Question: please help me find the right answer for questions 1, 3, 6, & 7 and explain why thank you At the end of the year,

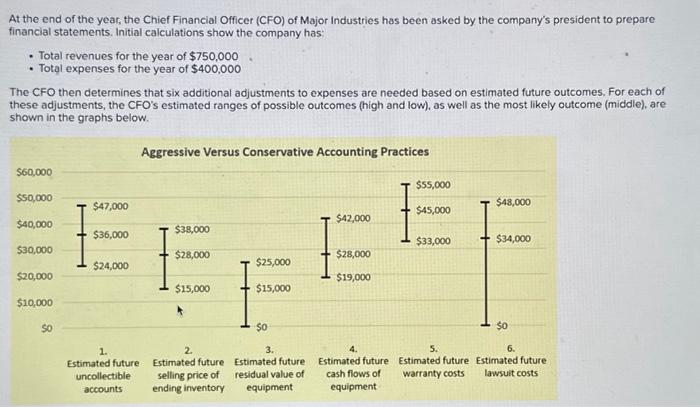

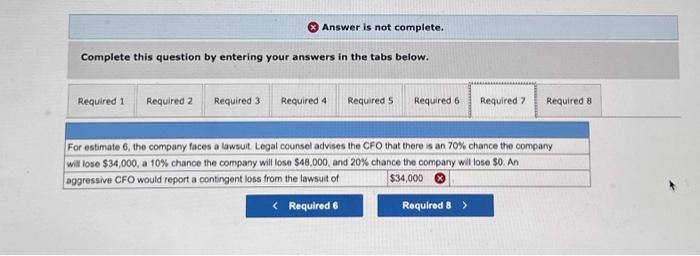

At the end of the year, the Chief Financial Officer (CFO) of Major Industries has been asked by the company's president to prepare financial statements. Initial calculations show the company has: - Total revenues for the year of $750,000 - Total expenses for the year of $400,000 The CFO then determines that six additional adjustments to expenses are needed based on estimated future outcomes, For each of these adjustments, the CFO's estimated ranges of possible outcomes (high and low), as well as the most likely outcome (middle), are shown in the graphs below. Answer is not complete. Complete this question by entering your answers in the tabs below. What is the reported amount of net income prior to any of the five adjustments? Answer is not complete. Complete this question by entering your answers in the tabs below. Answer is not complete. Complete this question by entering your answers in the tabs below. For estimate 5 , a conservative CFO would report estimated future warranty costs of $33,000 Answer is not complete. Complete this question by entering your answers in the tabs below. of estimate 6, the company faces a lawsuit Legal counsel advises the CFO that there is an 70% chance the company Il lose $34,000, a 10% chance the company will lose $48,000, and 20% chance the company will lose $0. An ggressive CFO would report a contingent loss from the lawsult of At the end of the year, the Chief Financial Officer (CFO) of Major Industries has been asked by the company's president to prepare financial statements. Initial calculations show the company has: - Total revenues for the year of $750,000 - Total expenses for the year of $400,000 The CFO then determines that six additional adjustments to expenses are needed based on estimated future outcomes, For each of these adjustments, the CFO's estimated ranges of possible outcomes (high and low), as well as the most likely outcome (middle), are shown in the graphs below. Answer is not complete. Complete this question by entering your answers in the tabs below. What is the reported amount of net income prior to any of the five adjustments? Answer is not complete. Complete this question by entering your answers in the tabs below. Answer is not complete. Complete this question by entering your answers in the tabs below. For estimate 5 , a conservative CFO would report estimated future warranty costs of $33,000 Answer is not complete. Complete this question by entering your answers in the tabs below. of estimate 6, the company faces a lawsuit Legal counsel advises the CFO that there is an 70% chance the company Il lose $34,000, a 10% chance the company will lose $48,000, and 20% chance the company will lose $0. An ggressive CFO would report a contingent loss from the lawsult of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts