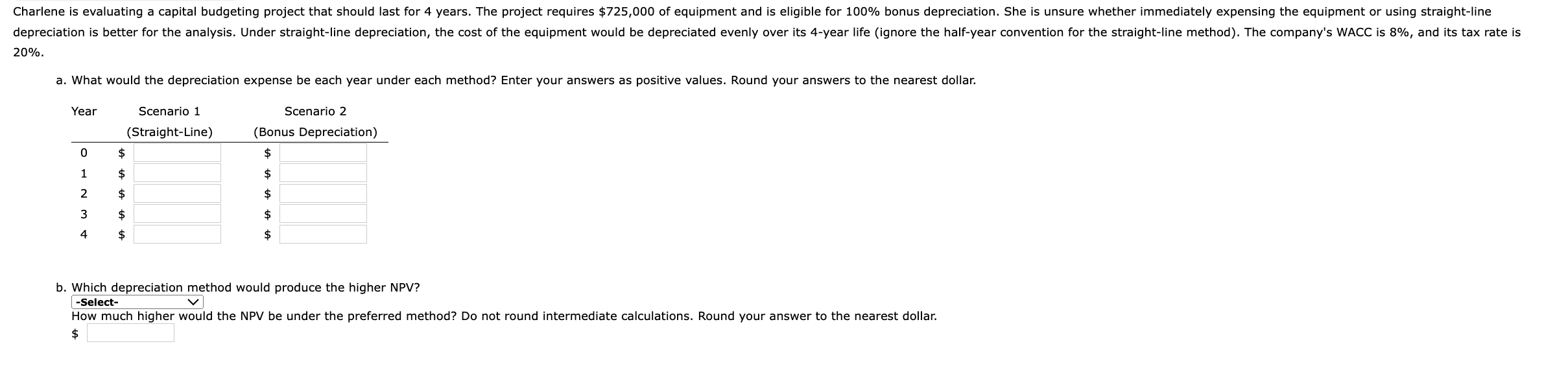

Question: PLEASE HELP ME FINISH ASAP! - - 20% a. What would the depreciation expense be each year under each method? Enter your answers as positive

PLEASE HELP ME FINISH ASAP!  -

-

-

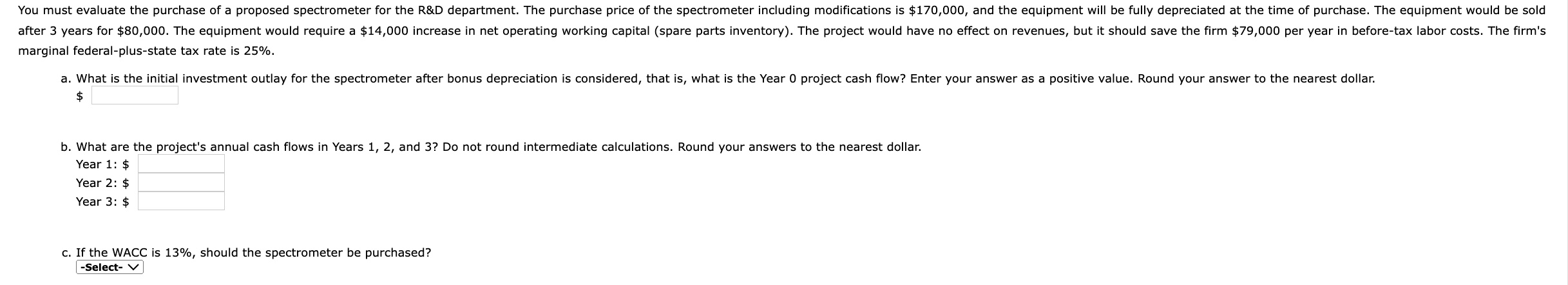

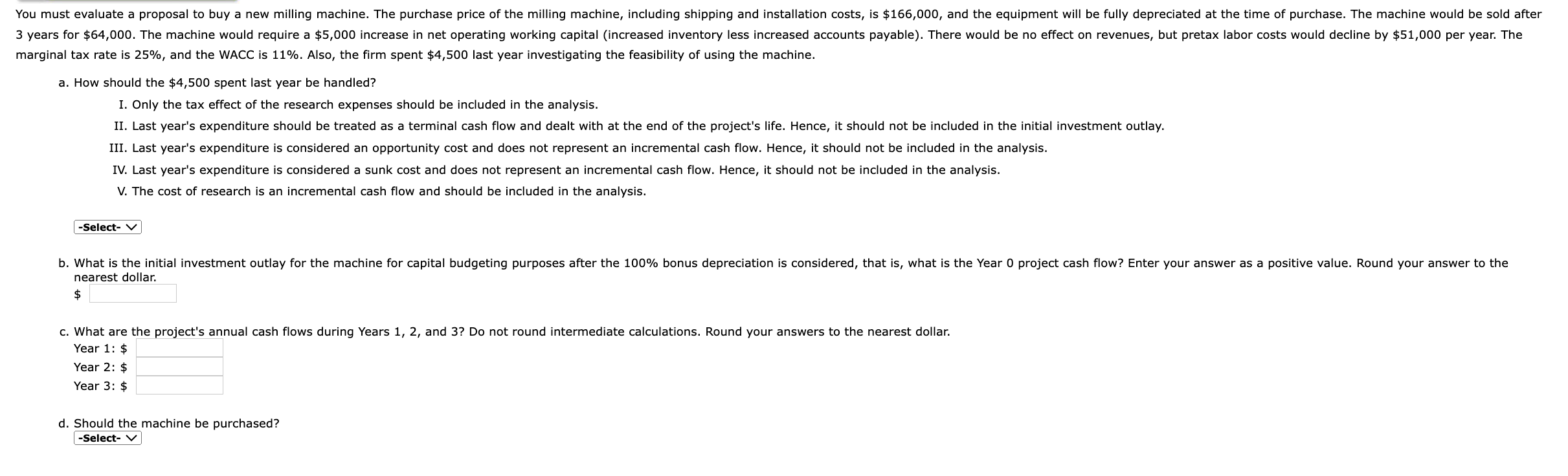

20% a. What would the depreciation expense be each year under each method? Enter your answers as positive values. Round your answers to the nearest dollar. b. Which depreciation method would produce the higher NPV? -Select- How much higher would the NPV be under the preferred method? Do not round intermediate calculations. Round your answer to the nearest dollar. $ marginal federal-plus-state tax rate is 25%. b. What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2: $ Year 3: $ c. If the WACC is 13%, should the spectrometer be purchased? marginal tax rate is 25%, and the WACC is 11%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? I. Only the tax effect of the research expenses should be included in the analysis. III. Last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. IV. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. V. The cost of research is an incremental cash flow and should be included in the analysis. -Select- V nearest dollar. $ c. What are the project's annual cash flows during Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2:$ Year 3: $ d. Should the machine be purchased? -Select- V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts