Question: * * * * Please help me find out what I did wrong in the included screenshots Thank you * * * * * On

Please help me find out what I did wrong in the included screenshots Thank you

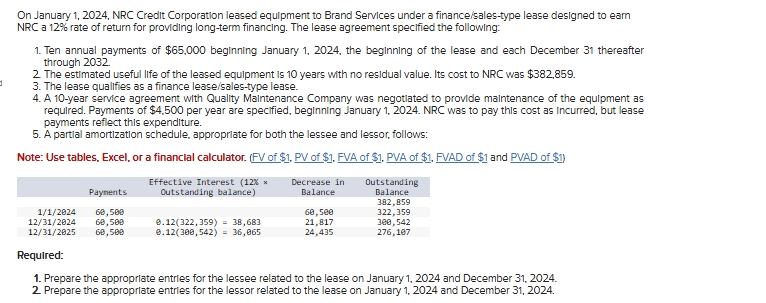

On January NRC Credit Corporation leased equipment to Brand Services under a financesalestype lease designed to eam NRC a rate of return for providing longterm financing. The lease agreement specified the following: Ten annual payments of $ beginning January the beginning of the lease and each December thereafter through The estimated useful life of the leased equipment is years with no residual value. Its cost to NRC was $ The lease qualifies as a finance leasesalestype lease. A year service agreement with Quality Malntenance Company was negotlated to provide maintenance of the equipment as required. Payments of $ per year are specified, beginning January NRC was to pay this cost as incurred, but lease payments reflect this expenditure. A partlal amortization schedule, approprlate for both the lessee and lessor, follows: Note: Use tables, Excel, or a financlal calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $ Effective Interest x Outstanding balanceDecrease in BalanceOutstanding Balance Required: Prepare the approprlate entrles for the lessee related to the lease on January and December Prepare the approprlate entrles for the lessor related to the lease on January and December

Complete this question by entering your answers in the tabs below.

Prepare the appropriate entries for the lessee related to the lease on January and December Note: Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transactionevent select No journal entry required" in the first account field.

No Date General Journal Debit Credit January Rightofuse asset Lease payable January Lease payable Maintenance expense Cash December Interest expense Lease payable Prepaid maintenance expense Cash December Amortization expense Rightofuse asset

Complete this question by entering your answers in the tabs below.

Prepare the appropriate entries for the lessor related to the lease on January and December Note: Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transactionevent select No journal entry required" in the first account field.

No Date General Journal Debit Credit January Lease receivable Equipment January Cash Lease receivable Deferred sales revenue ox O December Cash Lease receivable Interest revenue Deferred sales revenue ox

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock