Question: Please help me how to do the T1 for this problem. Lynn Simpson suddenly died on November 15, 2021 at the age of 53. Lynn

Please help me how to do the T1 for this problem.

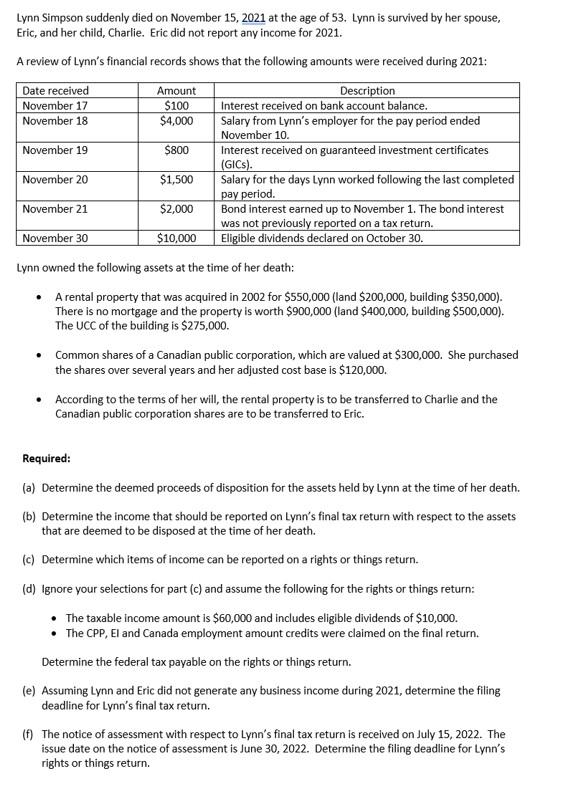

Lynn Simpson suddenly died on November 15, 2021 at the age of 53. Lynn is survived by her spouse, Eric, and her child, Charlie. Eric did not report any income for 2021. A review of Lynn's financial records shows that the following amounts were received during 2021: Lynn owned the following assets at the time of her death: - A rental property that was acquired in 2002 for $550,000 (land $200,000, building $350,000 ). There is no mortgage and the property is worth $900,000 (land $400,000, building $500,000 ). The UCC of the building is $275,000. - Common shares of a Canadian public corporation, which are valued at $300,000. She purchased the shares over several years and her adjusted cost base is $120,000. - According to the terms of her will, the rental property is to be transferred to Charlie and the Canadian public corporation shares are to be transferred to Eric. Required: (a) Determine the deemed proceeds of disposition for the assets held by Lynn at the time of her death. (b) Determine the income that should be reported on Lynn's final tax return with respect to the assets that are deemed to be disposed at the time of her death. (c) Determine which items of income can be reported on a rights or things return. (d) Ignore your selections for part (c) and assume the following for the rights or things return: - The taxable income amount is $60,000 and includes eligible dividends of $10,000. - The CPP, El and Canada employment amount credits were claimed on the final return. Determine the federal tax payable on the rights or things return. (e) Assuming Lynn and Eric did not generate any business income during 2021, determine the filing deadline for Lynn's final tax return. (f) The notice of assessment with respect to Lynn's final tax return is received on July 15, 2022. The issue date on the notice of assessment is June 30, 2022. Determine the filing deadline for Lynn's rights or things return. Lynn Simpson suddenly died on November 15, 2021 at the age of 53. Lynn is survived by her spouse, Eric, and her child, Charlie. Eric did not report any income for 2021. A review of Lynn's financial records shows that the following amounts were received during 2021: Lynn owned the following assets at the time of her death: - A rental property that was acquired in 2002 for $550,000 (land $200,000, building $350,000 ). There is no mortgage and the property is worth $900,000 (land $400,000, building $500,000 ). The UCC of the building is $275,000. - Common shares of a Canadian public corporation, which are valued at $300,000. She purchased the shares over several years and her adjusted cost base is $120,000. - According to the terms of her will, the rental property is to be transferred to Charlie and the Canadian public corporation shares are to be transferred to Eric. Required: (a) Determine the deemed proceeds of disposition for the assets held by Lynn at the time of her death. (b) Determine the income that should be reported on Lynn's final tax return with respect to the assets that are deemed to be disposed at the time of her death. (c) Determine which items of income can be reported on a rights or things return. (d) Ignore your selections for part (c) and assume the following for the rights or things return: - The taxable income amount is $60,000 and includes eligible dividends of $10,000. - The CPP, El and Canada employment amount credits were claimed on the final return. Determine the federal tax payable on the rights or things return. (e) Assuming Lynn and Eric did not generate any business income during 2021, determine the filing deadline for Lynn's final tax return. (f) The notice of assessment with respect to Lynn's final tax return is received on July 15, 2022. The issue date on the notice of assessment is June 30, 2022. Determine the filing deadline for Lynn's rights or things return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts