Question: Please help me finish these questions Please help me, I will give you a good rating All information about federal student loans can be found

Please help me finish these questions

Please help me, I will give you a good rating

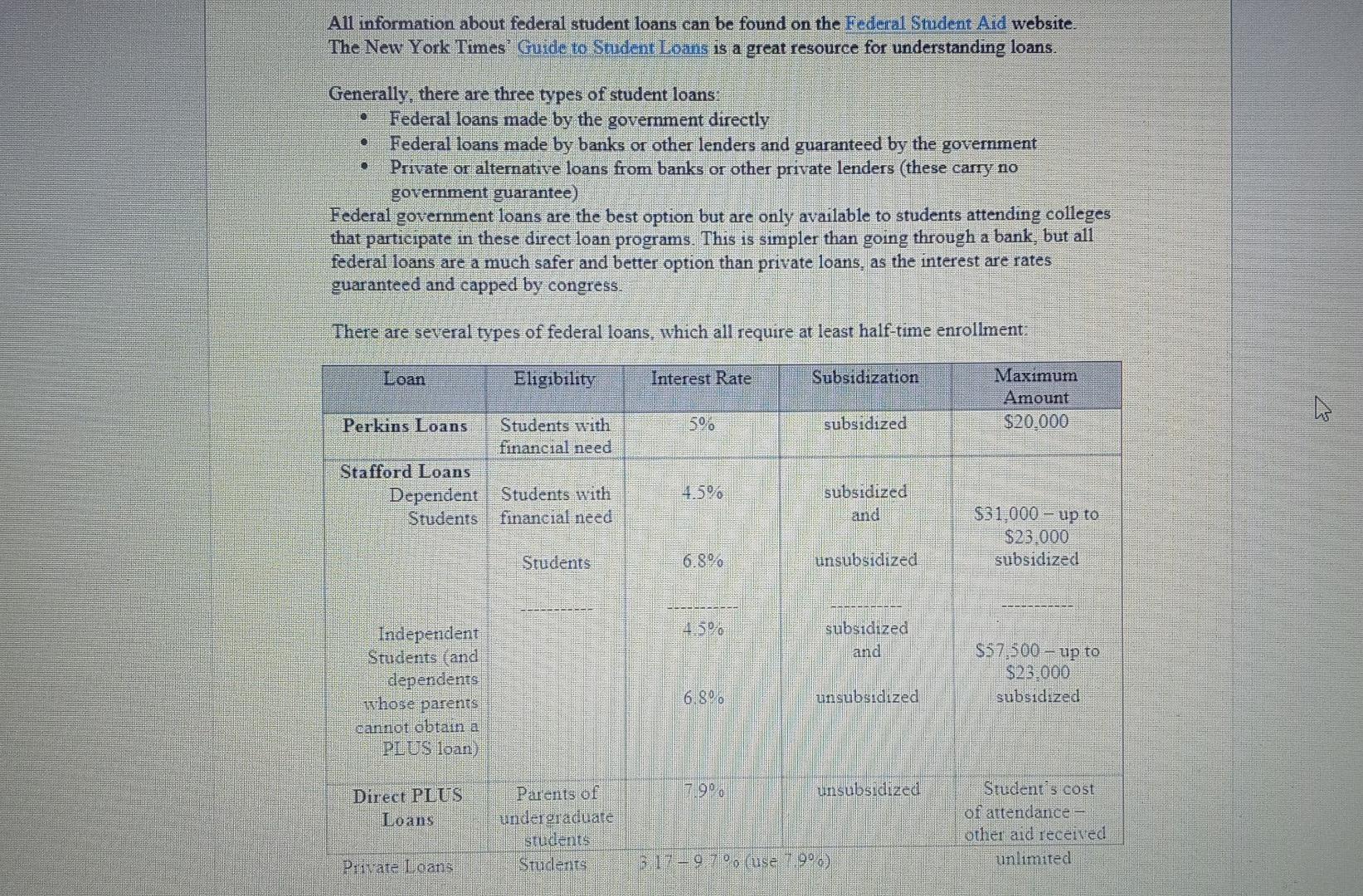

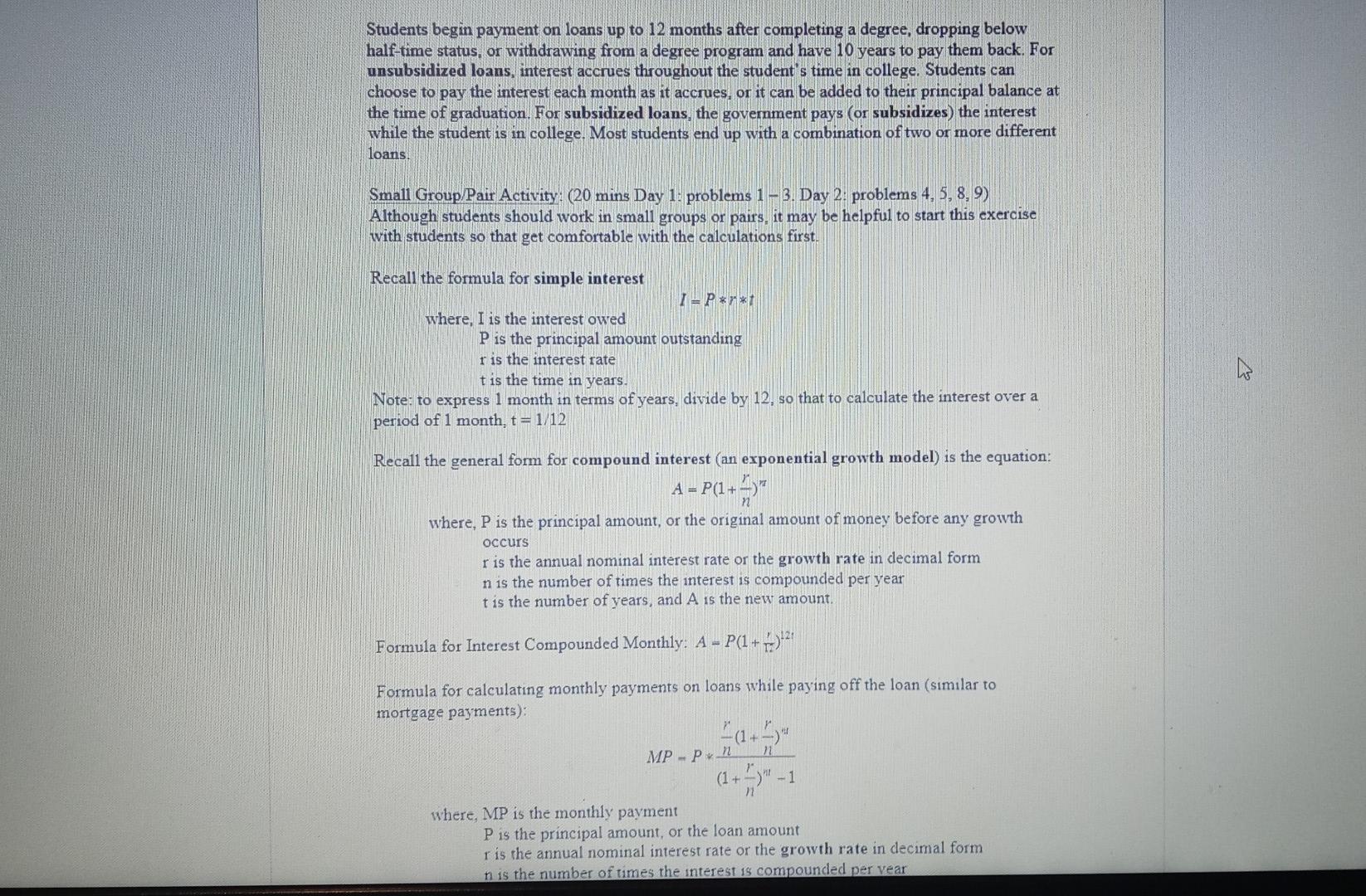

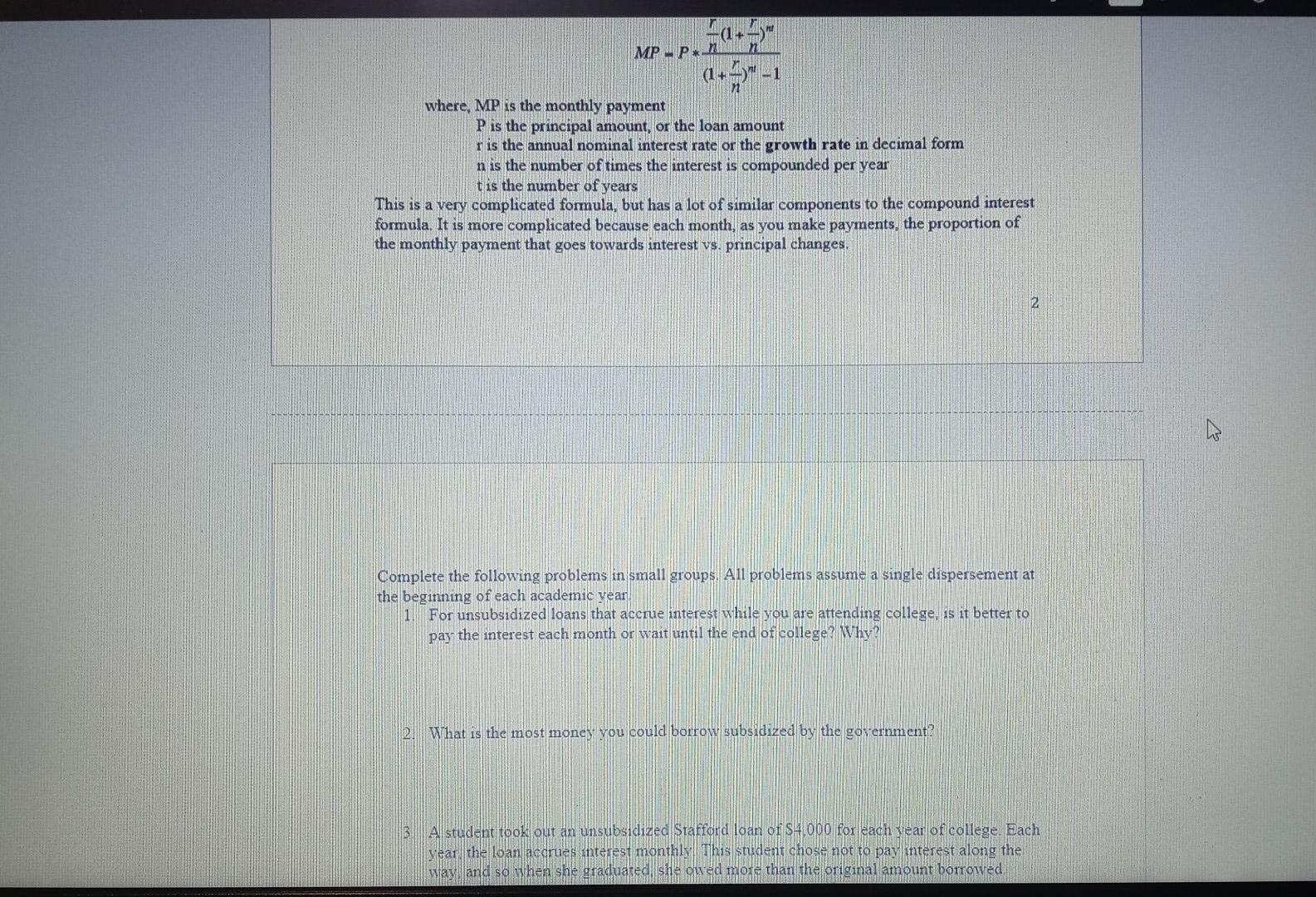

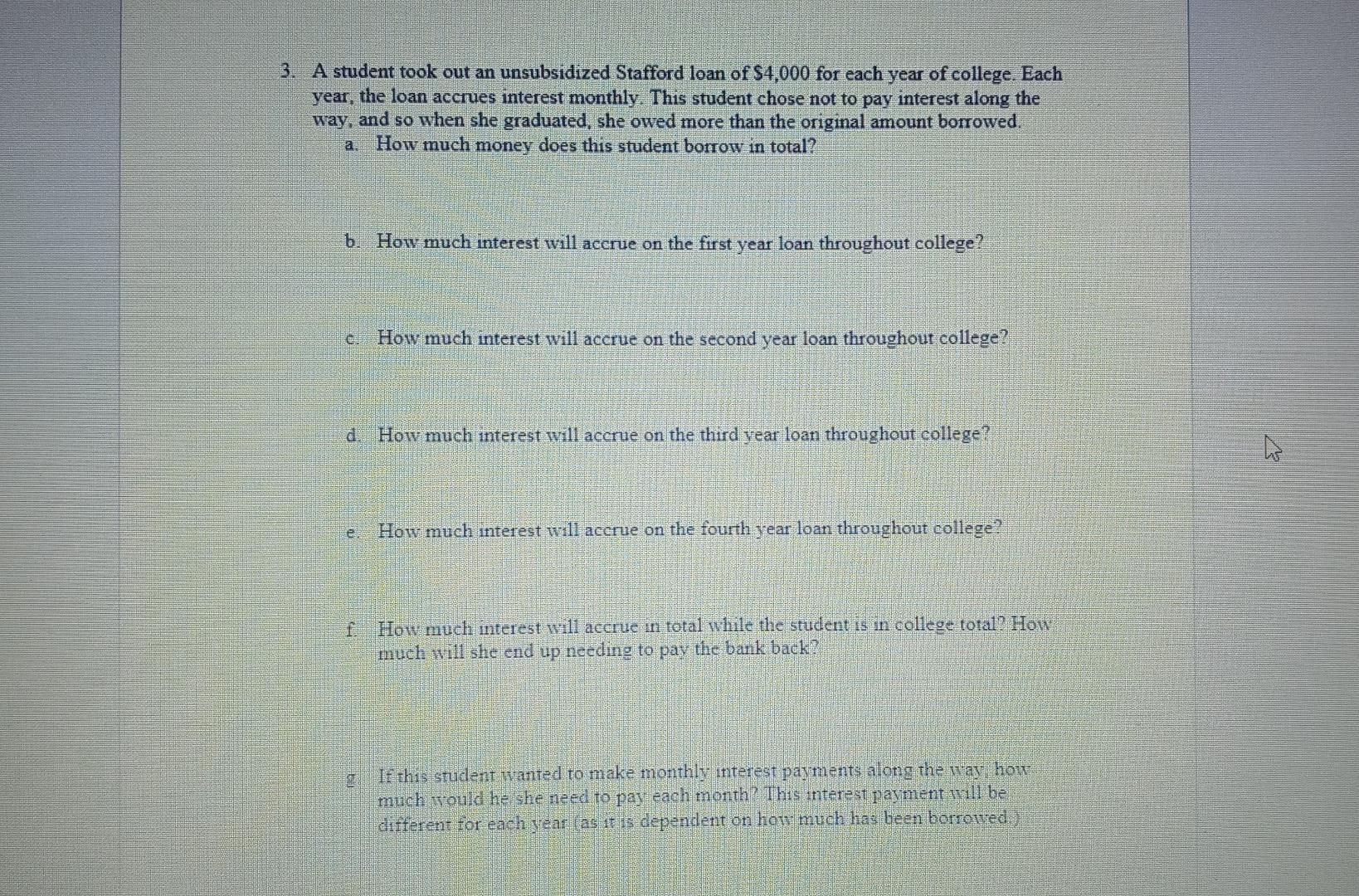

All information about federal student loans can be found on the Federal Student Aid website. The New York Times. Guide to Student Loans is a great resource for understanding loans. Generally, there are three types of student loans: Federal loans made by the government directly Federal loans made by banks or other lenders and guaranteed by the government Private or alternative loans from banks or other private lenders (these carry no government guarantee) Federal government loans are the best option but are only available to students attending colleges that participate in these direct loan programs. This is simpler than going through a bank, but all federal loans are a much safer and better option than private loans, as the interest are rates guaranteed and capped by congress. There are several types of federal loans, which all require at least half-time enrollment: Loan Eligibility Interest Rate Subsidization Maximum Amount $20.000 506 subsidized Perkins Loans Students with financial need Stafford Loans Dependent Students with Students financial need 4.590 subsidized and $31,000 = up to $23.000 subsidized Students 6.8% unsubsidized 150 subsidized and Independent Students and dependents whose parents cannot obtain a PLUS loan $57,500 up to $23000 subsidized 6.800 unsubsidized 7.90 unsubsidized Direct PLUS Loans Parents of undergraduate students Students Student's cost of attendance other and received unlimited Pirate Loans 17- 97 n use 790) Students begin payment on loans up to 12 months after completing a degree, dropping below half-time status, or withdrawing from a degree program and have 10 years to pay them back. For unsubsidized loans, interest accrues throughout the student's time in college. Students can choose to pay the interest each month as it accrues, or it can be added to their principal balance at the time of graduation. For subsidized loans, the government pays (or subsidizes) the interest while the student is in college. Most students end up with a combination of two or more different loans. Small Group/Pair Activity (20 mins Day 1: problems 1 - 3. Day 2: problems 4, 5, 8, 9) Although students should work in small groups or pairs, it may be helpful to start this exercise with students so that get comfortable with the calculations first. Recall the formula for simple interest T-P*** where, I is the interest owed P is the principal amount outstanding r is the interest rate t is the time in years. Note: to express 1 month in terms of years, divide by 12, so that to calculate the interest over a period of 1 month, t = 1/12 Recall the general form for compound interest (an exponential growth model) is the equation: A = P(1+52 n where, P is the principal amount, or the original amount of money before any growth occurs r is the annual nominal interest rate or the growth rate in decimal form n is the number of times the interest is compounded per year t is the number of years, and A is the new amount. Formula for Interest Compounded Monthly: A - P(1 + ->12 Formula for calculating monthly payments on loans while paying off the loan (similar to mortgage payments): *(1+) MP - Pn 11 (1+-> where, MP is the monthly payment P is the principal amount, or the loan amount r is the annual nominal interest rate or the growth rate in decimal form n is the number of times the interest is compounded per vear 0.5-1 a. MPP (+43"-1 where, MP is the monthly payment P is the principal amount, or the loan amount r is the annual nominal interest rate or the growth rate in decimal form n is the number of times the interest is compounded per year t is the number of years This is a very complicated formula, but has a lot of similar components to the compound interest formula. It is more complicated because each month, as you make payments, the proportion of the monthly payment that goes towards interest vs. principal changes, 2 Complete the following problems in small groups. All problems assume a single dispersement at the beginning of each academic year For unsubsidized loans that accrue interest while you are attending college, is it better to pay the interest each month or wait until the end of college? Vhy? D What is the most money you could borrow subsidized by the government? 3A student took out an unsubsidized Stafford loan of St.obo for each year of college. Each year, the loan accrues interest monthly This student chose not to paylinterest along the way, and so when she graduated she owed more than the original amount borrowed 3. A student took out an unsubsidized Stafford loan of $4,000 for each year of college. Each year, the loan accrues interest monthly. This student chose not to pay interest along the way, and so when she graduated, she owed more than the original amount borrowed. How much money does this student borrow in total? a b. How much interest will accrue on the first year loan throughout college? How much interest will accrue on the second year loan throughout college? d How much interest will accrue on the third year loan throughout college? e How much interest will accrue on the fourth year loan throughout college? How much interest will accrue in total while the student is in college total? How much will she end up needing to pay the bank back? ST T this student wanted to make monthly interest payments along the way how much trould he she need to pay each month? This interest payment will be different for each year (as it is dependent on how much has been borrowed) 7. Do you think you will pay your interest while in college? Why or why not? 8. Most repayment plans allow you 10 years to pay your loan back Calculate your monthly payments based on your principal owed after graduating. Use your answer to either (d) or (1). depending on if you plan to pay your interest along the way or not. ON How much will you end up paying for your loan total? (What is the difference between the amount you borrow (d) and the amount you actually have to play back including interest 10 Does this seem like a reasonable amount to pay each month? Why or why not? 11 Do these calculations change your thoughts about bonowing more college Why or why motz

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts