Question: Please help me find the maximum down payment. Please show the formula and work. PLEASE NOTE THAT THE LAST QUESTION: THE AMOUNT IS GREATER THAN

Please help me find the maximum down payment. Please show the formula and work.

PLEASE NOTE THAT THE LAST QUESTION: "THE AMOUNT IS GREATER THAN THE INTIAL OUTLAY OF $3,000,000."

Thanks

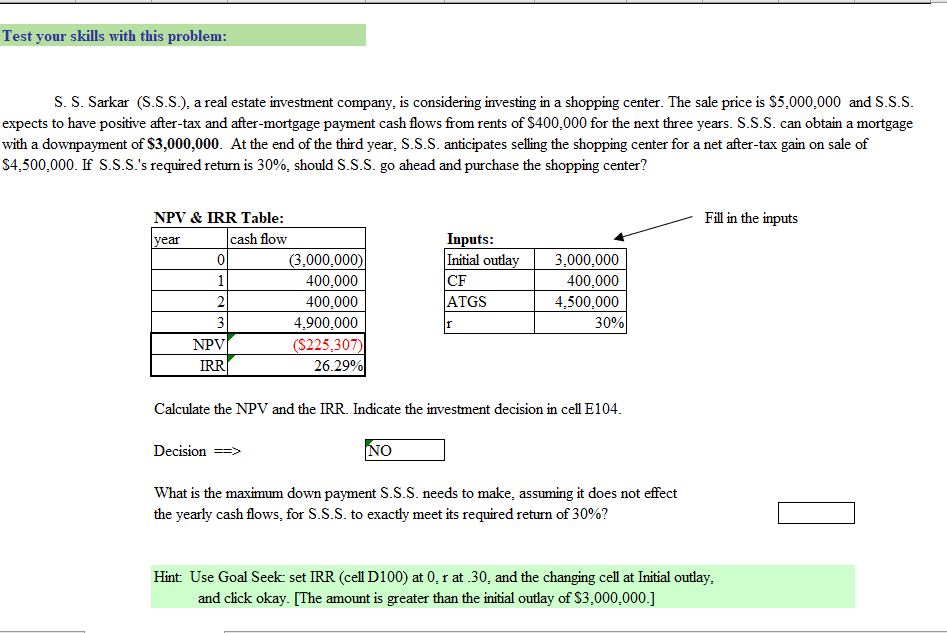

Test your skills with this problem: S. S. Sarkar (S.S.S.), a real estate investment company, is considering investing in a shopping center. The sale price is $5,000,000 and S.S.S. expects to have positive after-tax and after-mortgage payment cash flows from rents of $400,000 for the next three years. S.S.S. can obtain a mortgage with a downpayment of $3,000,000. At the end of the third year. S.S.S. anticipates selling the shopping center for a net after-tax gain on sale of $4.500,000. If S.S.S.'s required return is 30%, should S.S.S. go ahead and purchase the shopping center? Fill in the inputs NPV & IRR Table: year cash flow 0 (3,000,000) 1 400.000 2 400.000 3 4,900,000 NPV ($225,307) IRR 26.29% Inputs: Initial outlay CF ATGS 3,000,000 400,000 4,500,000 30% r Calculate the NPV and the IRR. Indicate the investment decision in cell E104. Decision ==> NO What is the maximum down payment S.S.S. needs to make, assuming it does not effect the yearly cash flows, for S.S.S. to exactly meet its required return of 30%? Hint: Use Goal Seek: set IRR (cell D100) at 0.1 at 30. and the changing cell at Initial outlay. and click okay. [The amount is greater than the initial outlay of $3,000,000.] Test your skills with this problem: S. S. Sarkar (S.S.S.), a real estate investment company, is considering investing in a shopping center. The sale price is $5,000,000 and S.S.S. expects to have positive after-tax and after-mortgage payment cash flows from rents of $400,000 for the next three years. S.S.S. can obtain a mortgage with a downpayment of $3,000,000. At the end of the third year. S.S.S. anticipates selling the shopping center for a net after-tax gain on sale of $4.500,000. If S.S.S.'s required return is 30%, should S.S.S. go ahead and purchase the shopping center? Fill in the inputs NPV & IRR Table: year cash flow 0 (3,000,000) 1 400.000 2 400.000 3 4,900,000 NPV ($225,307) IRR 26.29% Inputs: Initial outlay CF ATGS 3,000,000 400,000 4,500,000 30% r Calculate the NPV and the IRR. Indicate the investment decision in cell E104. Decision ==> NO What is the maximum down payment S.S.S. needs to make, assuming it does not effect the yearly cash flows, for S.S.S. to exactly meet its required return of 30%? Hint: Use Goal Seek: set IRR (cell D100) at 0.1 at 30. and the changing cell at Initial outlay. and click okay. [The amount is greater than the initial outlay of $3,000,000.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts