Question: Please help me fill out form 1040 with this information. TIA ome and Exclusions Group 4: Comprehensive Problems 1. Beverly and Ken Hair have been

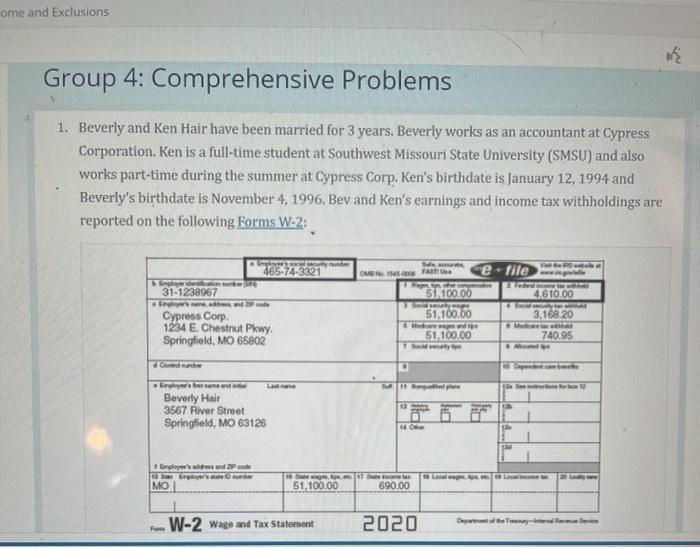

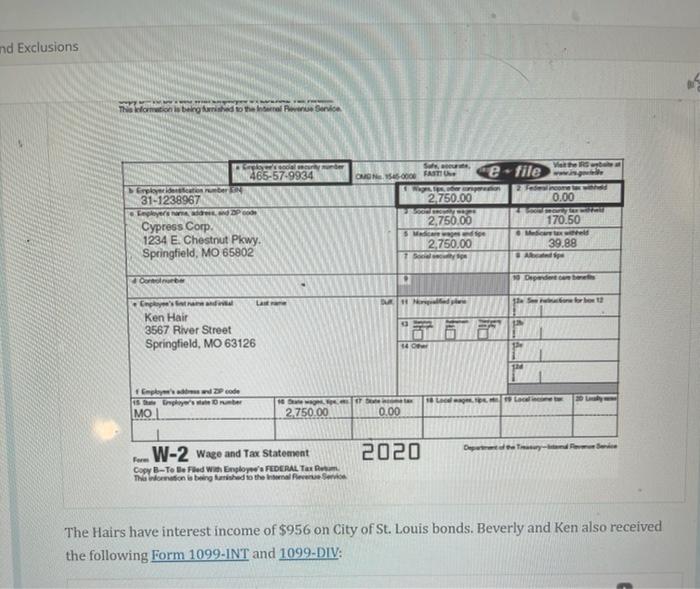

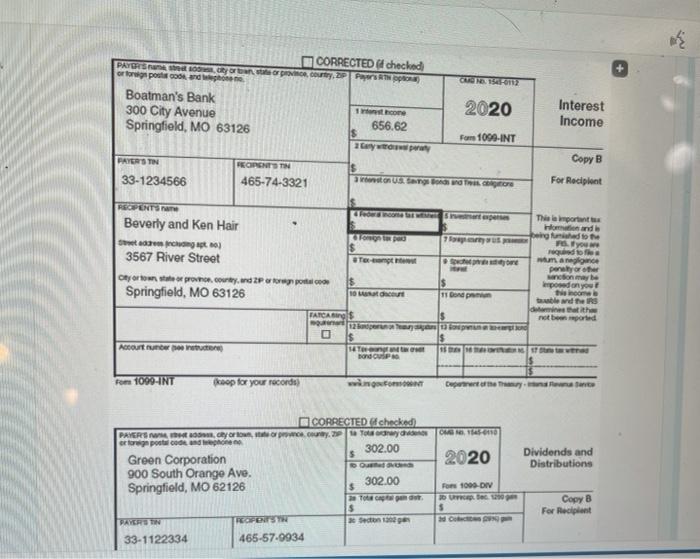

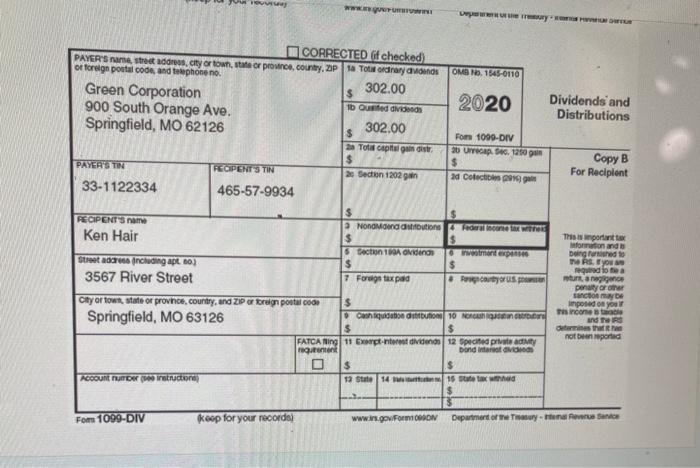

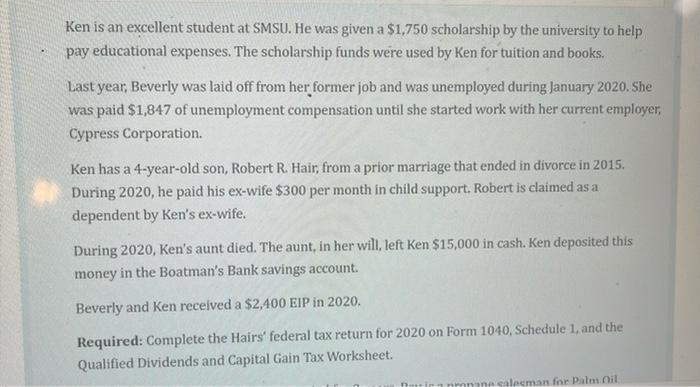

ome and Exclusions Group 4: Comprehensive Problems 1. Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Ken's birthdate is January 12, 1994 and Beverly's birthdate is November 4, 1996. Bev and Ken's earnings and income tax withholdings are reported on the following Forms W-2: 265-74-3321 31-1238967 Laporan Cypress Corp. 1234 E. Chestnut Pkwy. Springfield, MO 66802 w OF e. file 51,100.00 4.610.00 51,100.00 3,168,20 51.100.00 740.95 . Beverly Hair 3567 River Street Springfield, MO 63126 Begitude royer MO 51,100.00 For more 690.00 W-2 wage and Tax Statement 2020 nd Exclusions tion is being used to the Internet Service Worth Su 1545.000 FT e-file 0.00 G000 465-57-9934 Employers 31-1238967 Employers. Pode Cypress Corp. 1234 E. Chestnut Pkwy. Springfield, MO 65802 2.750.00 2,750.00 Made 2.750.00 Sony 170.50 Meld 39.88 Ape Oon 19 Dependent La Copy's Grand Ken Hair 3567 River Street Springfield, MO 63126 code Empty 15 Eros MO. nem LLL 2.750.00 0.00 . W-2 Wage and Tax Statement 2020 Copy B-To Bed With Employs FEDERAL Tax This Wormation tinguished to the leve The Hairs have interest income of $956 on City of St. Louis bonds. Beverly and Ken also received the following Form 1099-INT and 1099-DIV: M CORRECTED checked PAYGRIS GEOPOROZP Pro or for posts and Boatman's Bank hone 300 City Avenue 656.62 Springfield, MO 63126 $ by www 2020 Interest Income Fome 1090-INT PAYERS TIN Copy B FEONTIN 33-1234566 465-74-3321 on Garg Bond Thor For Recipient REGENTS See This important Beverly and Ken Hair Home and be pod romat) Forening for the IS pod of 3567 River Street To compt More wum and pontyor other con Crostate or pronourtyard Porporal poed on you Springfield, MO 63126 10 count 11 Bond the income be the TARCA IS wo 12 per a long $ is Account 14 Town 15 Dondup rom 1099-INT krop for your records) get Deporte They Dividends and Distributions CORRECTED (checked PAYERSy or low O 2 Toys Gene opondon $ 302.00 Green Corporation 2020 DO 900 South Orange Ave. 302.00 Springfield, MO 62126 $ For 1000-DIV TO Dec $ $ PAYROTIN ROSH 3e Section 102 33-1122334 465-57-9934 Copy B For Recipient HOT www M CORRECTED (f checked PAYER'S name stract address, city or town, state or province, Country DP Tot ordinary of foreign portal on, and telephone no. OMB NO. 1545-0110 Green Corporation 302.00 $ 2020 Dividends and 900 South Orange Ave. 10 Ques Distributions Springfield, MO 62126 302.00 $ For 1090-DIV 2 Total capital gainst 30 UITGRP 1200 gan $ Copy B $ PAYER'S TO RECIPENT TIN For Recipient 20 Sen 1202 gan ad Cotection gal 33-1122334 465-57-9934 $ RECIPENT's name Nondonado Federal This important Ken Hair $ formation and tection 100 Odens woment ex being used to Stronding apt. 80) The you $ $ ered for 3567 River Street 7 Foros tax paid Program angegance pontorer Bancomate City or town, state or province. country, and ZIP foreign postal 000 $ imposed on your incones quia DUO 10 NORGEN and I Springfield, MO 63126 $ $ des that not been reported FATCA Ring 11 Ertnere dividend 12 specified private nogen bond Intret $ Account Tretructor 13 State 14 i 16 takwed Form 1099-DIV koop for your records) www.sgow Form Department of me when Senior Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Last year, Beverly was laid off from her former job and was unemployed during January 2020. She was paid $1,847 of unemployment compensation until she started work with her current employer, Cypress Corporation. Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2015. During 2020, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken's ex-wife. During 2020, Ken's aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman's Bank savings account. Beverly and Ken received a $2,400 EIP in 2020, Required: Complete the Hairs' federal tax return for 2020 on Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. one saleeman for Palm Oil ome and Exclusions Group 4: Comprehensive Problems 1. Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Ken's birthdate is January 12, 1994 and Beverly's birthdate is November 4, 1996. Bev and Ken's earnings and income tax withholdings are reported on the following Forms W-2: 265-74-3321 31-1238967 Laporan Cypress Corp. 1234 E. Chestnut Pkwy. Springfield, MO 66802 w OF e. file 51,100.00 4.610.00 51,100.00 3,168,20 51.100.00 740.95 . Beverly Hair 3567 River Street Springfield, MO 63126 Begitude royer MO 51,100.00 For more 690.00 W-2 wage and Tax Statement 2020 nd Exclusions tion is being used to the Internet Service Worth Su 1545.000 FT e-file 0.00 G000 465-57-9934 Employers 31-1238967 Employers. Pode Cypress Corp. 1234 E. Chestnut Pkwy. Springfield, MO 65802 2.750.00 2,750.00 Made 2.750.00 Sony 170.50 Meld 39.88 Ape Oon 19 Dependent La Copy's Grand Ken Hair 3567 River Street Springfield, MO 63126 code Empty 15 Eros MO. nem LLL 2.750.00 0.00 . W-2 Wage and Tax Statement 2020 Copy B-To Bed With Employs FEDERAL Tax This Wormation tinguished to the leve The Hairs have interest income of $956 on City of St. Louis bonds. Beverly and Ken also received the following Form 1099-INT and 1099-DIV: M CORRECTED checked PAYGRIS GEOPOROZP Pro or for posts and Boatman's Bank hone 300 City Avenue 656.62 Springfield, MO 63126 $ by www 2020 Interest Income Fome 1090-INT PAYERS TIN Copy B FEONTIN 33-1234566 465-74-3321 on Garg Bond Thor For Recipient REGENTS See This important Beverly and Ken Hair Home and be pod romat) Forening for the IS pod of 3567 River Street To compt More wum and pontyor other con Crostate or pronourtyard Porporal poed on you Springfield, MO 63126 10 count 11 Bond the income be the TARCA IS wo 12 per a long $ is Account 14 Town 15 Dondup rom 1099-INT krop for your records) get Deporte They Dividends and Distributions CORRECTED (checked PAYERSy or low O 2 Toys Gene opondon $ 302.00 Green Corporation 2020 DO 900 South Orange Ave. 302.00 Springfield, MO 62126 $ For 1000-DIV TO Dec $ $ PAYROTIN ROSH 3e Section 102 33-1122334 465-57-9934 Copy B For Recipient HOT www M CORRECTED (f checked PAYER'S name stract address, city or town, state or province, Country DP Tot ordinary of foreign portal on, and telephone no. OMB NO. 1545-0110 Green Corporation 302.00 $ 2020 Dividends and 900 South Orange Ave. 10 Ques Distributions Springfield, MO 62126 302.00 $ For 1090-DIV 2 Total capital gainst 30 UITGRP 1200 gan $ Copy B $ PAYER'S TO RECIPENT TIN For Recipient 20 Sen 1202 gan ad Cotection gal 33-1122334 465-57-9934 $ RECIPENT's name Nondonado Federal This important Ken Hair $ formation and tection 100 Odens woment ex being used to Stronding apt. 80) The you $ $ ered for 3567 River Street 7 Foros tax paid Program angegance pontorer Bancomate City or town, state or province. country, and ZIP foreign postal 000 $ imposed on your incones quia DUO 10 NORGEN and I Springfield, MO 63126 $ $ des that not been reported FATCA Ring 11 Ertnere dividend 12 specified private nogen bond Intret $ Account Tretructor 13 State 14 i 16 takwed Form 1099-DIV koop for your records) www.sgow Form Department of me when Senior Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Last year, Beverly was laid off from her former job and was unemployed during January 2020. She was paid $1,847 of unemployment compensation until she started work with her current employer, Cypress Corporation. Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2015. During 2020, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken's ex-wife. During 2020, Ken's aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman's Bank savings account. Beverly and Ken received a $2,400 EIP in 2020, Required: Complete the Hairs' federal tax return for 2020 on Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. one saleeman for Palm Oil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts