Question: Please help me find the Earnings per share and Return on common stockholders' equity. Question 3 iew Policies -how Attempt History Current Attempt in Progress

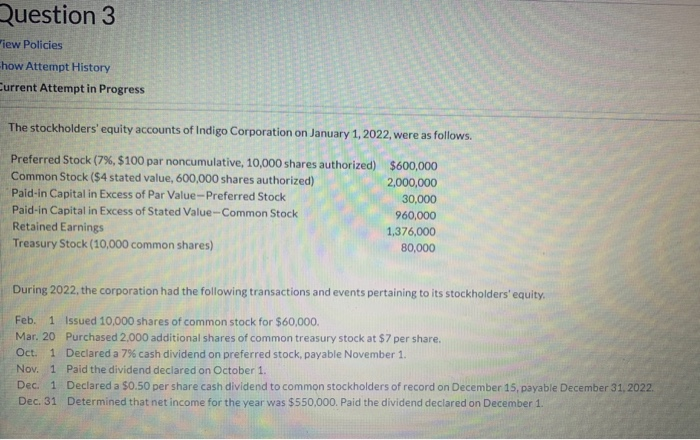

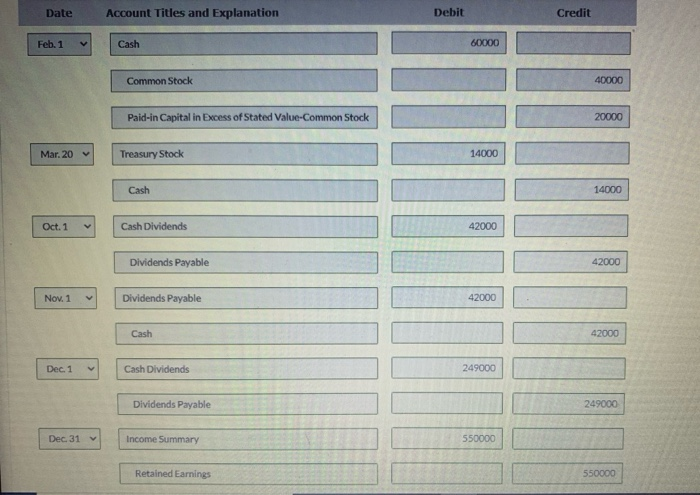

Question 3 iew Policies -how Attempt History Current Attempt in Progress The stockholders' equity accounts of Indigo Corporation on January 1, 2022, were as follows. Preferred Stock (7%, $100 par noncumulative, 10,000 shares authorized) $600,000 Common Stock ($4 stated value, 600,000 shares authorized) 2,000,000 Paid-in Capital in Excess of Par Value-Preferred Stock 30,000 Paid-in Capital in Excess of Stated Value-Common Stock 960,000 Retained Earnings 1,376,000 Treasury Stock (10,000 common shares) 80,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders'equity. Feb. 1 Issued 10,000 shares of common stock for $60,000 Mar. 20 Purchased 2,000 additional shares of common treasury stock at $7 per share. Oct. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 2022. Dec. 31 Determined that net income for the year was $550,000. Paid the dividend declared on December 1 Date Account Titles and Explanation Debit Credit Feb. 1 Cash 60000 Common Stock 40000 Paid-in Capital in Excess of Stated Value-Common Stock 20000 Mar. 20 Treasury Stock 14000 Cash 14000 Oct. 1 Cash Dividends 42000 Dividends Payable 42000 Nov. 1 Dividends Payable 42000 Cash 42000 Dec. 1 Cash Dividends 249000 Dividends Payable 249000 Dec 31 Income Summary 550000 Retained Earnings 550000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts