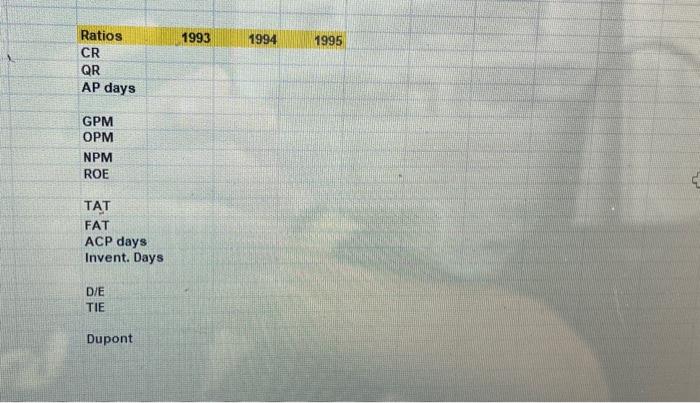

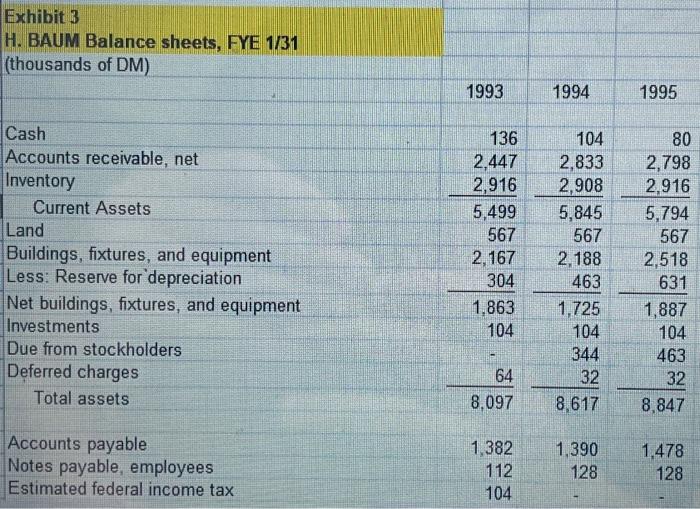

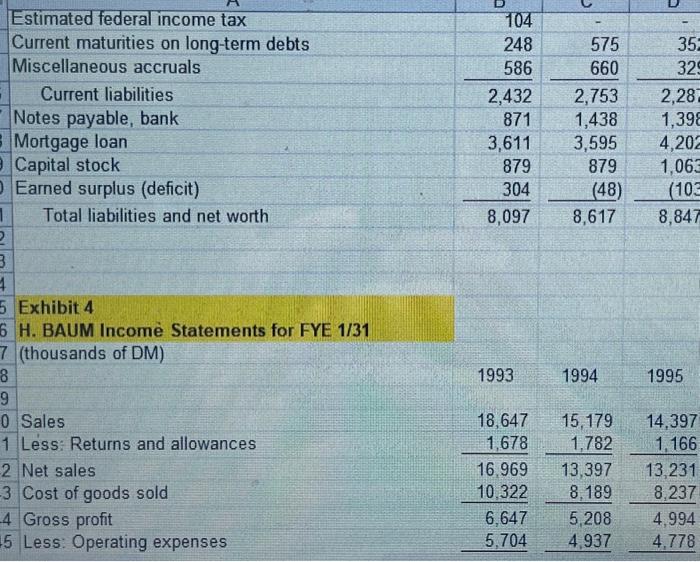

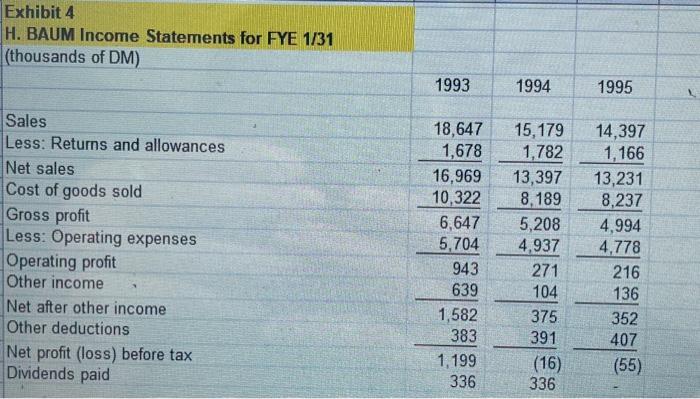

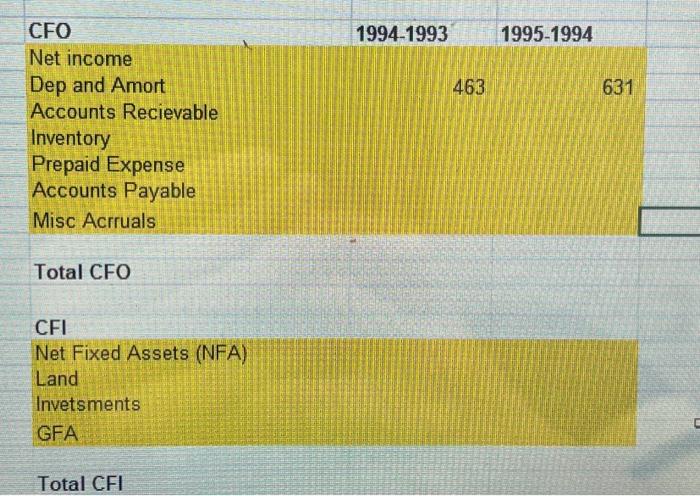

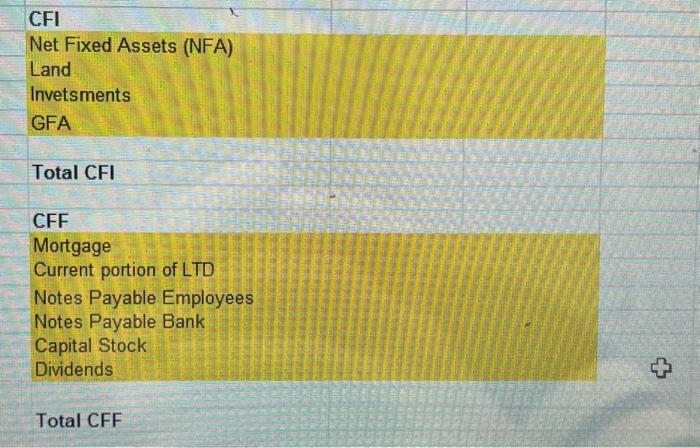

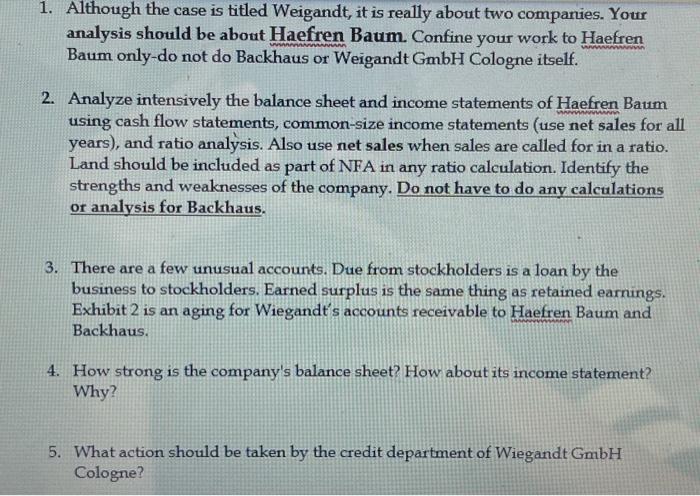

Total fiabilties and net worth 8,0973048,617(46)8,847(103) Total CFF Exhibit 4 H. BAUM Income Statements for FYE 1/31 (thousands of DIA) CR QR AP days GPM OPM NPM ROE TAT FAT ACP days Invent. Days DiE TIE Dupont Exhibit 3 H. BAUM Balance sheets, FYE 1/31 (thousands of DM) Cash Accounts receivable, net Inventory Current Assets Land Buildings, fixtures, and equipment Less: Reserve for depreciation Net buildings, fixtures, and equipment Investments Due from stockholders Deferred charges Total assets Accounts payable Notes payable, employees Estimated federal income tax \begin{tabular}{lrrrrr} \hline Estimated federal income tax & \multicolumn{1}{l}{} & 104 & & \\ Current maturities on long-term debts & 248 & 575 & 35 \\ Miscellaneous accruals & 586 & 660 & 32 \\ \cline { 5 - 6 } & Current liabilities & 2,432 & 2,753 & 2,28 \\ Notes payable, bank & 871 & 1,438 & 1,398 \\ Mortgage loan & 3,611 & 3,595 & 4,202 \\ Capital stock & 879 & 879 & 1,063 \\ Earned surplus (deficit) & 304 & (48) & (103 \\ \cline { 4 - 6 } & Total liabilities and net worth & 8,097 & 8,617 & 8,847 \end{tabular} Exhibit 4 H. BAUM Income Statements for FYE 1/31 (thousands of DM) Sales Lss: Returns and allowances 2 Net sales 3 Cost of goods sold 4 Gross profit 5 Less: Operating expenses 199319941995 Exhibit 4 H. BAUM Income Statements for FYE 1/31 (thousands of DM) \begin{tabular}{lrrr|r|} & 1993 & 1994 & 1995 \\ \hline Sales & & & \\ \hline Less: Returns and allowances & 18,647 & 15,179 & 14,397 \\ \hline Net sales & 1,678 & 1,782 & 1,166 \\ \hline Cost of goods sold & 16,969 & 13,397 & 13,231 \\ \hline Gross profit & 10,322 & 8,189 & 8,237 \\ \hline Less: Operating expenses & 6,647 & 5,208 & 4,994 \\ \hline Operating profit & 5,704 & 4,937 & 4,778 \\ Other income & 943 & 271 & 216 \\ Net after other income & 639 & 104 & 136 \\ Other deductions & 1,582 & 375 & 352 \\ Net profit (loss) before tax & 383 & 391 & 407 \\ Dividends paid & 1,199 & (16) & (55) \\ & & 336 & 336 & - \\ \hline \end{tabular} CFO 1994-1993 1995-1994 Net income Dep and Amort 463 631 Accounts Recievable Inventory Prepaid Expense Accounts Payable Misc Acrruals Total CFO CFI Net Fixed Assets (NFA) Land Invetsments GFA Total CFI CFI Net Fixed Assets (NFA) Land Invetsments GFA Total CFI CFF Mortgage Current portion of LTD Notes Payable Employees Notes Payable Bank Capital Stock Dividends Total CFF Ratios CR QR AP days GPM OPM NPM ROE TAT FAT ACP days Invent. Days D/E TIE Ratios 1993 1994 1995 CR QR AP days GPM OPM NPM ROE TAT FAT ACP days Invent. Days D/E TIE Dupont 1. Although the case is titled Weigandt, it is really about two companies. Your analysis should be about Haefren Baum. Confine your work to Haefren Baum only-do not do Backhaus or Weigandt GmbH Cologne itself. 2. Analyze intensively the balance sheet and income statements of Haefren Baum using cash flow statements, common-size income statements (use net sales for al years), and ratio analysis. Also use net sales when sales are called for in a ratio. Land should be included as part of NFA in any ratio calculation. Identify the strengths and weaknesses of the company. Do not have to do any calculations or analysis for Backhaus. 3. There are a few unusual accounts. Due from stockholders is a loan by the business to stockholders. Earned surplus is the same thing as retained earnungs. Exhibit 2 is an aging for Wiegandt's accounts receivable to Haefren Baum and Backhaus. 4. How strong is the company's balance sheet? How about its income statement? Why? 5. What action should be taken by the credit department of Wiegandt GmbH Cologne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts