Question: please help me fill out the boxes! thank you so much! The 2021 and 2020 balance sheets of Gibson Corporation follow. The 2021 income statement

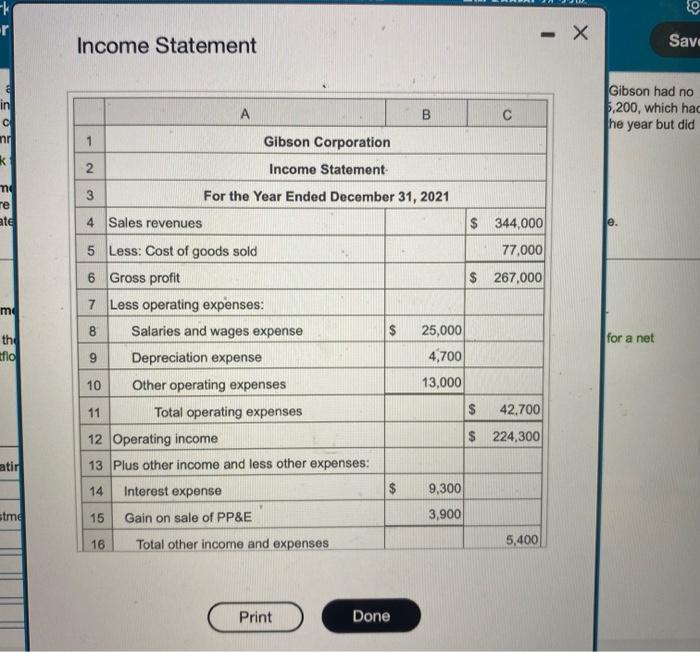

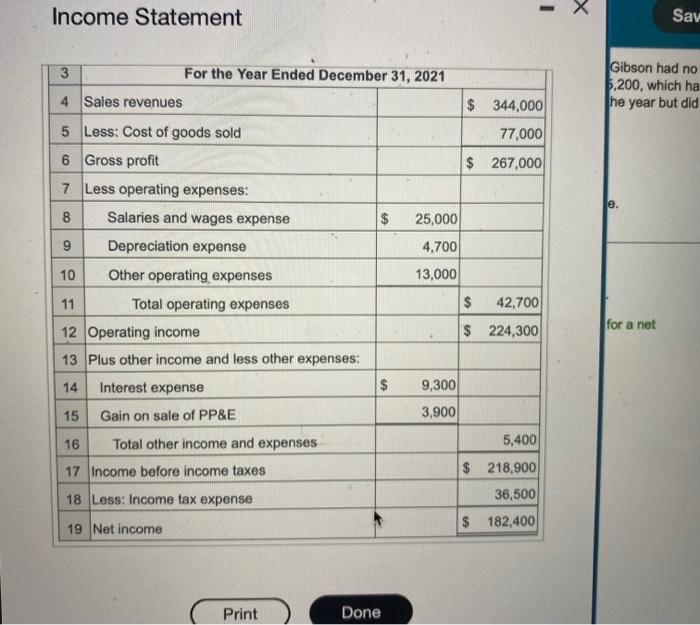

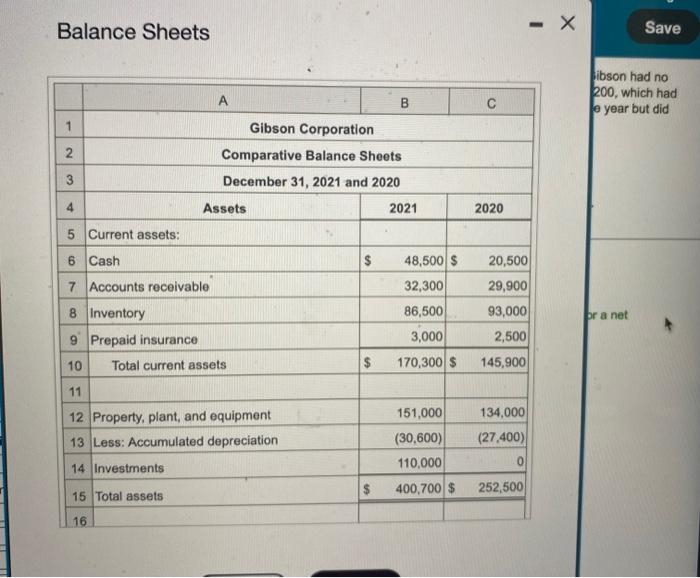

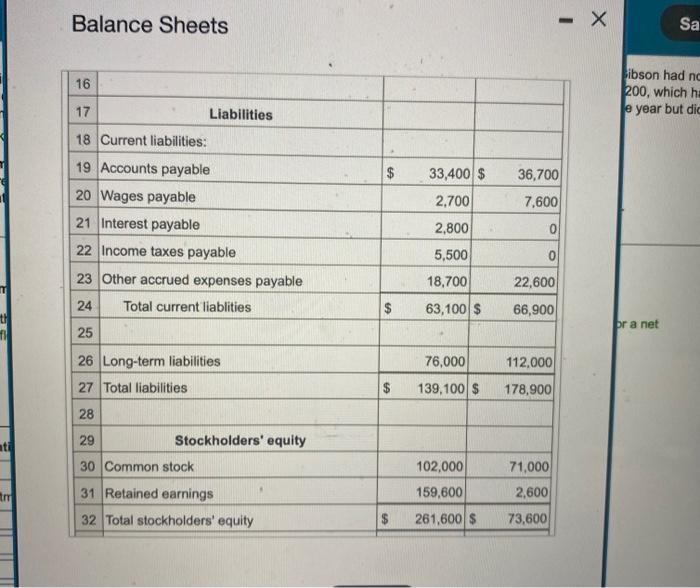

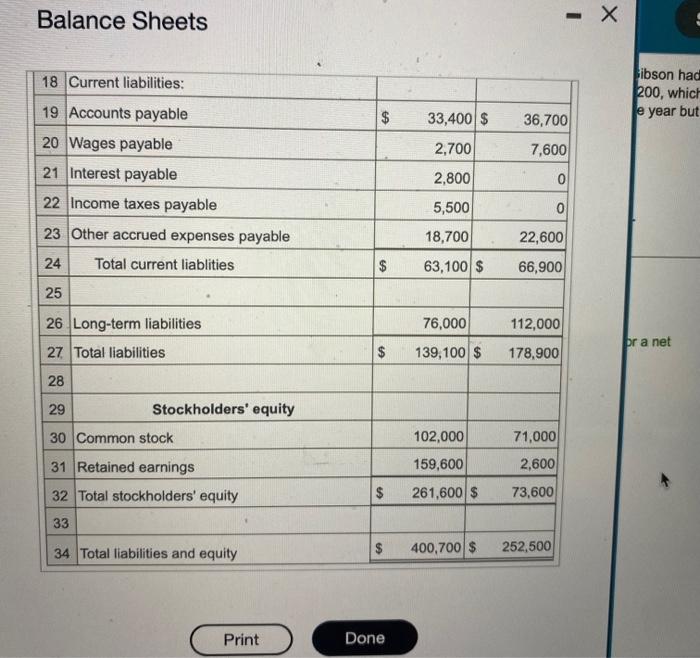

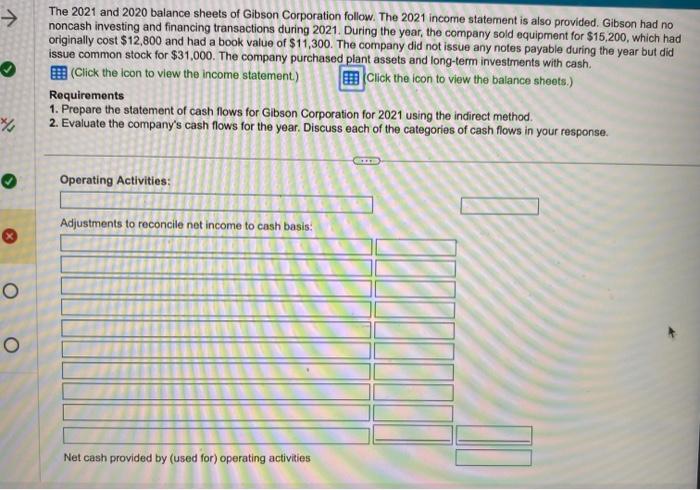

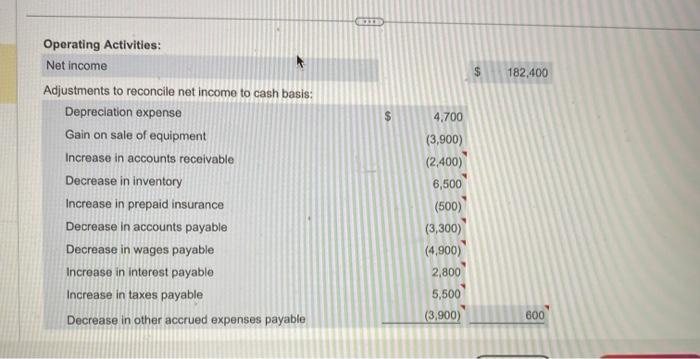

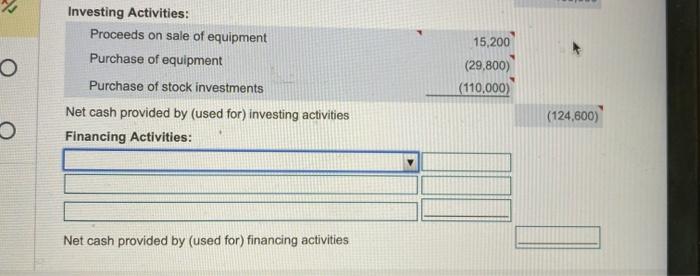

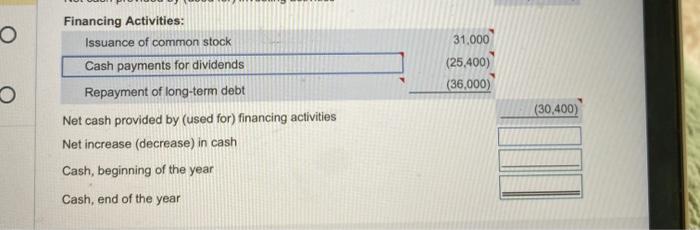

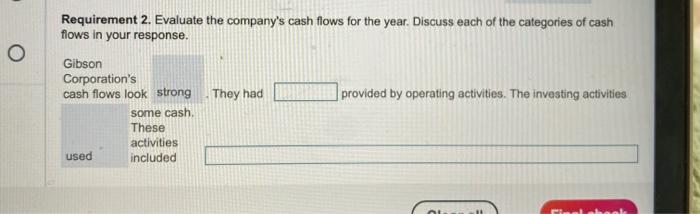

The 2021 and 2020 balance sheets of Gibson Corporation follow. The 2021 income statement is also provided. Gibson had no noncash investing and financing transactions during 2021. During the year, the company sold equipment for $15,200, which had originally cost $12,800 and had a book value of $11,300. The company did not issue any notes payable during the year but did issue common stock for $31,000. The company purchased plant assets and long-term investments with cash. (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) Requirements 1. Prepare the statement of cash flows for Gibson Corporation for 2021 using the indirect method. 2. Evaluate the company's cash flows for the year. Discuss each of the categories of cash flows in your response. Requirement 1. Prepare the statement of cash flows for Gibson Corporation for 2021 using the indirect method. Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted or for a net cash outflow.) Income Statement Gibson had no 5,200, which hac he year but did Income Statement Gibson had no , 200, which ha he year but did Balance Sheets Save 200, which had 200, year but did Balance Sheets x Balance Sheets x The 2021 and 2020 balance sheets of Gibson Corporation follow. The 2021 income statement is also provided. Gibson had no noncash investing and financing transactions during 2021 . During the year, the company sold equipment for $15,200, which had originally cost $12,800 and had a book value of $11,300. The company did not issue any notes payable during the year but did issue common stock for $31,000. The company purchased plant assets and long-term investments with cash. (Click the icon to view the income statement) Click the icon to view the balance sheets.) Requirements 1. Prepare the statement of cash flows for Gibson Corporation for 2021 using the indirect method. 2. Evaluate the company's cash flows for the year. Discuss each of the categories of cash flows in your response. Operating Activities: Operating Activities: Net income Adjustments to reconcile net income to cash basis: Depreciation expense Gain on sale of equipment Increase in accounts receivable Decrease in inventory Increase in prepaid insurance Decrease in accounts payable Decrease in wages payable Increase in interest payable Increase in taxes payable Decrease in other accrued expenses payable Investing Activities: Proceeds on sale of equipment Purchase of equipment Purchase of stock investments 15,200 (29,800) (110,000) Net cash provided by (used for) investing activities (124,600) Financing Activities: Net cash provided by (used for) financing activities Financing Activities: Requirement 2. Evaluate the company's cash flows for the year. Discuss each of the categories of cash fows in your response. Gibson Corporation's cash flows look some cash. They had provided by operating activities. The investing activities These activities included

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts