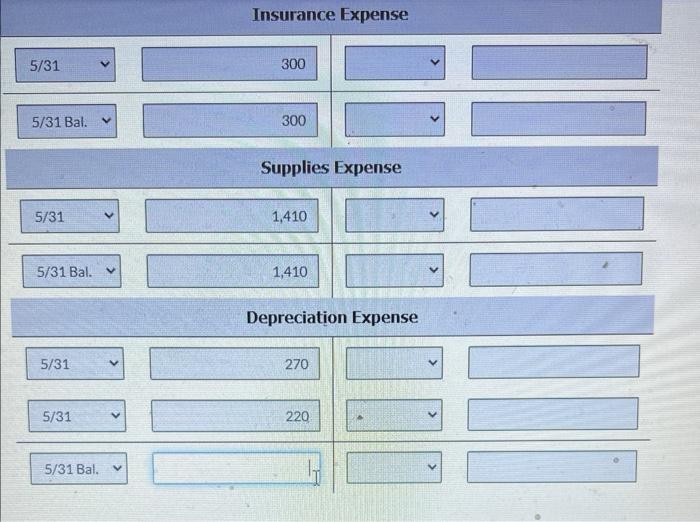

Question: please help me for the correct answer depreciation expenses for 5/31 Bal. The Sandhill Hotel opened for business on May 1, 2022. Here is its

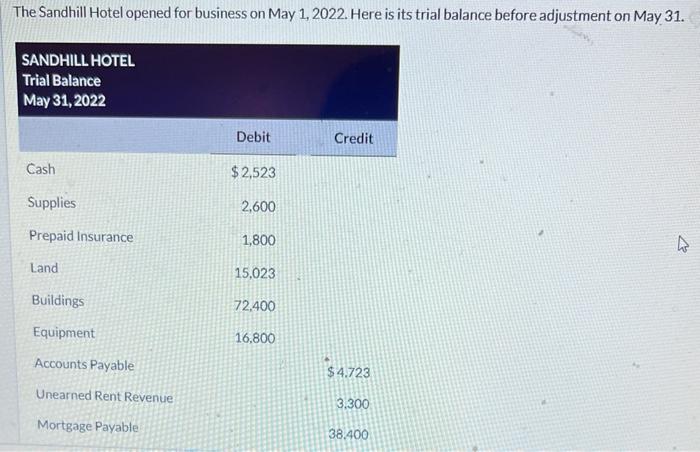

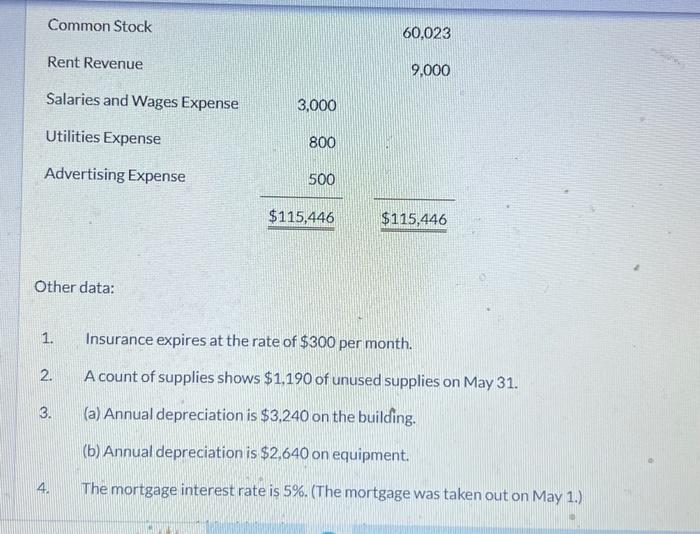

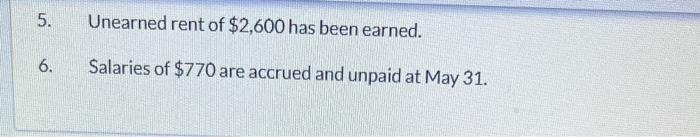

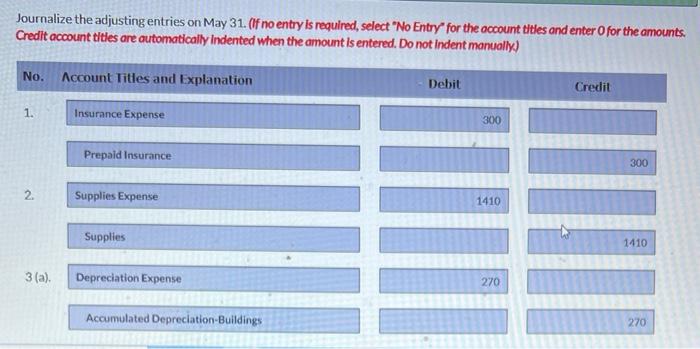

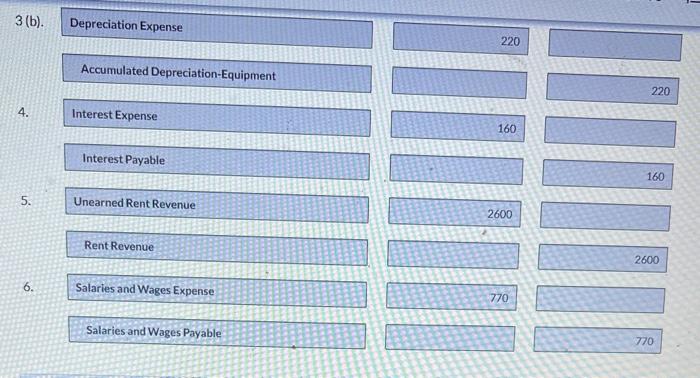

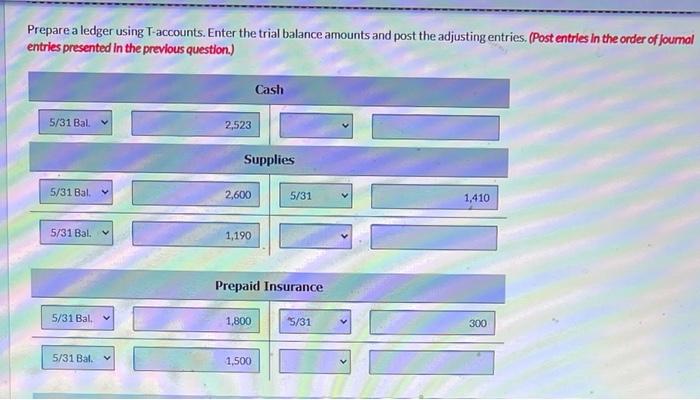

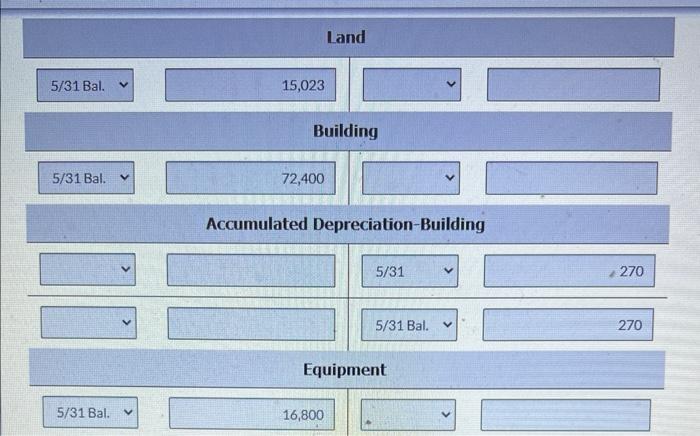

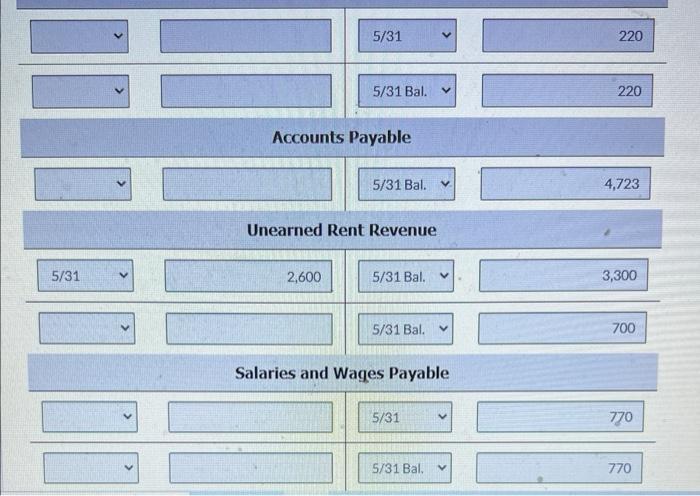

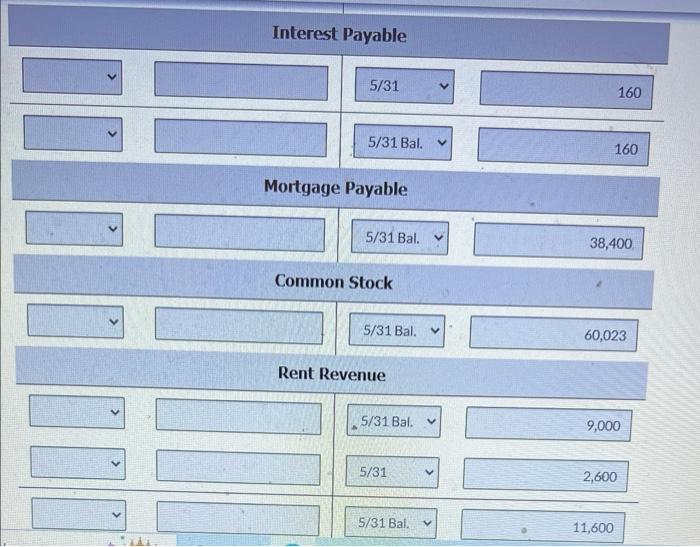

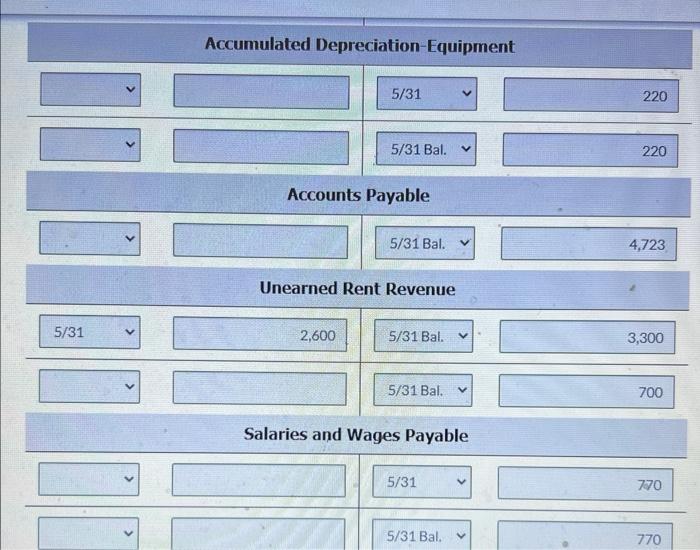

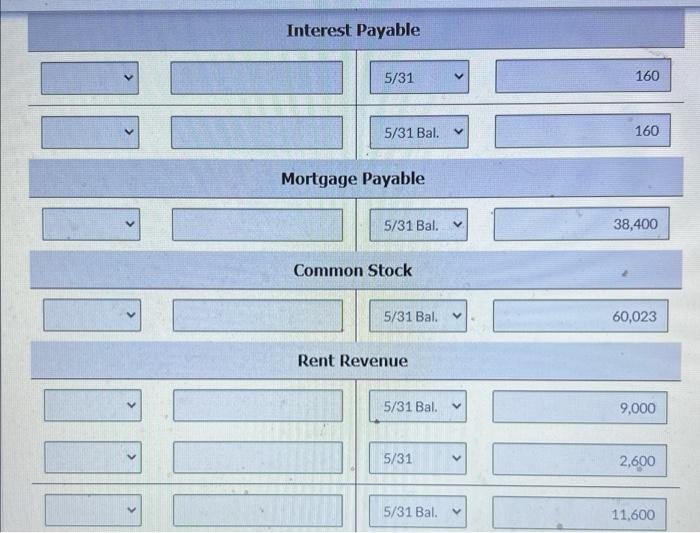

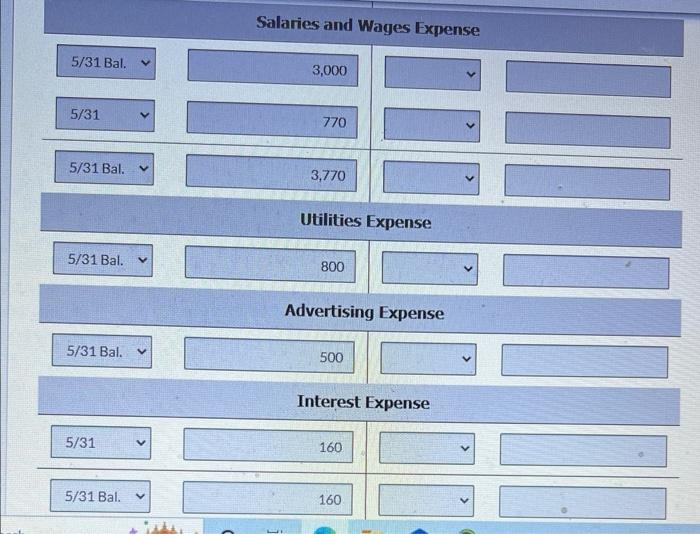

The Sandhill Hotel opened for business on May 1, 2022. Here is its trial balance before adjustment on May 31. Other data: 1. Insurance expires at the rate of $300 per month. 2. A count of supplies shows $1,190 of unused supplies on May 31 . 3. (a) Annual depreciation is $3,240 on the building. (b) Annual depreciation is $2,640 on equipment. 4. The mortgage interest rate is 5%. (The mortgage was taken out on May 5. Unearned rent of $2,600 has been earned. 6. Salaries of $770 are accrued and unpaid at May 31 . Journalize the adjusting entries on May 31. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manuolly) Salaries and Wages Payable 770 Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (Post entrles in the order of foumol entries presented in the previous question.) Land Accumulated Depreciation-Building Equipment Accounts Payable Unearned Rent Revenue Salaries and Wages Payable Interest Payable Mortgage Payable Rent Revenue Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Interest Payable Salaries and Wages Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts