Question: Please help me fill out the chart using the account titles given, I have all those right just need the numbers PV of 1 Factor

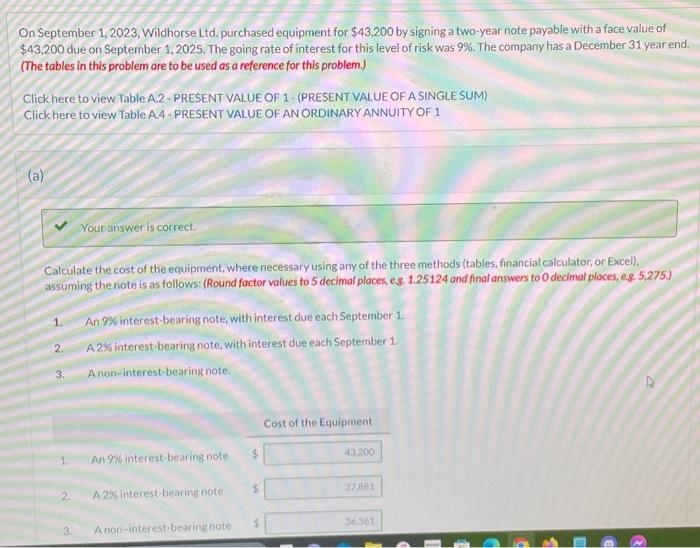

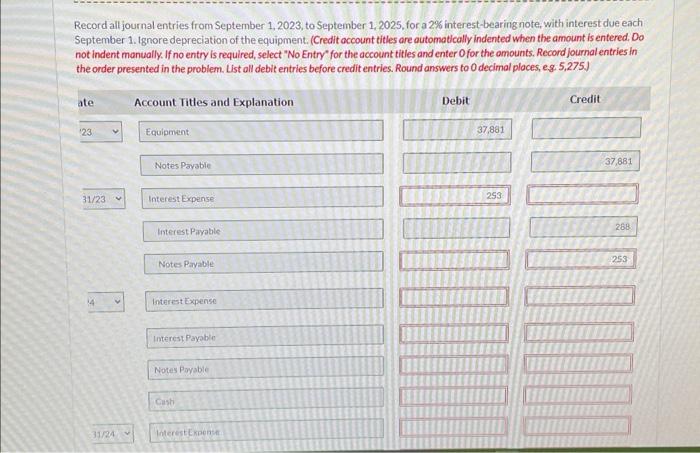

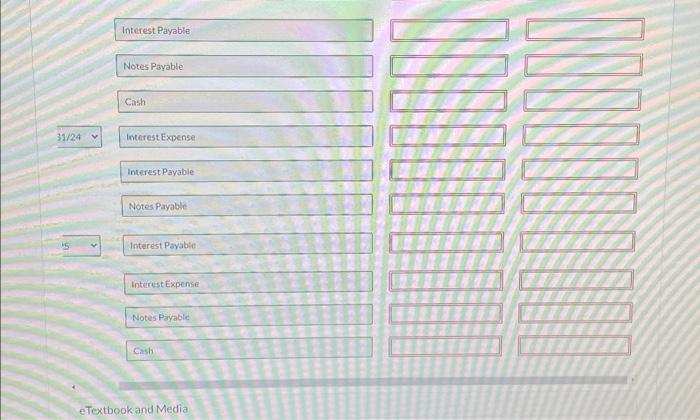

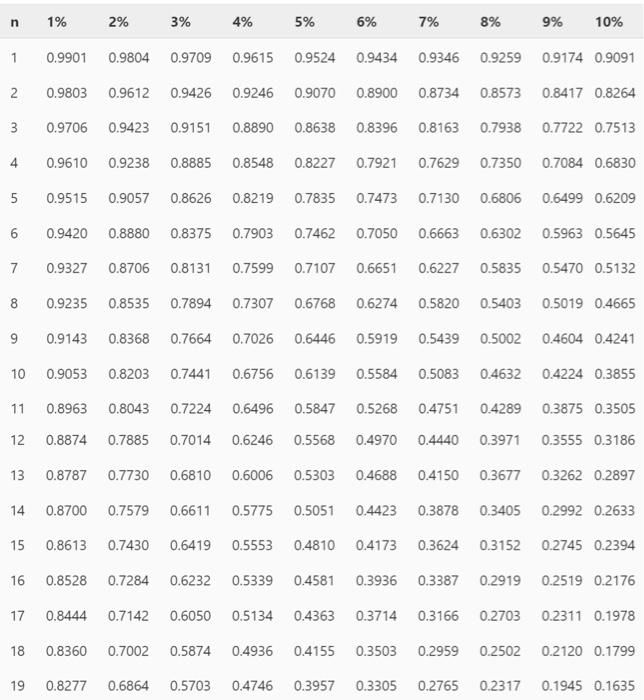

On September 1,2023 , Wildhorse Ltd. purchased equipment for $43,200 by signing a two-year note payable with a face value of $43,200 due on September 1,2025 . The going rate of interest for this level of risk was 9%. The company has a December 31 year end. (The tables in this problem are to be used as a reference for this problem.) Click here to view Table A.2-PRESENT VALUE OF 1- (PRESENT VALUE OF A SINGLE SUM) Click here to view Table A.4 - PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (a) Your-answer is correct. Calculate the cost of the equipment, where necessary using any of the three methods (tables, financial calculator, or Excel). assuming the note is as follows: (Round factor values to 5 decimal places, es. 1.25124 and final answers to 0 decimal places, es. 5,275.) 1. An 9% interest bearing note, with interest due each September 1. 2. A 2% interest-bearing note, with interest due each September 1. 3. Anon-interest-bearing note- Record all journal entries from September 1,2023 , to September 1,2025 , for a 2% interest-bearing note, with interest due each September 1. Ignore depreciation of the equipment. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. (ist ali debit entries before credit entries. Round answers to 0 decimal ploces, e.g. 5,275 ) Interest Payable Notes Payable Cash 31/24 Interest Expense Interest Payable Notes Payable is Interest Pavabie Interest Expense Notes Payabic Gish eTextbookand Media \begin{tabular}{lllllllllll} n & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% \\ 1 & 0.9901 & 0.9804 & 0.9709 & 0.9615 & 0.9524 & 0.9434 & 0.9346 & 0.9259 & 0.9174 & 0.9091 \\ 2 & 0.9803 & 0.9612 & 0.9426 & 0.9246 & 0.9070 & 0.8900 & 0.8734 & 0.8573 & 0.8417 & 0.8264 \\ 3 & 0.9706 & 0.9423 & 0.9151 & 0.8890 & 0.8638 & 0.8396 & 0.8163 & 0.7938 & 0.7722 & 0.7513 \\ 4 & 0.9610 & 0.9238 & 0.8885 & 0.8548 & 0.8227 & 0.7921 & 0.7629 & 0.7350 & 0.7084 & 0.6830 \\ 5 & 0.9515 & 0.9057 & 0.8626 & 0.8219 & 0.7835 & 0.7473 & 0.7130 & 0.6806 & 0.6499 & 0.6209 \\ 6 & 0.9420 & 0.8880 & 0.8375 & 0.7903 & 0.7462 & 0.7050 & 0.6663 & 0.6302 & 0.5963 & 0.5645 \\ 7 & 0.9327 & 0.8706 & 0.8131 & 0.7599 & 0.7107 & 0.6651 & 0.6227 & 0.5835 & 0.5470 & 0.5132 \\ 8 & 0.9235 & 0.8535 & 0.7894 & 0.7307 & 0.6768 & 0.6274 & 0.5820 & 0.5403 & 0.5019 & 0.4665 \\ 9 & 0.9143 & 0.8368 & 0.7664 & 0.7026 & 0.6446 & 0.5919 & 0.5439 & 0.5002 & 0.4604 & 0.4241 \\ 10 & 0.9053 & 0.8203 & 0.7441 & 0.6756 & 0.6139 & 0.5584 & 0.5083 & 0.4632 & 0.4224 & 0.3855 \\ 11 & 0.8963 & 0.8043 & 0.7224 & 0.6496 & 0.5847 & 0.5268 & 0.4751 & 0.4289 & 0.3875 & 0.3505 \\ 12 & 0.8874 & 0.7885 & 0.7014 & 0.6246 & 0.5568 & 0.4970 & 0.4440 & 0.3971 & 0.3555 & 0.3186 \\ 13 & 0.8787 & 0.7730 & 0.6810 & 0.6006 & 0.5303 & 0.4688 & 0.4150 & 0.3677 & 0.3262 & 0.2897 \\ 14 & 0.8700 & 0.7579 & 0.6611 & 0.5775 & 0.5051 & 0.4423 & 0.3878 & 0.3405 & 0.2992 & 0.2633 \\ 15 & 0.8613 & 0.7430 & 0.6419 & 0.5553 & 0.4810 & 0.4173 & 0.3624 & 0.3152 & 0.2745 & 0.2394 \\ 16 & 0.8528 & 0.7284 & 0.6232 & 0.5339 & 0.4581 & 0.3936 & 0.3387 & 0.2919 & 0.2519 & 0.2176 \\ 17 & 0.8444 & 0.7142 & 0.6050 & 0.5134 & 0.4363 & 0.3714 & 0.3166 & 0.2703 & 0.2311 & 0.1978 \\ 18 & 0.8360 & 0.7002 & 0.5874 & 0.4936 & 0.4155 & 0.3503 & 0.2959 & 0.2502 & 0.2120 & 0.1799 \\ 19 & 0.8277 & 0.6864 & 0.5703 & 0.4746 & 0.3957 & 0.3305 & 0.2765 & 0.2317 & 0.1945 & 0.1635 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts