Question: Please help me find the realized and recognized gain or loss if any 6. Corporate formation (20 points) In 2020, Mark, Alice, Howard, Frances, and

Please help me find the realized and recognized gain or loss if any

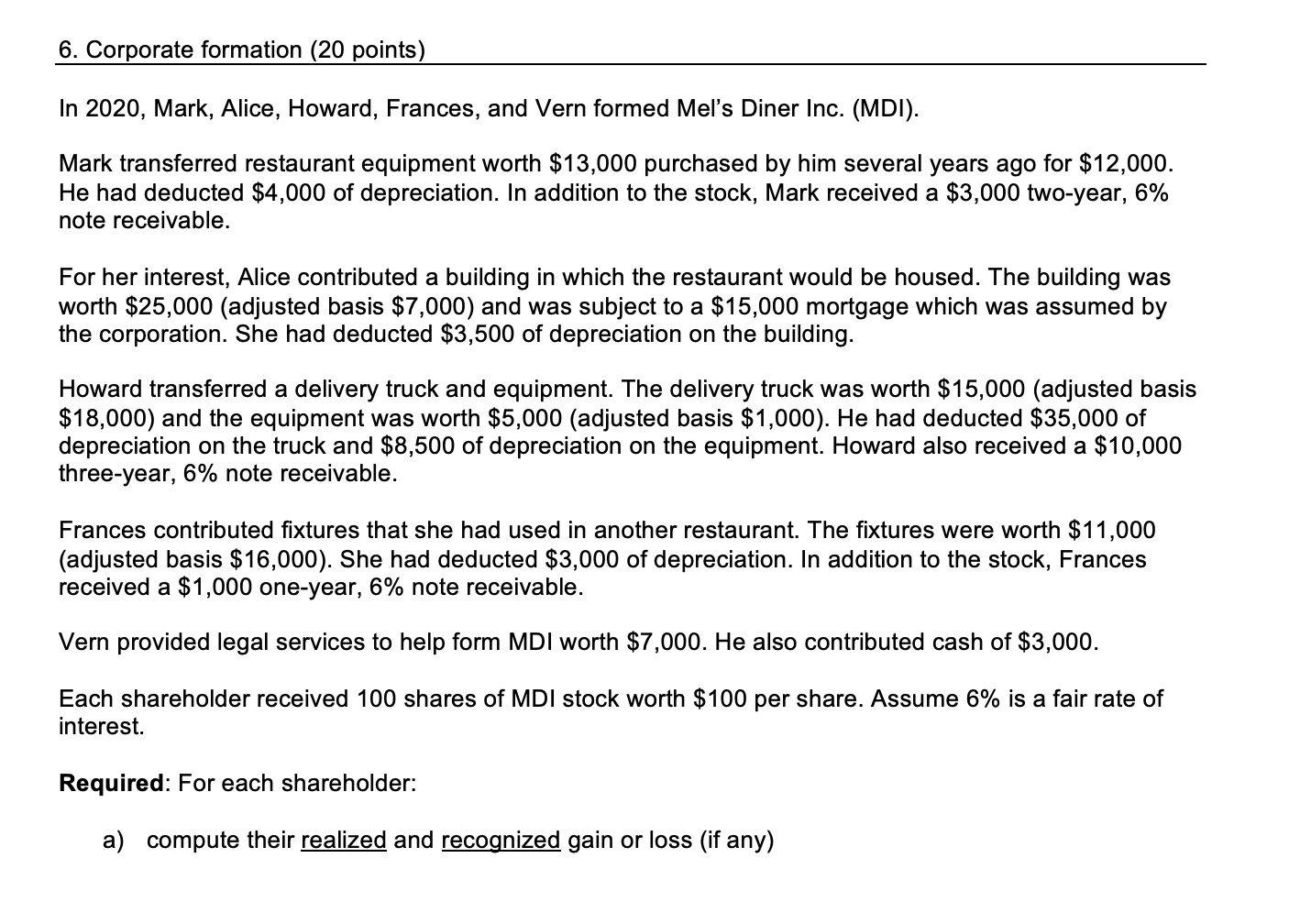

6. Corporate formation (20 points) In 2020, Mark, Alice, Howard, Frances, and Vern formed Mel's Diner Inc. (MDI). Mark transferred restaurant equipment worth $13,000 purchased by him several years ago for $12,000. He had deducted $4,000 of depreciation. In addition to the stock, Mark received a $3,000 two-year, 6% note receivable. For her interest, Alice contributed a building in which the restaurant would be housed. The building was worth $25,000 (adjusted basis $7,000) and was subject to a $15,000 mortgage which was assumed by the corporation. She had deducted $3,500 of depreciation on the building. Howard transferred a delivery truck and equipment. The delivery truck was worth $15,000 (adjusted basis $18,000) and the equipment was worth $5,000 (adjusted basis $1,000). He had deducted $35,000 of depreciation on the truck and $8,500 of depreciation on the equipment. Howard also received a $10,000 three-year, 6% note receivable. Frances contributed xtures that she had used in another restaurant. The xtures were worth $11,000 (adjusted basis $16,000). She had deducted $3,000 of depreciation. In addition to the stock, Frances received a $1,000 one-year, 6% note receivable. Vern provided legal services to help form MDI worth $7,000. He also contributed cash of $3,000. Each shareholder received 100 shares of MDI stock worth $100 per share. Assume 6% is a fair rate of interest. Required: For each shareholder: a) compute their realized and recognized gain or loss (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts