Question: please help me find my error. it is telling me 8.06-8.09 are wrong. can you please also help with 8.10-8.12? thank you!!!! I See The

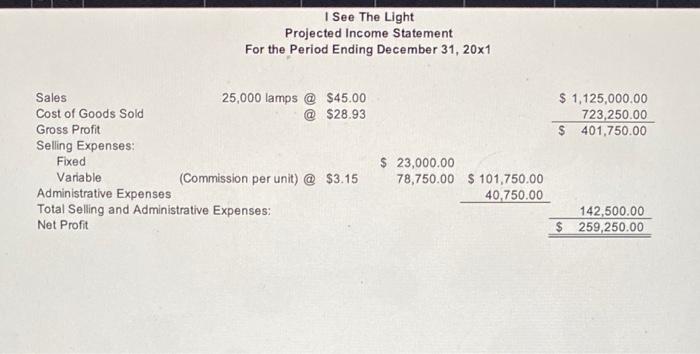

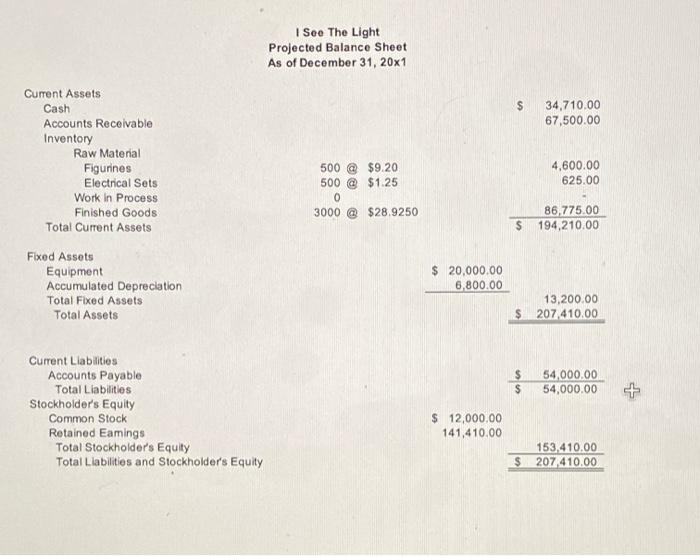

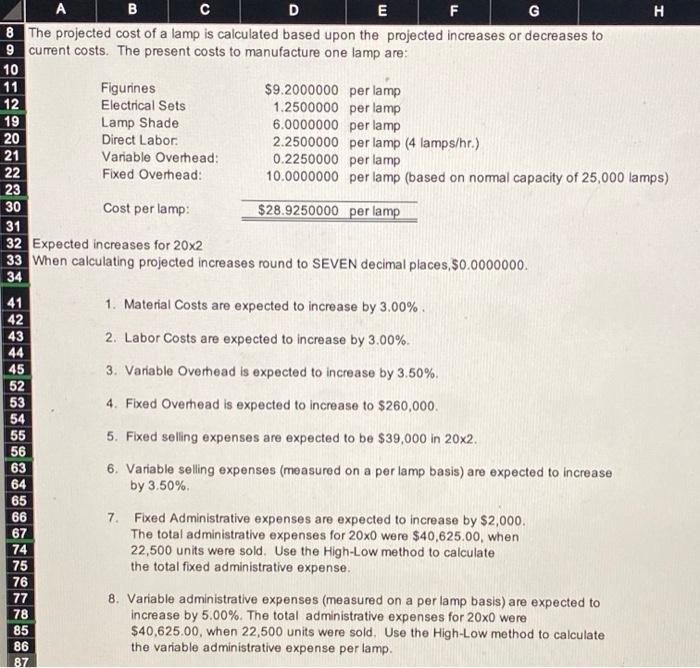

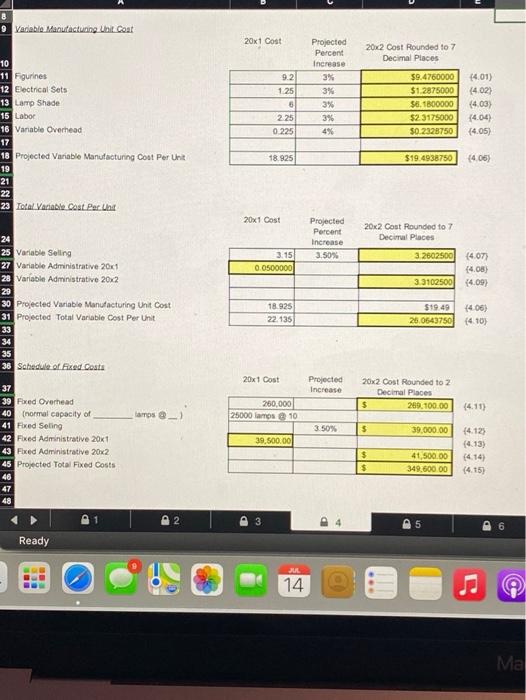

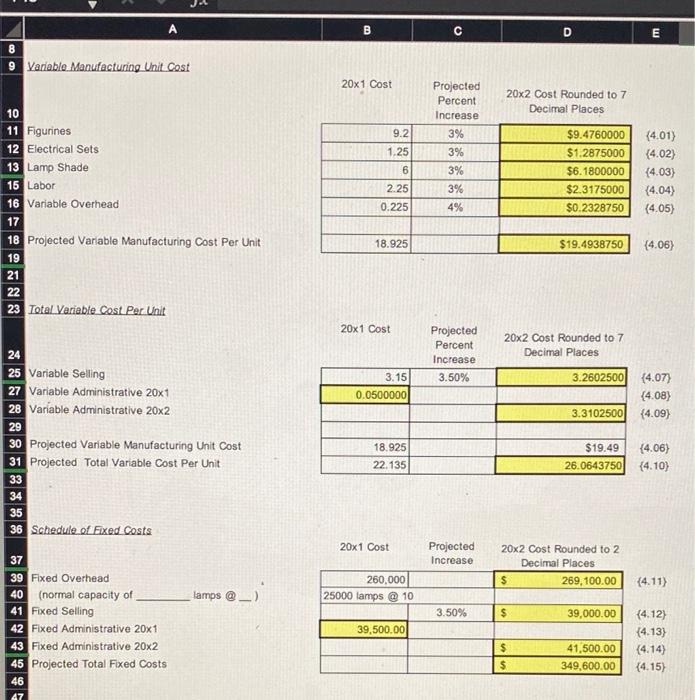

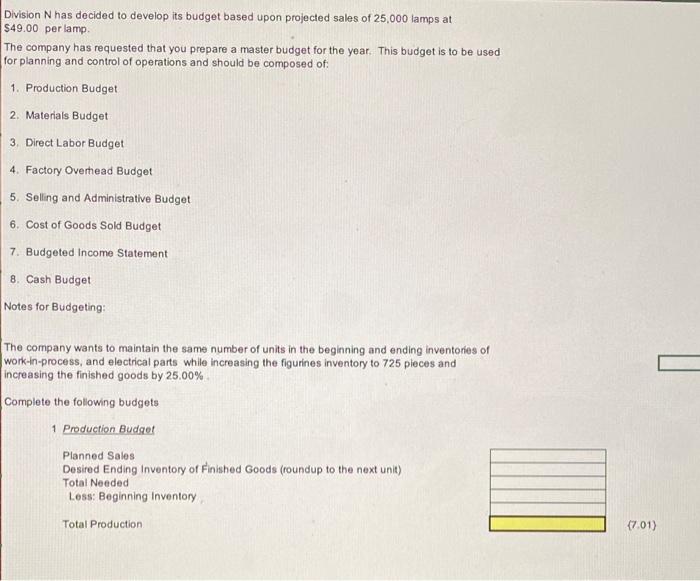

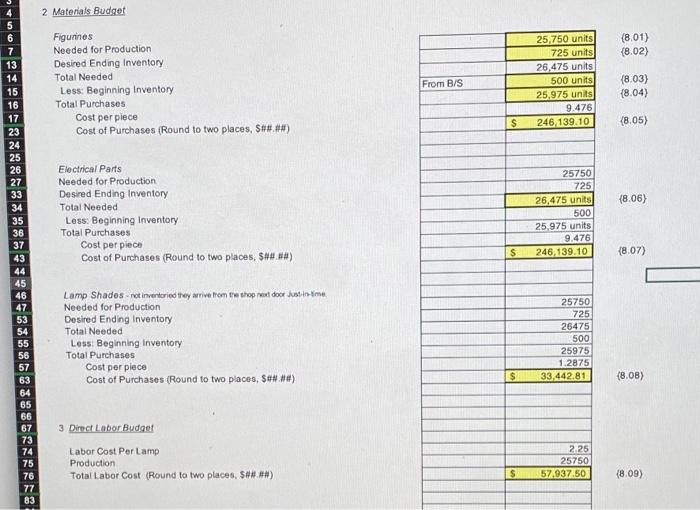

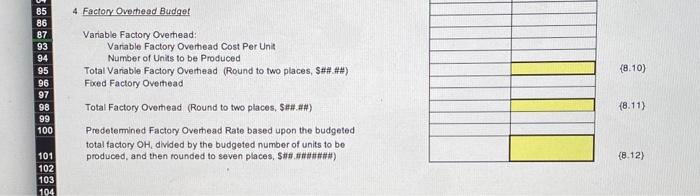

I See The Light Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 723,250.00 $ 401,750.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $28.93 Gross Profit Selling Expenses: Fixed Variable (Commission per unit) @ $3.15 Administrative Expenses Total Selling and Administrative Expenses: Net Profit $ 23,000.00 78,750.00 $ 101,750.00 40,750.00 142,500.00 $ 259,250.00 I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 4,600.00 625.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work In Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 500 @ $9.20 500 @ $1.25 0 3000 @ $28.9250 86,775.00 194,210.00 $ $ 20,000.00 6,800.00 13,200.00 S. 207.410.00 $ S 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Llabilities and Stockholder's Equity $ 12,000.00 141,410.00 153,410.00 207,410.00 $ F 22 A B D E F G H 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 10 11 Figurines $9.2000000 per lamp 12 Electrical Sets 1.2500000 per lamp 19 Lamp Shade 6.0000000 per lamp 20 Direct Labor 2.2500000 per lamp (4 lamps/hr.) 21 Variable Overhead: 0.2250000 per lamp Fixed Overhead: 10.0000000 per lamp (based on normal capacity of 25,000 lamps) 23 30 Cost per lamp: $28.9250000 per lamp 31 32 Expected increases for 20x2 33 When calculating projected increases round to SEVEN decimal places, 50.0000000. 34 41 1. Material Costs are expected to increase by 3.00% 42 43 2. Labor Costs are expected to increase by 3.00%. 44 45 3. Variable Overhead is expected to increase by 3.50%. 52 53 4. Fixed Overhead is expected to increase to $260,000 54 55 5. Fixed selling expenses are expected to be $39,000 in 20x2. 56 63 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50% 65 66 7. Fixed Administrative expenses are expected to increase by $2,000. 67 The total administrative expenses for 20x0 were $40,625.00, when 74 22,500 units were sold. Use the High-Low method to calculate 75 the total fixed administrative expense. 76 77 8. Variable administrative expenses (measured on a per lamp basis) are expected to 78 increase by 5.00%. The total administrative expenses for 20x0 were 85 $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate 86 the variable administrative expense per lamp. 87 64 8 9 Variable Manufacturing Unit Coat 20x1 Cost 2012 Cost Rounded to 7 Decimal Places 9.2 125 5 2.25 0.225 Projected Percent Increase 3% 3% 3% 3% 4% 10 11 Fgurines 12 Electrical Sets 13 Lamp Shade 15 Labor 16 Variable Overhead 17 18 Projected Variable Manufacturing Cost Per Unit 19 21 22 23 Total Variable Cost Par. Unt $9.4760000 $1.2875000 $6.100000 $2.3175000 50.2328750 14.01) (402) (4.03) {4.04) 14.05) 18.925 $19.4938750 (406) 20x1 Cost Projected Percent Increase 3.50% 20x2 Cost Rounded to 7 Decimal Places 3.2602500 3.15 0.0500000 (4.07) 14.08) (4.09) 3.3102500 24 25 Variable Selling 27 Variable Administrative 20x1 28 Variable Administrative 202 29 30 Projected Variable Manufacturing Unit Cost 31 Projected Total Variable Cost Per Unit 33 34 35 Schedule of Fixed Costs 18.925 22.135 $19.49 14.06) 26.0543750 (410) 20x1 Cost Projected Increase 20x2 Cost Rounded to 2 Decimal Places $ 289.100.00 260,000 25000 lamos 10 (411) lamps-) 3.50% $ 39,000.00 37 39 Fixed Overhead 40 normal capacity of 41 Fixed Soling 42 Fixed Administrative 20x1 43 Fixed Administrative 20x2 45 Projected Total Fixed Costs 46 47 48 39,500.00 (4.123 (4.13) (4.14) (4.15) $ $ 41,500.00 349.600.00 3 Ready JUL BB 14 . Ma A B D E 8 9 Variable Manufacturing Unit Cost 20x 1 Cost 20x2 Cost Rounded to 7 Decimal Places Projected Percent Increase 3% 3% 9.2. 1.25 10 11 Figurines 12 Electrical Sets 13 Lamp Shade 15 Labor 16 Variable Overhead 17 18 Projected Variable Manufacturing Cost Per Unit 19 21 22 23 Total Variable Cost Per Unit 6 2.25 0.225 3% 3% 4% $9.4760000 $1.2875000 $6.1800000 $2.3175000 $0.2328750 (4.01) {4.02) {4.03) (4.04) {4.05) 18.925 $19.4938750 {4.06) 20x1 Cost Projected Percent Increase 3.50% 20x2 Cost Rounded to 7 Decimal Places 3.2602500 3.15 0.0500000 {4.07) {4.08) {4.09) 3.3102500 24 25 Variable Selling 27 Variable Administrative 20x1 28 Variable Administrative 20x2 29 30 Projected Variable Manufacturing Unit Cost 31 Projected Total Variable Cost Per Unit 33 34 35 36 Schedule of Fixed Costs 18.925 22.135 $19.49 26.0643750 {4.06) {4.10) 20x 1 Cost Projected Increase 20x2 Cost Rounded to 2 Decimal Places $ 269,100.00 260,000 25000 lamps @ 10 {4.11) lamps @_) 37 39 Fixed Overhead 40 (normal capacity of 41 Fixed Selling 42 Fixed Administrative 20x1 43 Fixed Administrative 20x2 45 Projected Total Fixed Costs 3.50% $ 39,000.00 39,500.00 {4.12) {4.13) (4.14) (4.15) $ $ 41.500.00 349,600.00 46 47 Division N has decided to develop its budget based upon projected sales of 25.000 lamps at $49.00 per lamp The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the figurines inventory to 725 places and increasing the finished goods by 25.00% Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods (roundup to the next unit) Total Needed Loss: Beginning Inventory Total Production 17.01) 2 Materials Budget (8.01) (8.02) Figurinos Needed for Production Desired Ending Inventory Total Needed Less: Beginning Inventory Total Purchases Cost per piece Cost of Purchases (Round to two places, $##.##) From B/S 25,750 units 725 units 26,475 units 500 units 25,975 units 9.476 246.139.10 (803) (8.04) $ (8.05) {8.06) Electrical Parts Needed for Production Desired Ending Inventory Total Needed Less: Beginning Inventory Total Purchases Cost per piece Cost of Purchases (Round to two places, 5## ## 257501 725 26,475 units 500 25,975 units 9.476 246.139.10 $ 5 6 7 13 14 15 16 17 23 24 25 26 27 33 34 35 36 37 43 44 45 46 47 53 54 55 56 57 63 64 65 66 67 73 74 75 76 77 83 (8.07) Lamp Shades - not inventoried they arrive from the top ext door Justis-time Needed for Production Dosired Ending Inventory Total Needed Less Beginning inventory Total Purchases Cost per piece Cost of Purchases (Round to two places, Sow.) 25750 725 26475 500 25975 1.2875 33,442.81 $ {8.08) 3 Direct Labor Budget Labor Cost Per Lamp Production Total Labor Cost (Round to two places, S.) 2.25 25750 57.037.50 $ 18.09) 85 86 87 93 94 95 96 97 98 99 100 (8.10) 4 Factory Overhead Budget Vanable Factory Overhead: Vanable Factory Overhead Cost Per Unit Number of Units to be produced Total Vanable Factory Overhead (Round to two places, $#### Foxed Factory Overhead Total Factory Overhead (Round to two places, S##.##) Predetermined Factory Overhead Rate based upon the budgeted total factory OH, divided by the budgeted number of units to be produced, and then founded to seven places, $ #####) (8.11) (8.12) 101 102 103 104

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts