Question: Please help me find the right answer for this question. Thank you so much! Depreciation of property other than real property begins in the middle

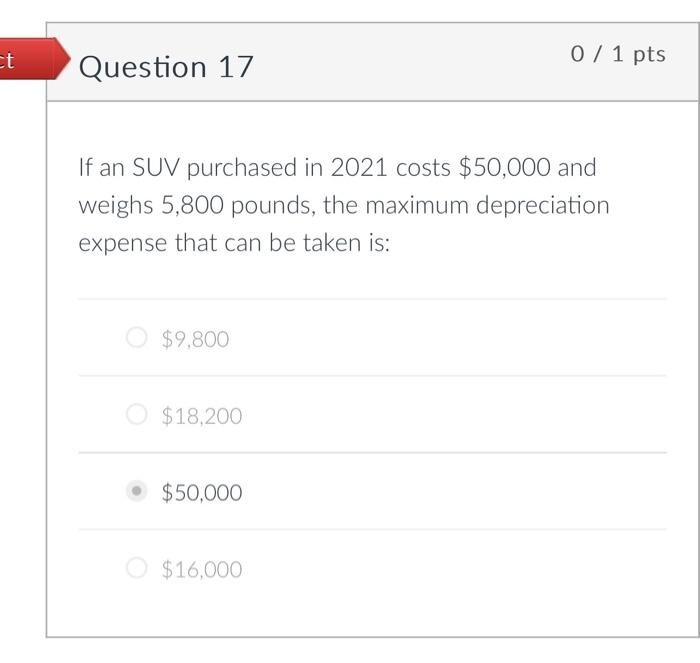

Depreciation of property other than real property begins in the middle of the quarter in which it is placed in service when more than: 25% of the total cost of Section 179 property placed in service during the year occurs during the fourth quarter. 40% of the total cost of all depreciable property placed in service during the year occurs during the fourth quarter. 25% of the total cost of all depreciable property placed in service during the year occurs during the fourth quarter. 40% of the total cost of property less any Section 179 deduction placed in service during the year occurs during the fourth quarter. If an SUV purchased in 2021 costs $50,000 and weighs 5,800 pounds, the maximum depreciation expense that can be taken is: \begin{tabular}{|} $9,800 \\ $18,200 \\ $50,000 \\ $16,000 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts