Question: Please help me ! ! ! Holly was an employee in Alberta whose employment was terminated during the current year. Using the information from the

Please help me

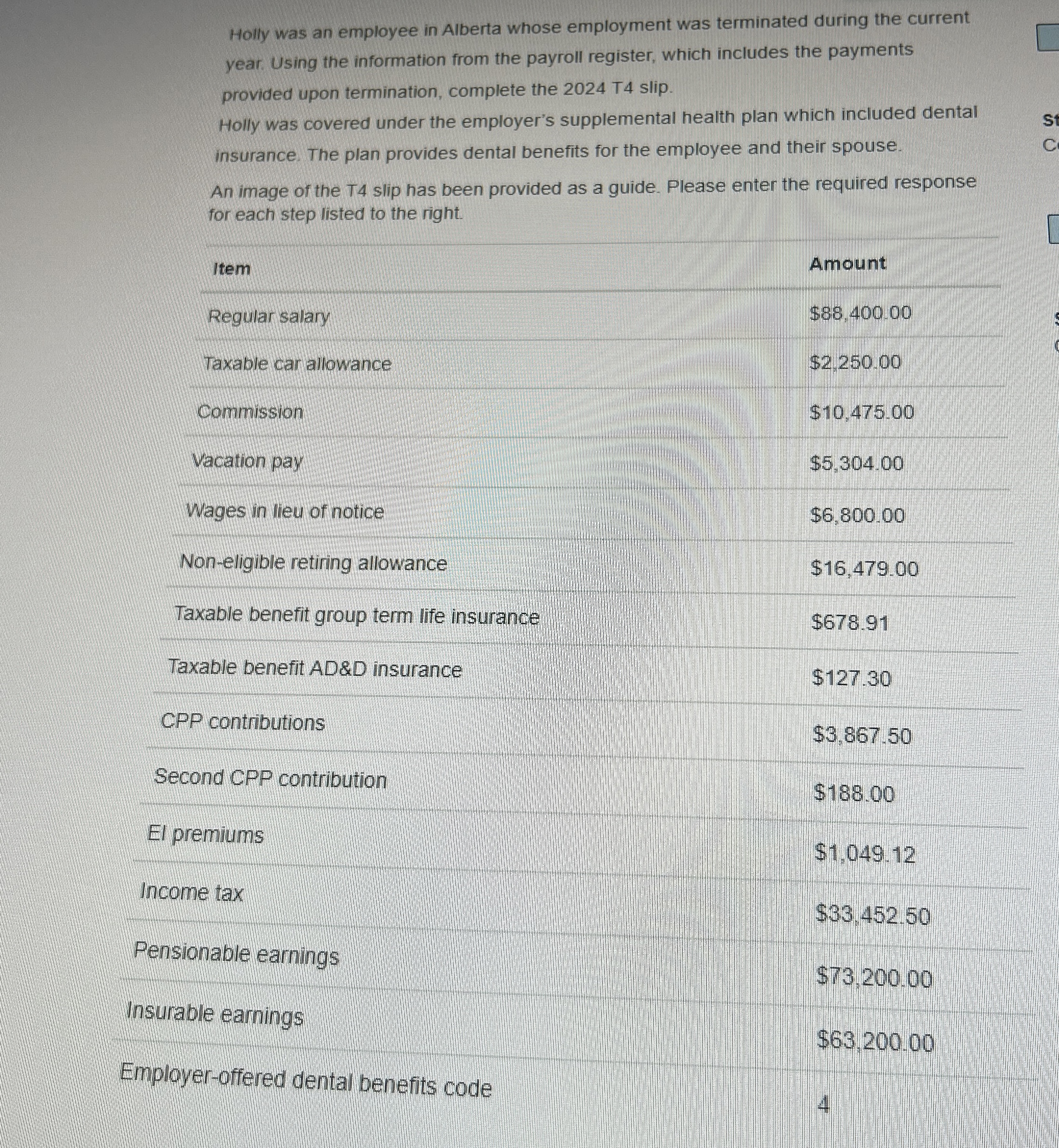

Holly was an employee in Alberta whose employment was terminated during the current year. Using the information from the payroll register, which includes the payments provided upon termination, complete the T slip.

Holly was covered under the employer's supplemental health plan which included dental insurance. The plan provides dental benefits for the employee and their spouse.

An image of the slip has been provided as a guide. Please enter the required response for each step listed to the right.

emAmountRegular salary,$

QUESTIONS:

step complete box

stepcomplwfe box

complete box a

complete box

complete box

complete box

complete box

complete box

enter the code for other taxable benefits and allowances

enter the correct amount for other taxable benefits and allowances

enter the code for commission earnings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock