Question: please help me fill out the boxes and help me with the debit and credit The January 1, Year 1 trial balance for the Martin

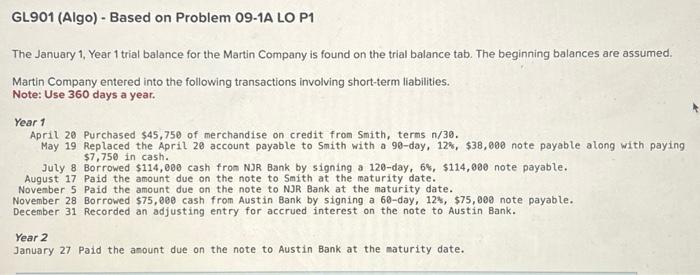

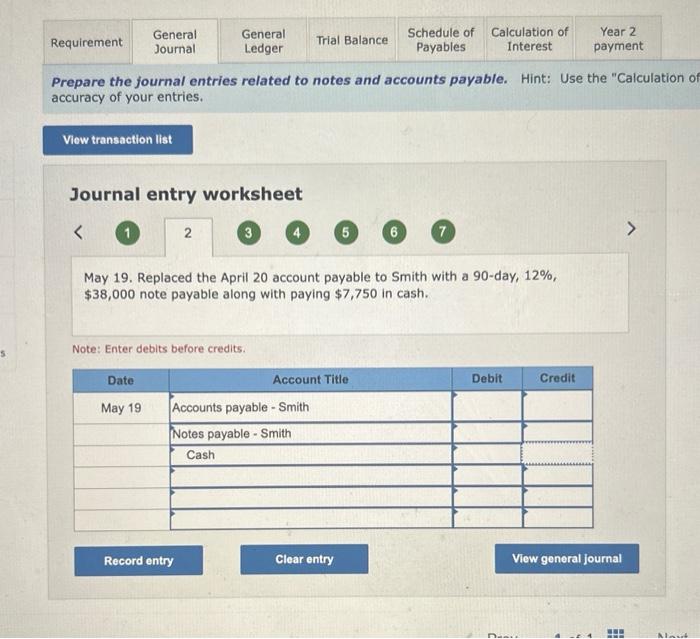

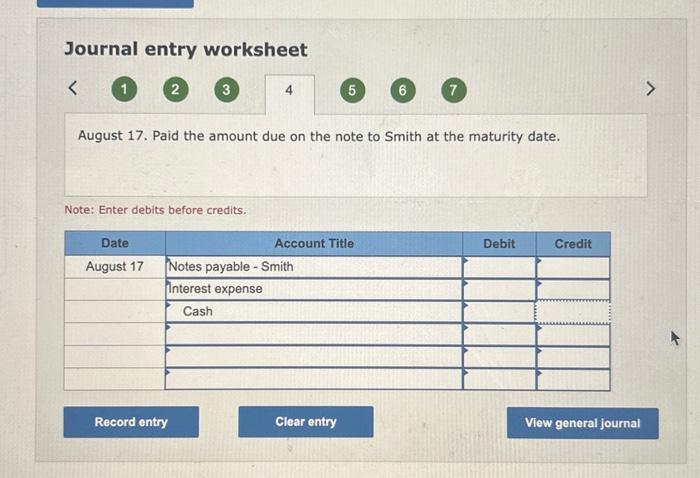

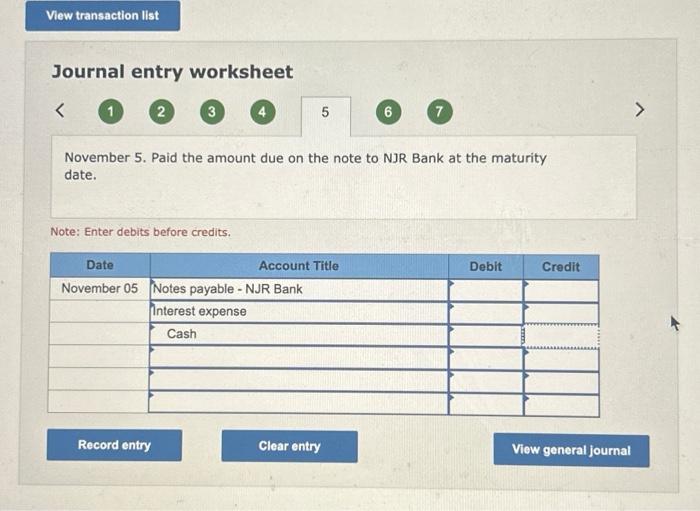

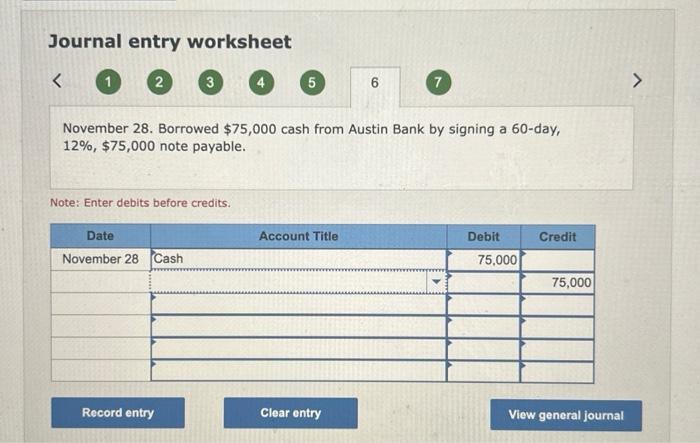

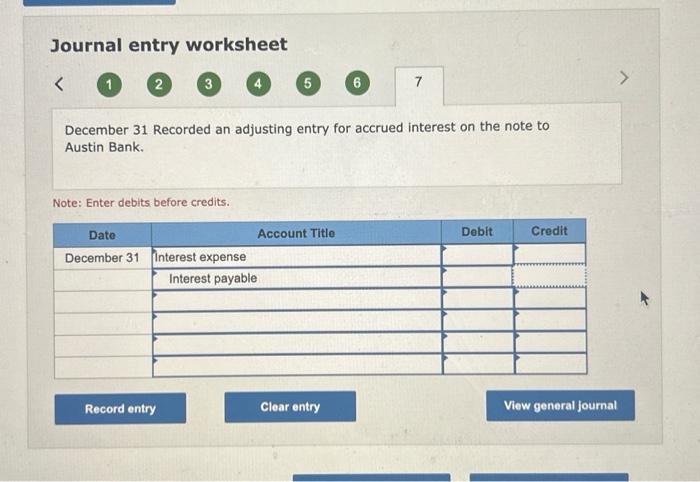

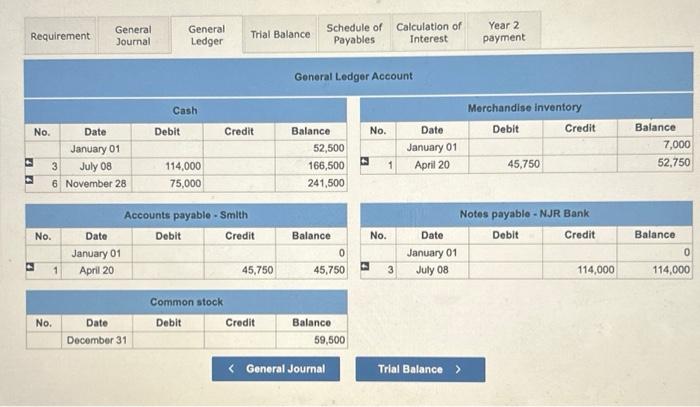

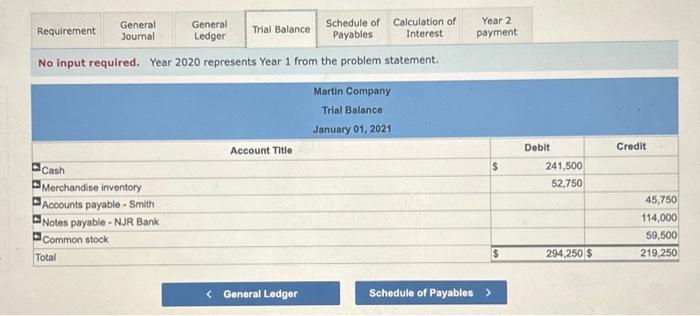

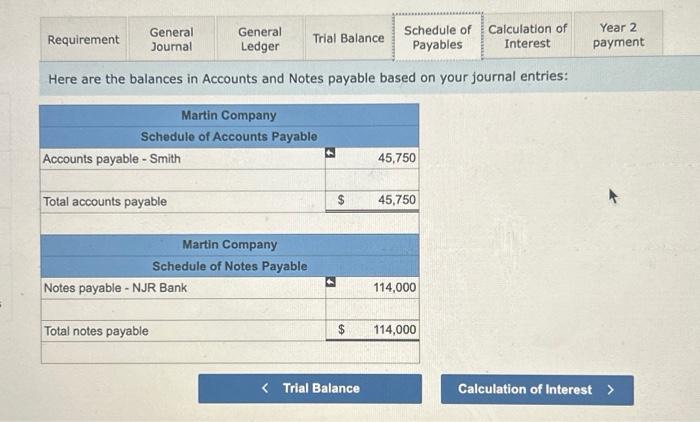

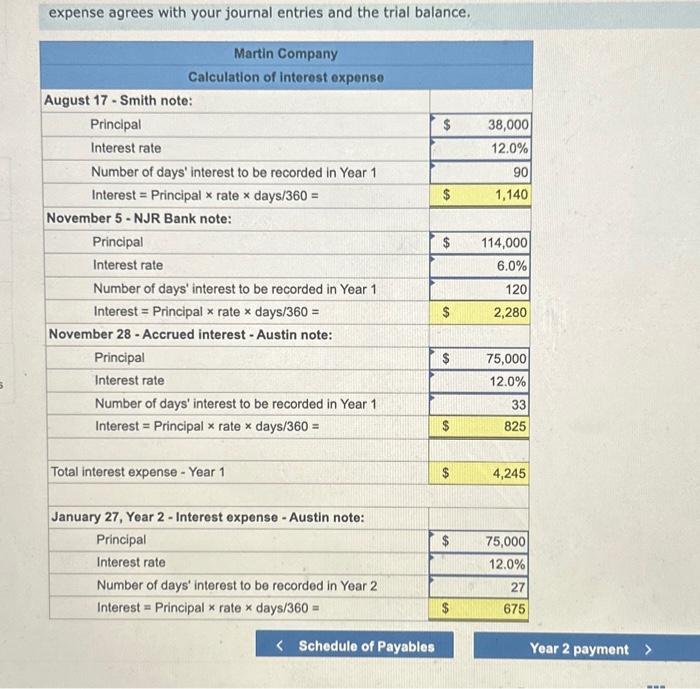

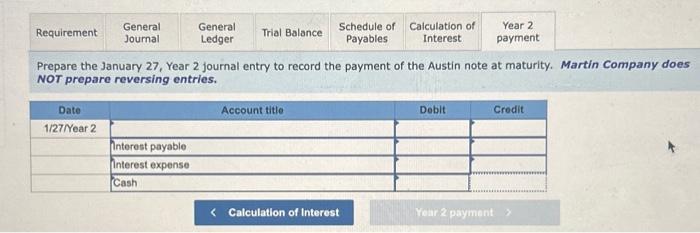

The January 1, Year 1 trial balance for the Martin Company is found on the trial balance tab. The beginning balances are assumed. Martin Company entered into the following transactions involving short-term liabilities. Note: Use 360 days a year. Year 1 April 20 Purchased $45,750 of merchandise on credit from Smith, terms n/30. May 19 Replaced the April 20 account payable to Smith with a 90 -day, 12%,$38,000 note payable along with paying $7,750 in cash. July 8 Borrowed $114,000 cash from NJR Bank by signing a 120-day, 6\%, $114,000 note payable. August 17 Paid the amount due on the note to Smith at the maturity date. November 5 Paid the amount due on the note to NJR Bank at the maturity date. November 28 Borrowed $75,000 cash from Austin Bank by signing a 60-day, 12\%, $75,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Austin Bank. Year 2 January 27 Paid the amount due on the note to Austin Bank at the maturity date. Prepare the journal entries related to notes and accounts payable. Hint: Use the "Calculation accuracy of your entries. Journal entry worksheet 67 May 19. Replaced the April 20 account payable to Smith with a 90 -day, 12%, $38,000 note payable along with paying $7,750 in cash. Note: Enter debits before credits. Journal entry worksheet 1 2 7 August 17. Paid the amount due on the note to Smith at the maturity date. Note: Enter debits before credits. Journal entry worksheet 1 November 5 . Paid the amount due on the note to NJR Bank at the maturity date. Note: Enter debits before credits. Journal entry worksheet 1 2 3 November 28 . Borrowed $75,000 cash from Austin Bank by signing a 60 -day, 12%,$75,000 note payable. Note: Enter debits before credits. Journal entry worksheet 1. 2 3 5 6 December 31 Recorded an adjusting entry for accrued interest on the note to Austin Bank. Note: Enter debits before credits. General Ledger Account No input required. Year 2020 represents Year 1 from the problem statement. Here are the balances in Accounts and Notes payable based on your journal entries: aunanea anrape with unum inurnal entrien and the trial halanra Prepare the January 27, Year 2 journal entry to record the payment of the Austin note at maturity. NOT prepare reversing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts