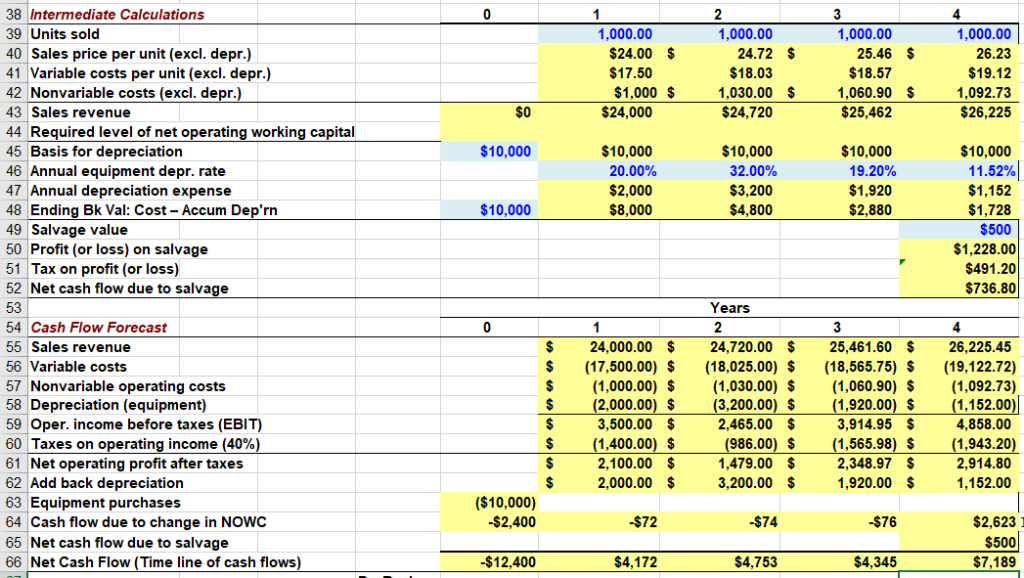

Question: Please help me find NPV, IRR, Payback, and Discount. Please show work, I will make sure to thumbs up. Thank you! 38 Intermediate Calculations 39

Please help me find NPV, IRR, Payback, and Discount. Please show work, I will make sure to thumbs up. Thank you!

Please help me find NPV, IRR, Payback, and Discount. Please show work, I will make sure to thumbs up. Thank you!

38 Intermediate Calculations 39 Units sold 40 Sales price per unit (excl. depr.) 41 Variable costs per unit (excl. depr.) 42 Nonvariable costs (excl. depr.) 43 Sales revenue 44 Required level of net operating working capital 45 Basis for depreciation 46 Annual equipment depr. rate 47 Annual depreciation expense 48 Ending Bk Val: Cost Accum Dep'rn 49 Salvage value 50 Profit (or loss) on salvage 51 Tax on profit (or loss) 52 Net cash flow due to salvage 53 54 Cash Flow Forecast 55 Sales revenue 56 Variable costs 57 Nonvariable operating costs 58 Depreciation (equipment) 59 Oper. income before taxes (EBIT) 60 Taxes on operating income (40% 61 Net operating profit after taxes 62 Add back depreciation 63 Equipment purchases 64 Cash flow due to change in NOWC 65 Net cash flow due to salvage 66 Net Cash Flow (Time line of cash flows 1,000.00 $17.50 $24,000 1,000.00 1,000.00 1,000.00 $24.00 $ 24.72 $ 25.46 $ $18.03 1,030.00 $ $24,720 $18.57 1,060.90 $ $25,462 $1,000 $ 1,092.73 $26,225 $10,000 19.20% $1,920 $2,880 $10,000 11 .52% $1,152 $10,000 $10,000 20.00% $2,000 $8,000 $10,000 32.00% $3,200 $4,800 $10,000 $1,728 $1,228.00 $491.20 $736.80 Years $ 24,000.00 $24,720.00 25,461.60 S 26,225.45 $(17,500.00) $ (18,025.00) $(18,565.75) $ (19,122.72) $(1,000.00) $ (1,030.00) $ (1,060.90) $(1,092.73) 1,152.00 4,858.00 1,943.20 2,914.80 1,152.00 (2,000.00)$ 3,500.00 $ (1,400.00) $ 2,100.00 $ 2,000.00 $ (3,200.00) $ 2,465.00 $ 986.00) $ 1,479.00 $ 3,200.00 $ 1.920.00) S 3,914.95 $ (1,565.98) S 2,348.97 $ 1,920.00$ ($10,000) -$2,400 $2,6231 $500 $7,189 -$12,400 $4,172 $4,753 $4,345 38 Intermediate Calculations 39 Units sold 40 Sales price per unit (excl. depr.) 41 Variable costs per unit (excl. depr.) 42 Nonvariable costs (excl. depr.) 43 Sales revenue 44 Required level of net operating working capital 45 Basis for depreciation 46 Annual equipment depr. rate 47 Annual depreciation expense 48 Ending Bk Val: Cost Accum Dep'rn 49 Salvage value 50 Profit (or loss) on salvage 51 Tax on profit (or loss) 52 Net cash flow due to salvage 53 54 Cash Flow Forecast 55 Sales revenue 56 Variable costs 57 Nonvariable operating costs 58 Depreciation (equipment) 59 Oper. income before taxes (EBIT) 60 Taxes on operating income (40% 61 Net operating profit after taxes 62 Add back depreciation 63 Equipment purchases 64 Cash flow due to change in NOWC 65 Net cash flow due to salvage 66 Net Cash Flow (Time line of cash flows 1,000.00 $17.50 $24,000 1,000.00 1,000.00 1,000.00 $24.00 $ 24.72 $ 25.46 $ $18.03 1,030.00 $ $24,720 $18.57 1,060.90 $ $25,462 $1,000 $ 1,092.73 $26,225 $10,000 19.20% $1,920 $2,880 $10,000 11 .52% $1,152 $10,000 $10,000 20.00% $2,000 $8,000 $10,000 32.00% $3,200 $4,800 $10,000 $1,728 $1,228.00 $491.20 $736.80 Years $ 24,000.00 $24,720.00 25,461.60 S 26,225.45 $(17,500.00) $ (18,025.00) $(18,565.75) $ (19,122.72) $(1,000.00) $ (1,030.00) $ (1,060.90) $(1,092.73) 1,152.00 4,858.00 1,943.20 2,914.80 1,152.00 (2,000.00)$ 3,500.00 $ (1,400.00) $ 2,100.00 $ 2,000.00 $ (3,200.00) $ 2,465.00 $ 986.00) $ 1,479.00 $ 3,200.00 $ 1.920.00) S 3,914.95 $ (1,565.98) S 2,348.97 $ 1,920.00$ ($10,000) -$2,400 $2,6231 $500 $7,189 -$12,400 $4,172 $4,753 $4,345

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts