Question: PLEASE help me fill out this excel sheet. questions are attached with blank excel worksheet You are an entrepreneur who has been building your small

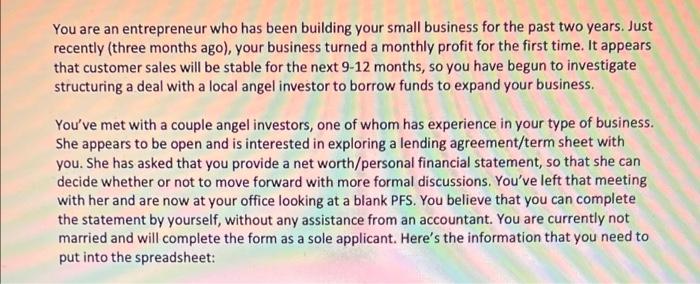

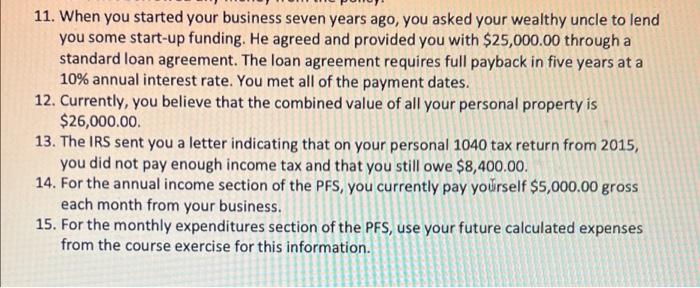

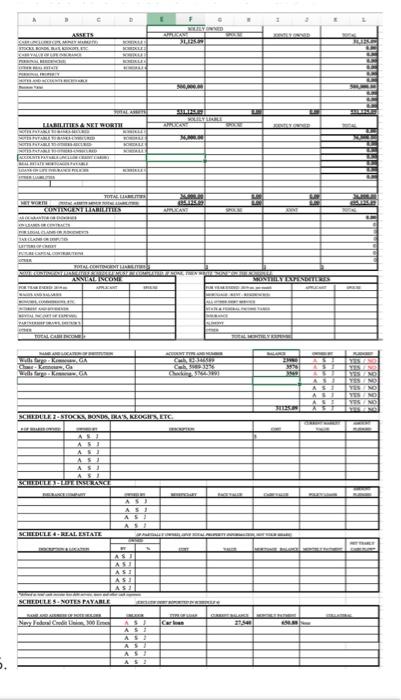

You are an entrepreneur who has been building your small business for the past two years. Just recently (three months ago), your business turned a monthly profit for the first time. It appears that customer sales will be stable for the next 9-12 months, so you have begun to investigate structuring a deal with a local angel investor to borrow funds to expand your business. You've met with a couple angel investors, one of whom has experience in your type of business. She appears to be open and is interested in exploring a lending agreement/term sheet with you. She has asked that you provide a net worth/personal financial statement, so that she can decide whether or not to move forward with more formal discussions. You've left that meeting with her and are now at your office looking at a blank PFS. You believe that you can complete the statement by yourself, without any assistance from an accountant. You are currently not married and will complete the form as a sole applicant. Here's the information that you need to put into the spreadsheet: a 11. When you started your business seven years ago, you asked your wealthy uncle to lend you some start-up funding. He agreed and provided you with $25,000.00 through a standard loan agreement. The loan agreement requires full payback in five years at a 10% annual interest rate. You met all of the payment dates. 12. Currently, you believe that the combined value of all your personal property is $26,000.00 13. The IRS sent you a letter indicating that on your personal 1040 tax return from 2015, you did not pay enough income tax and that you still owe $8,400.00. 14. For the annual income section of the PFS, you currently pay yourself $5,000.00 gross each month from your business. 15. For the monthly expenditures section of the PFS, use your future calculated expenses from the course exercise for this information. 1 F 1 WORD CE ASSETS LETRA BLOG BLOG DELE NORSKE BILLIG EMBERI SELECT LELBILITIESIANET WITH TE ROGGE PALLEROLS LABURRARE TITAE LILLED TWRTH CESTI VESTITATS LEHET SAR CAS BARAT BRE TICE TRGONTHILLER MINSANITY SALATLANCLES WAT T. Koda GALKAN CODE GRAD 10 TORT AE ONS AR H SCHEDULE 2 STOCKS BONDS, BAS, KEBOCH ETG 4 A A A AS AL SV SCHLOROLLERULLAT KIPI CNC SCIELDELE - REAL ESTATE AS AS SCHEDULES NOTES PAYABLE Nas redes de 200 Car AS1 AS 23.500 ASI You are an entrepreneur who has been building your small business for the past two years. Just recently (three months ago), your business turned a monthly profit for the first time. It appears that customer sales will be stable for the next 9-12 months, so you have begun to investigate structuring a deal with a local angel investor to borrow funds to expand your business. You've met with a couple angel investors, one of whom has experience in your type of business. She appears to be open and is interested in exploring a lending agreement/term sheet with you. She has asked that you provide a net worth/personal financial statement, so that she can decide whether or not to move forward with more formal discussions. You've left that meeting with her and are now at your office looking at a blank PFS. You believe that you can complete the statement by yourself, without any assistance from an accountant. You are currently not married and will complete the form as a sole applicant. Here's the information that you need to put into the spreadsheet: a 11. When you started your business seven years ago, you asked your wealthy uncle to lend you some start-up funding. He agreed and provided you with $25,000.00 through a standard loan agreement. The loan agreement requires full payback in five years at a 10% annual interest rate. You met all of the payment dates. 12. Currently, you believe that the combined value of all your personal property is $26,000.00 13. The IRS sent you a letter indicating that on your personal 1040 tax return from 2015, you did not pay enough income tax and that you still owe $8,400.00. 14. For the annual income section of the PFS, you currently pay yourself $5,000.00 gross each month from your business. 15. For the monthly expenditures section of the PFS, use your future calculated expenses from the course exercise for this information. 1 F 1 WORD CE ASSETS LETRA BLOG BLOG DELE NORSKE BILLIG EMBERI SELECT LELBILITIESIANET WITH TE ROGGE PALLEROLS LABURRARE TITAE LILLED TWRTH CESTI VESTITATS LEHET SAR CAS BARAT BRE TICE TRGONTHILLER MINSANITY SALATLANCLES WAT T. Koda GALKAN CODE GRAD 10 TORT AE ONS AR H SCHEDULE 2 STOCKS BONDS, BAS, KEBOCH ETG 4 A A A AS AL SV SCHLOROLLERULLAT KIPI CNC SCIELDELE - REAL ESTATE AS AS SCHEDULES NOTES PAYABLE Nas redes de 200 Car AS1 AS 23.500 ASI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts