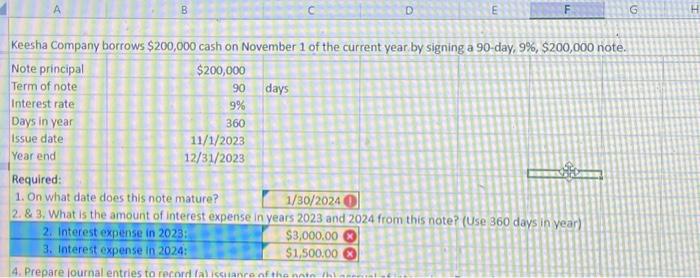

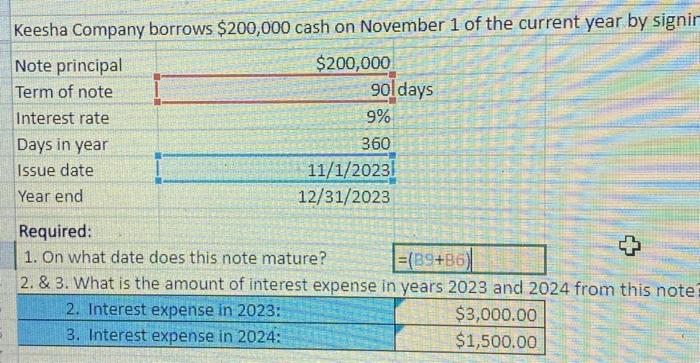

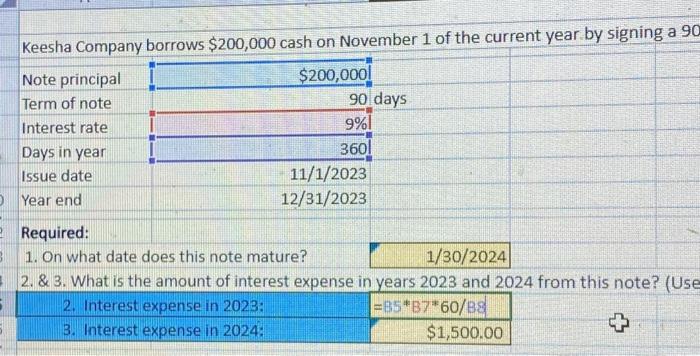

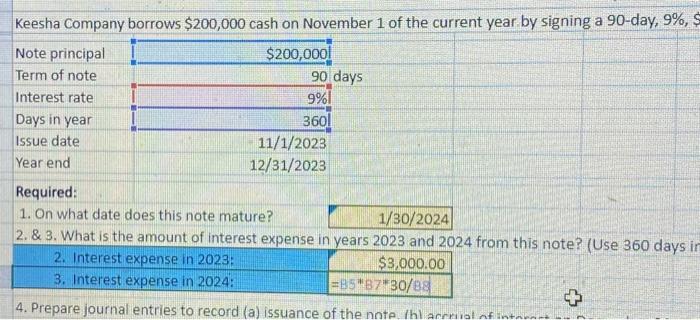

Question: please help me get the correct formula in the excel sheet to reflect the right answer. Keesha Company borrows $200,000 cash on November 1 of

Keesha Company borrows $200,000 cash on November 1 of the current year by signit Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90 -day, 9%, Note principal Term of note Interest rate Days in year Issue date Year end Required: 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in vears 2023 and 2024 from this note? (Use 360 days Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90 \begin{tabular}{l} Note principal \\ Term of note \\ Interest rate \\ Days in year \\ \hline Issue date \\ Year end \\ \hline Required: \\ \hline 1. On what date does this note mature? \end{tabular} 2. \& 3. What is the amount of interest expense in years 2023 and 2024 from this note? (Use 2. Interest expense in 2023 : 3. Interest expense in 2024: $1,500.00=853760/88 A B C D E F Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90-day, 9\%, $200,000 note. Note principal Term of note Interest rate Days in year Issue date Year end $200,000 Required: 1. On what date does this note mature? 1/30/20240 2. \& 3. What is the amount of interest expense in years 2023 and 2024 from this note? (Use 360 days in year) 2. Interest expense in 2023: 3. Interest expense in 2024: $3,000,00 4. Prepare lournal entries to record fal iseuanco

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts