Question: Please Help me find the correct answer for the below red incorrect cells: On January 1 , 2 0 X 4 , Plum Corporation acquired

Please Help me find the correct answer for the below red incorrect cells:

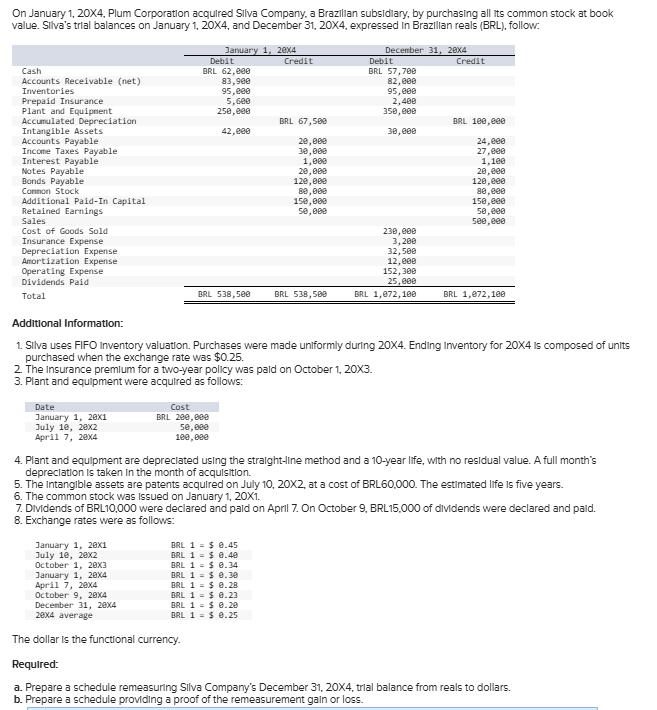

On January X Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. Silvas trial balances on January X and December X expressed in Brazilian reals BRL follow: January XDecember XDebitCreditDebitCreditCashBRL BRL Accounts Receivable netInventoriesPrepaid InsurancePlant and EquipmentAccumulated DepreciationBRL BRL Intangible AssetsAccounts PayableIncome Taxes PayableInterest PayableNotes PayableBonds PayableCommon StockAdditional PaidIn CapitalRetained EarningsSalesCost of Goods SoldInsurance ExpenseDepreciation ExpenseAmortization ExpenseOperating ExpenseDividends PaidTotalBRL BRL BRL BRL Additional Information: Silva uses FIFO inventory valuation. Purchases were made uniformly during X Ending inventory for X is composed of units purchased when the exchange rate was $ The insurance premium for a twoyear policy was paid on October X Plant and equipment were acquired as follows: DateCostJanuary XBRL July XApril X Plant and equipment are depreciated using the straightline method and a year life, with no residual value. A full months depreciation is taken in the month of acquisition. The intangible assets are patents acquired on July X at a cost of BRL The estimated life is five years. The common stock was issued on January X Dividends of BRL were declared and paid on April On October BRL of dividends were declared and paid. Exchange rates were as follows: January XBRL $ July XBRL $ October XBRL $ January XBRL $ April XBRL $ October XBRL $ December XBRL $ X averageBRL $ The dollar is the functional currency. Required: Prepare a schedule remeasuring Silva Companys December X trial balance from reals to dollars. Prepare a schedule providing a proof of the remeasurement gain or loss.

a Prepare a schedule remeasuring Silva Company's December X trial balance from reals to dollars.

b Prepare a schedule providing a proof of the remeasurement gain or loss.

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a schedule remeasuring Silva Company's December X trial balance from reals to dollars.

Note: If no adjustment is needed, select No entry necessary'.

SILVA COMPANY Trial Balance Remeasurement December X US Dollars Cash $ Accounts Receivable net Inventory Prepaid Insurance Plant and Equipment Intangible Assets Cost of Goods Sold Insurance Expense Depreciation Expense Amortization Expense O Operating Expense Dividends Paid Total No Entry Necessary Total Debits $ Accumulated Depreciation $ Accounts Payable Income Tax Payable Interest Payable Notes Payable Bonds Payable Common Stock Additional paidin Capital Retained Earnings Sales Total $ Remeasurement Gain Total Credits $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock