Question: Please help me find the answer Annual Report Round: 0 Baldwin C59559 Dec. 31, 2019 2019 Income Statement 2019 Common (Product Name:) Baker Bead Bolt

Please help me find the answer

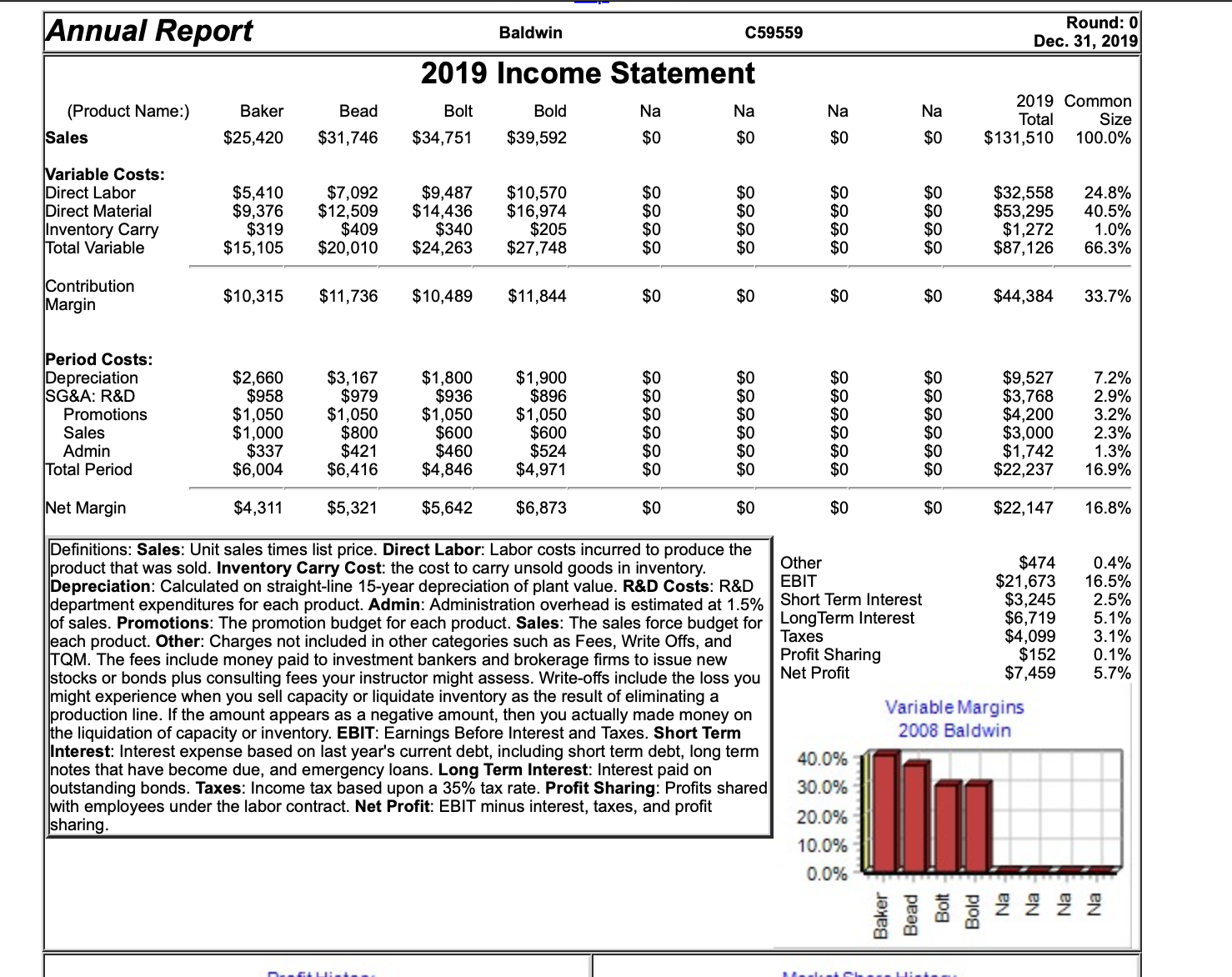

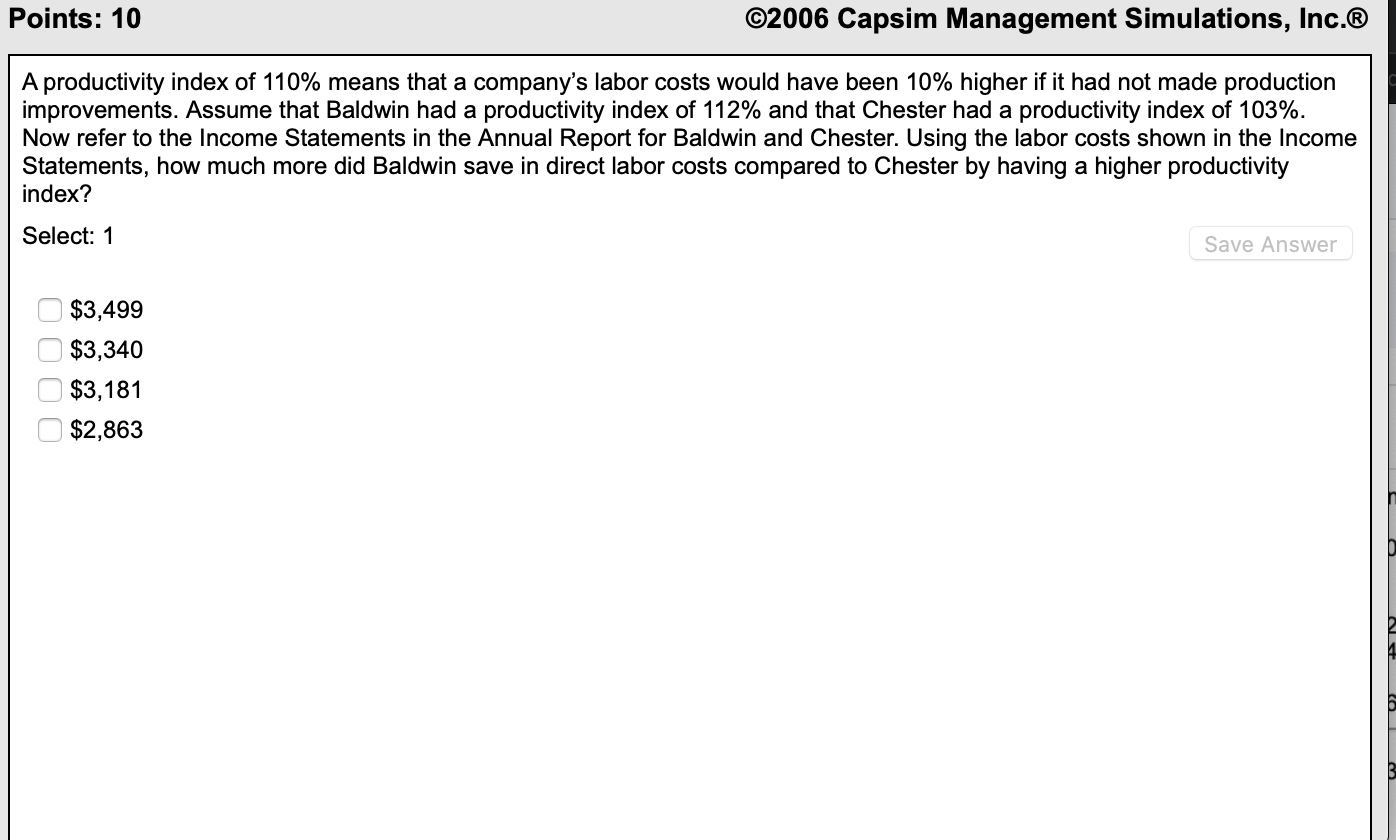

Annual Report Round: 0 Baldwin C59559 Dec. 31, 2019 2019 Income Statement 2019 Common (Product Name:) Baker Bead Bolt Bold Na Na Na Na Total Size Sales $25,420 $31,746 $34,751 $39,592 $0 $0 $0 $0 $131,510 100.0% Variable Costs: Direct Labor $5,410 $7,092 $9,487 $10,570 $0 $0 $0 $0 $32,558 24.8% Direct Material $9,376 $12,509 $14,436 $16,974 $0 $0 $0 $0 $53,295 40.5% nventory Carry $319 $409 $340 $205 $0 $0 $0 $0 $1,272 1.0% Total Variable $15, 105 $20,010 $24,263 $27,748 $0 $0 $0 $0 $87,126 66.3% Contribution $10,315 $11,736 $10,489 $11,844 $0 $0 $0 $44,384 33.7% Margin Period Costs: Depreciation $2,660 $3, 167 $1,800 $1,900 $0 $0 $0 $0 $9,527 7.2% SG&A: R $958 $979 $936 $896 $0 $0 $0 $0 $3,768 2.9% Promotions $1,050 $1,050 $1,050 $ 1,050 $0 $0 $0 $0 $4,200 3.2% Sales $ 1,000 $800 $600 $600 $0 $0 $0 $0 $3,000 2.3% Admin $337 $421 $460 $524 $0 $0 $0 $0 $1,742 1.3% Total Period $6,004 $6,416 $4,846 $4,971 $0 $0 $0 $0 $22,237 16.9% Net Margin $4,311 $5,321 $5,642 $6,873 $0 $0 $0 $0 $22, 147 16.8% Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory Other $474 0.4% Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EBIT $21,673 16.5% department expenditures for each product. Admin: Administration overhead is estimated at 1.5% Short Term Interest $3,245 2.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long Term Interest $6,719 5.1% each product. Other: Charges not included in other categories such as Fees, Write Offs, and Taxes $4,099 3.1% TQM. The fees include money paid to investment bankers and brokerage firms to issue new Profit Sharing $152 0.1% stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you Net Profit $7,459 5.7% might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on Variable Margins the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term 2008 Baldwin Interest: Interest expense based on last year's current debt, including short term debt, long term 40.0% notes that have become due, and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared 30.0% with employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit 20.0% sharing. 10.0% 0.0% Baker Bead Bold 2 2 22Points: 10 2006 Capsim Management Simulations, lnc. A productivity index of 110% means that a company's labor costs would have been 10% higher if it had not made production improvements. Assume that Baldwin had a productivity index of 112% and that Chester had a productivity index of 103%. Now refer to the Income Statements in the Annual Report for Baldwin and Chester. Using the labor costs shown in the Income Statements, how much more did Baldwin save in direct labor costs compared to Chester by having a higher productivity index? Select: 1 Save Answer 9 $3,499 9 $3,340 0 $3,131 0 $2,863