Question: Please help me find the remaining salvage values and solve for Part B (with formulas and work included). Thanks! A B D E F G

Please help me find the remaining salvage values and solve for Part B (with formulas and work included). Thanks!

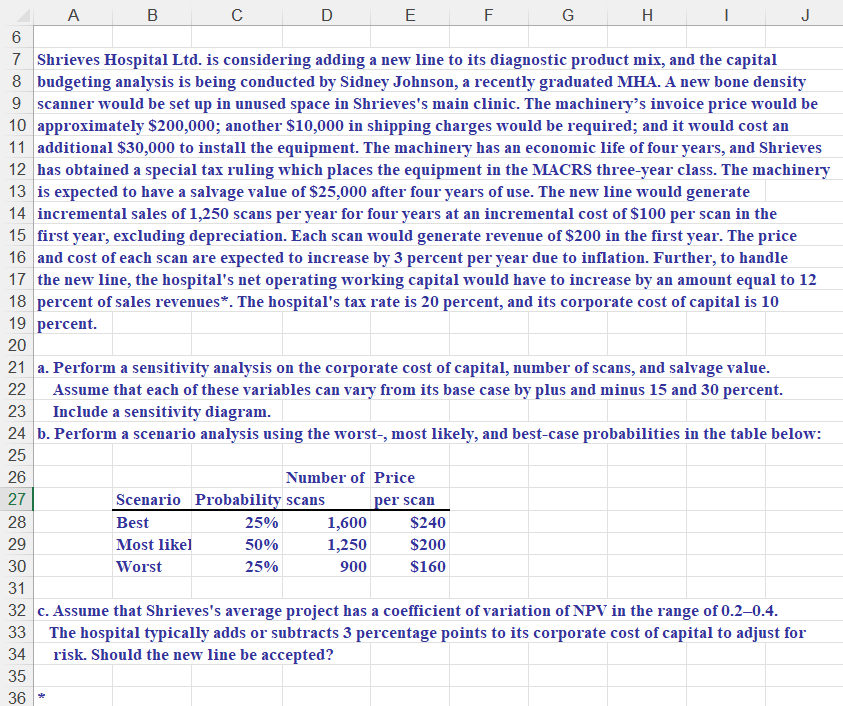

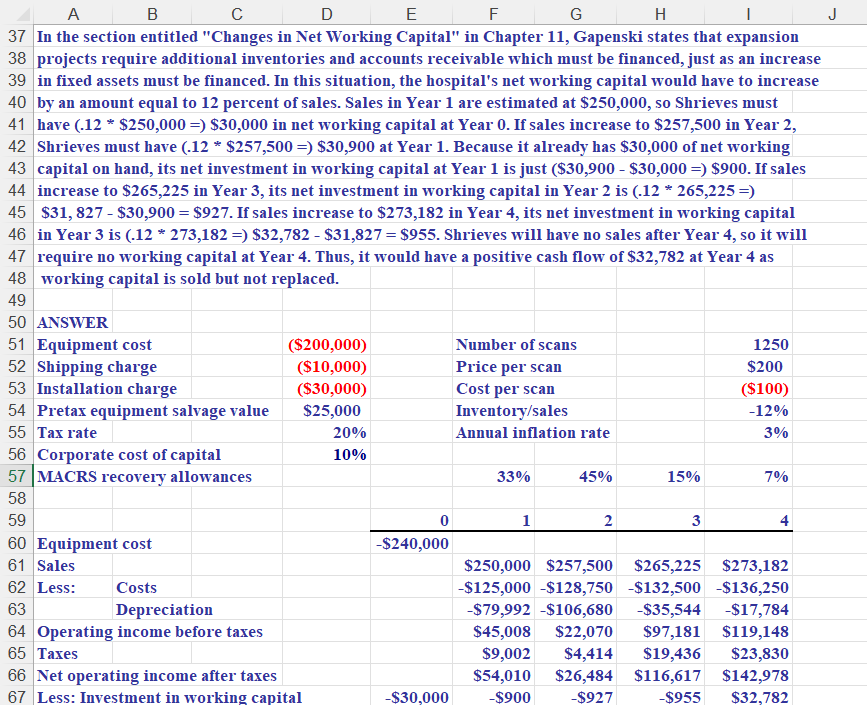

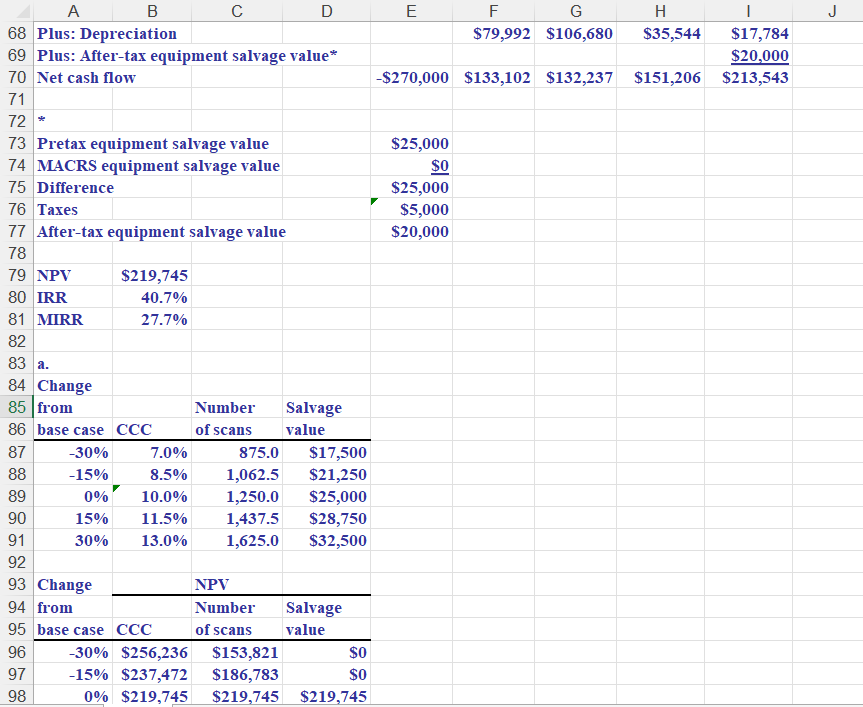

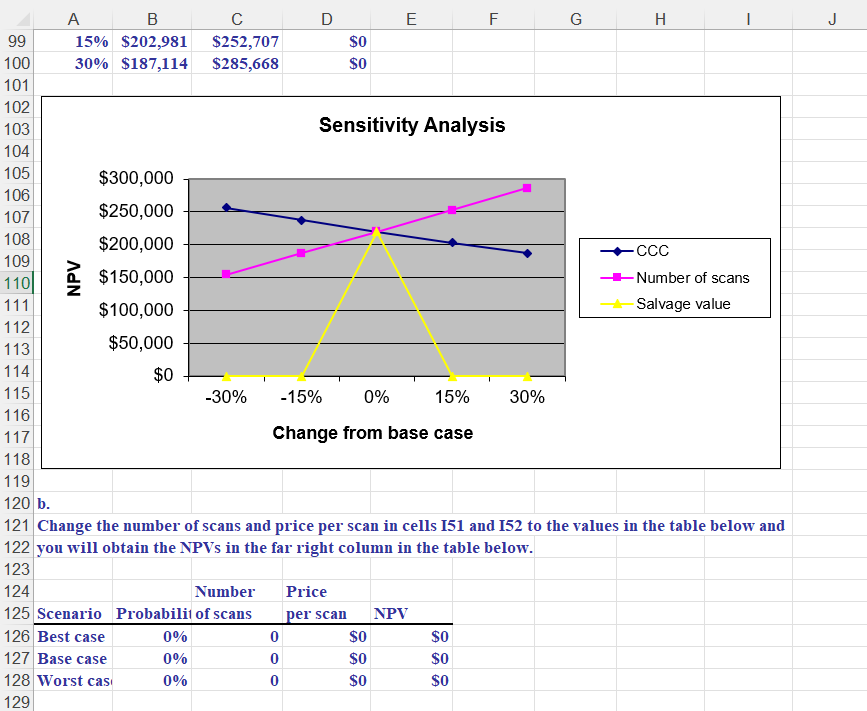

A B D E F G H 1 J 6 7 Shrieves Hospital Ltd. is considering adding a new line to its diagnostic product mix, and the capital 8 budgeting analysis is being conducted by Sidney Johnson, a recently graduated MHA. A new bone density 9 scanner would be set up in unused space in Shrieves's main clinic. The machinery's invoice price would be 10 approximately $200,000; another $10,000 in shipping charges would be required; and it would cost an 11 additional $30,000 to install the equipment. The machinery has an economic life of four years, and Shrieves 12 has obtained a special tax ruling which places the equipment in the MACRS three-year class. The machinery 13 is expected to have a salvage value of $25,000 after four years of use. The new line would generate 14 incremental sales of 1,250 scans per year for four years at an incremental cost of $100 per scan in the 15 first year, excluding depreciation. Each scan would generate revenue of $200 in the first year. The price 16 and cost of each scan are expected to increase by 3 percent per year due to inflation. Further, to handle 17 the new line, the hospital's net operating working capital would have to increase by an amount equal to 12 18 percent of sales revenues*. The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 19 percent. 20 23 21 a. Perform a sensitivity analysis on the corporate cost of capital, number of scans, and salvage value. 22 Assume that each of these variables can vary from its base case by plus and minus 15 and 30 percent. Include a sensitivity diagram. 24 b. Perform a scenario analysis using the worst-, most likely, and best-case probabilities in the table below: 25 26 Number of Price 27 Scenario Probability scans per scan 28 Best 25% 1,600 $240 29 Most likel 50% 1,250 $200 30 Worst 25% 900 $160 31 32 c. Assume that Shrieves's average project has a coefficient of variation of NPV in the range of 0.2-0.4. 33 The hospital typically adds or subtracts 3 percentage points to its corporate cost of capital to adjust for risk. Should the new line be accepted? 35 34 36 - B D E F G H I J 37 In the section entitled "Changes in Net Working Capital" in Chapter 11, Gapenski states that expansion 38 projects require additional inventories and accounts receivable which must be financed, just as an increase 39 in fixed assets must be financed. In this situation, the hospital's net working capital would have to increase 40 by an amount equal to 12 percent of sales. Sales in Year 1 are estimated at $250,000, so Shrieves must 41 have (.12 * $250,000 =) $30,000 in net working capital at Year 0. If sales increase to $257,500 in Year 2, 42 Shrieves must have (.12 * $257,500 =) $30,900 at Year 1. Because it already has $30,000 of net working 43 capital on hand, its net investment in working capital at Year 1 is just ($30,900 - $30,000 =) $900. If sales 44 increase to $265,225 in Year 3, its net investment in working capital in Year 2 is (.12 * 265,225=) 45 $31, 827 - $30,900 = $927. If sales increase to $273,182 in Year 4, its net investment in working capital 46 in Year 3 is (-12 * 273,182 =) $32,782 - $31,827 = $955. Shrieves will have no sales after Year 4, so it will 47 require no working capital at Year 4. Thus, it would have a positive cash flow of $32,782 at Year 4 as 48 working capital is sold but not replaced. 49 50 ANSWER 51 Equipment cost ($200,000) Number of scans 1250 52 Shipping charge ($10,000) Price per scan $200 53 Installation charge ($30,000) Cost per scan ($100) 54 Pretax equipment salvage value $25,000 Inventory/sales -12% 55 Tax rate 20% Annual inflation rate 3% 56 Corporate cost of capital 10% 57 MACRS recovery allowances 33% 45% 15% 7% 58 59 1 2 3 4 60 Equipment cost $240,000 61 Sales $250,000 $257,500 $265,225 $273,182 62 Less: Costs -$125,000 $128,750 $132,500 $136,250 63 Depreciation $ 79,992 -$106,680 $35,544 -$17,784 64 Operating income before taxes $45,008 $22,070 $97,181 $119,148 65 Taxes $9,002 $4,414 $19,436 $23,830 66 Net operating income after taxes $54,010 $26,484 $116,617 $142,978 67 Less: Investment in working capital $30,000 -$900 -$927 $955 $32,782 J A B D 68 Plus: Depreciation 69 Plus: After-tax equipment salvage value* 70 Net cash flow 71 E F G H I $79,992 $106,680 $35,544 $17,784 $20,000 -$270,000 $133,102 $132,237 $151,206 $213,543 72 - 73 Pretax equipment salvage value 74 MACRS equipment salvage value 75 Difference 76 Taxes 77 After-tax equipment salvage value 78 79 NPV $219,745 80 IRR 40.7% 81 MIRR 27.7% 82 $25,000 $0 $25,000 $5,000 $20,000 83 a. 87 84 Change 85 from Number Salvage 86 base case CCC of scans value -30% 7.0% 875.0 $17,500 88 -15% 8.5% 1,062.5 $21,250 89 0% 10.0% 1,250.0 $25,000 90 15% 11.5% 1,437.5 $28,750 91 30% 13.0% 1,625.0 $32,500 92 93 Change NPV 94 from Number Salvage 95 base case CCC of scans value 96 -30% $256,236 $153,821 $0 97 -15% $237,472 $186,783 $0 98 0% $219,745 $219,745 $219,745 E 1 J 110 { $150,000 B D F G H I 99 15% $202,981 $252,707 $0 100 30% $187,114 $285,668 $0 101 102 103 Sensitivity Analysis 104 105 $300,000 106 107 $250,000 108 $200,000 CCC $ - Number of scans 111 $100,000 Salvage value 112 113 $50,000 114 115 -30% -15% 0% 15% 30% 116 117 Change from base case 118 119 120 b. 121 Change the number of scans and price per scan in cells 151 and 152 to the values in the table below and 122 you will obtain the NPVs in the far right column in the table below. 123 124 Number Price 125 Scenario Probabilit of scans per scan NPV 126 Best case 0% 0 $0 127 Base case 0% 0 $0 $0 128 Worst cas 0% 0 $0 $0 129 $0 $0 A B D E F G H 1 J 6 7 Shrieves Hospital Ltd. is considering adding a new line to its diagnostic product mix, and the capital 8 budgeting analysis is being conducted by Sidney Johnson, a recently graduated MHA. A new bone density 9 scanner would be set up in unused space in Shrieves's main clinic. The machinery's invoice price would be 10 approximately $200,000; another $10,000 in shipping charges would be required; and it would cost an 11 additional $30,000 to install the equipment. The machinery has an economic life of four years, and Shrieves 12 has obtained a special tax ruling which places the equipment in the MACRS three-year class. The machinery 13 is expected to have a salvage value of $25,000 after four years of use. The new line would generate 14 incremental sales of 1,250 scans per year for four years at an incremental cost of $100 per scan in the 15 first year, excluding depreciation. Each scan would generate revenue of $200 in the first year. The price 16 and cost of each scan are expected to increase by 3 percent per year due to inflation. Further, to handle 17 the new line, the hospital's net operating working capital would have to increase by an amount equal to 12 18 percent of sales revenues*. The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 19 percent. 20 23 21 a. Perform a sensitivity analysis on the corporate cost of capital, number of scans, and salvage value. 22 Assume that each of these variables can vary from its base case by plus and minus 15 and 30 percent. Include a sensitivity diagram. 24 b. Perform a scenario analysis using the worst-, most likely, and best-case probabilities in the table below: 25 26 Number of Price 27 Scenario Probability scans per scan 28 Best 25% 1,600 $240 29 Most likel 50% 1,250 $200 30 Worst 25% 900 $160 31 32 c. Assume that Shrieves's average project has a coefficient of variation of NPV in the range of 0.2-0.4. 33 The hospital typically adds or subtracts 3 percentage points to its corporate cost of capital to adjust for risk. Should the new line be accepted? 35 34 36 - B D E F G H I J 37 In the section entitled "Changes in Net Working Capital" in Chapter 11, Gapenski states that expansion 38 projects require additional inventories and accounts receivable which must be financed, just as an increase 39 in fixed assets must be financed. In this situation, the hospital's net working capital would have to increase 40 by an amount equal to 12 percent of sales. Sales in Year 1 are estimated at $250,000, so Shrieves must 41 have (.12 * $250,000 =) $30,000 in net working capital at Year 0. If sales increase to $257,500 in Year 2, 42 Shrieves must have (.12 * $257,500 =) $30,900 at Year 1. Because it already has $30,000 of net working 43 capital on hand, its net investment in working capital at Year 1 is just ($30,900 - $30,000 =) $900. If sales 44 increase to $265,225 in Year 3, its net investment in working capital in Year 2 is (.12 * 265,225=) 45 $31, 827 - $30,900 = $927. If sales increase to $273,182 in Year 4, its net investment in working capital 46 in Year 3 is (-12 * 273,182 =) $32,782 - $31,827 = $955. Shrieves will have no sales after Year 4, so it will 47 require no working capital at Year 4. Thus, it would have a positive cash flow of $32,782 at Year 4 as 48 working capital is sold but not replaced. 49 50 ANSWER 51 Equipment cost ($200,000) Number of scans 1250 52 Shipping charge ($10,000) Price per scan $200 53 Installation charge ($30,000) Cost per scan ($100) 54 Pretax equipment salvage value $25,000 Inventory/sales -12% 55 Tax rate 20% Annual inflation rate 3% 56 Corporate cost of capital 10% 57 MACRS recovery allowances 33% 45% 15% 7% 58 59 1 2 3 4 60 Equipment cost $240,000 61 Sales $250,000 $257,500 $265,225 $273,182 62 Less: Costs -$125,000 $128,750 $132,500 $136,250 63 Depreciation $ 79,992 -$106,680 $35,544 -$17,784 64 Operating income before taxes $45,008 $22,070 $97,181 $119,148 65 Taxes $9,002 $4,414 $19,436 $23,830 66 Net operating income after taxes $54,010 $26,484 $116,617 $142,978 67 Less: Investment in working capital $30,000 -$900 -$927 $955 $32,782 J A B D 68 Plus: Depreciation 69 Plus: After-tax equipment salvage value* 70 Net cash flow 71 E F G H I $79,992 $106,680 $35,544 $17,784 $20,000 -$270,000 $133,102 $132,237 $151,206 $213,543 72 - 73 Pretax equipment salvage value 74 MACRS equipment salvage value 75 Difference 76 Taxes 77 After-tax equipment salvage value 78 79 NPV $219,745 80 IRR 40.7% 81 MIRR 27.7% 82 $25,000 $0 $25,000 $5,000 $20,000 83 a. 87 84 Change 85 from Number Salvage 86 base case CCC of scans value -30% 7.0% 875.0 $17,500 88 -15% 8.5% 1,062.5 $21,250 89 0% 10.0% 1,250.0 $25,000 90 15% 11.5% 1,437.5 $28,750 91 30% 13.0% 1,625.0 $32,500 92 93 Change NPV 94 from Number Salvage 95 base case CCC of scans value 96 -30% $256,236 $153,821 $0 97 -15% $237,472 $186,783 $0 98 0% $219,745 $219,745 $219,745 E 1 J 110 { $150,000 B D F G H I 99 15% $202,981 $252,707 $0 100 30% $187,114 $285,668 $0 101 102 103 Sensitivity Analysis 104 105 $300,000 106 107 $250,000 108 $200,000 CCC $ - Number of scans 111 $100,000 Salvage value 112 113 $50,000 114 115 -30% -15% 0% 15% 30% 116 117 Change from base case 118 119 120 b. 121 Change the number of scans and price per scan in cells 151 and 152 to the values in the table below and 122 you will obtain the NPVs in the far right column in the table below. 123 124 Number Price 125 Scenario Probabilit of scans per scan NPV 126 Best case 0% 0 $0 127 Base case 0% 0 $0 $0 128 Worst cas 0% 0 $0 $0 129 $0 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts