Question: Please help me how to get this answer X 18.7-11a Question Help On January 1, 2019, Precision Pumps leases nonspecialized pumping equipment to Mega Construction.

Please help me how to get this answer

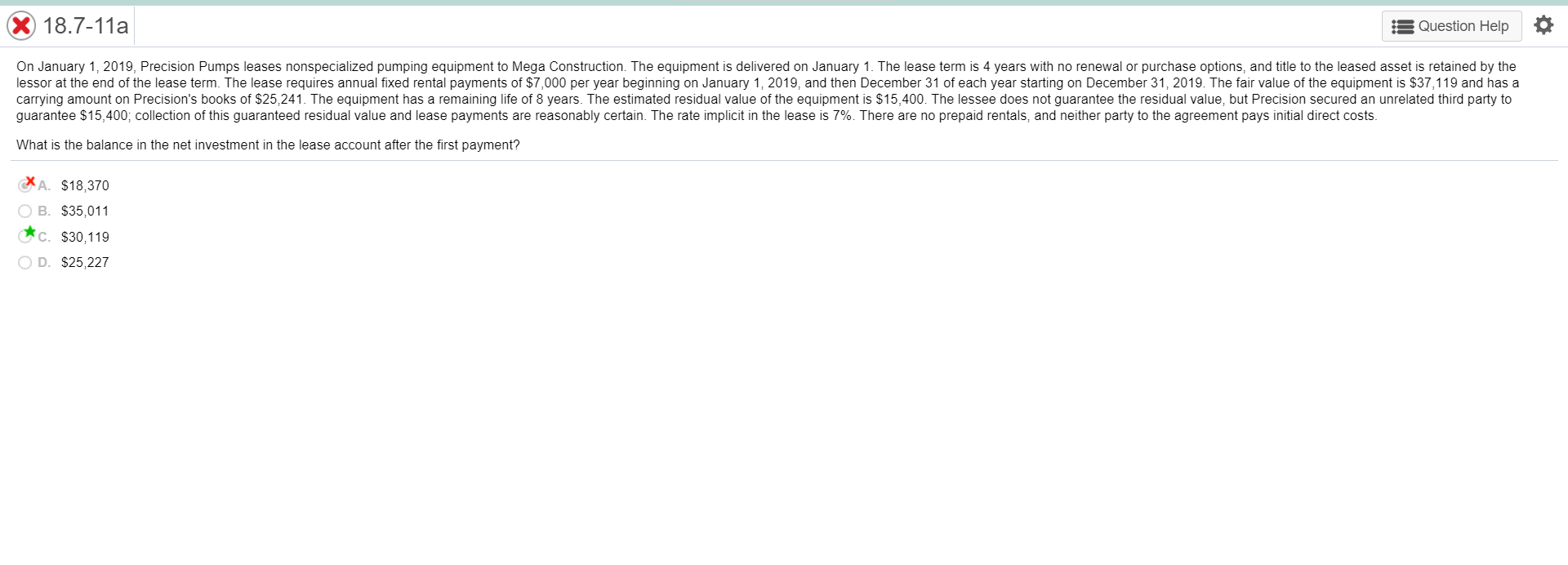

X 18.7-11a Question Help On January 1, 2019, Precision Pumps leases nonspecialized pumping equipment to Mega Construction. The equipment is delivered on January 1. The lease term is 4 years with no renewal or purchase options, and title to the leased asset is retained by the lessor at the end of the lease term. The lease requires annual fixed rental payments of $7,000 per year beginning on January 1, 2019, and then December 31 of each year starting on December 31, 2019. The fair value of the equipment is $37,119 and has a carrying amount on Precision's books of $25,241. The equipment has a remaining life of 8 years. The estimated residual value of the equipment is $15,400. The lessee does not guarantee the residual value, but Precision secured an unrelated third party to guarantee $15,400, collection of this guaranteed residual value and lease payments are reasonably certain. The rate implicit in the lease is 7%. There are no prepaid rentals, and neither party to the agreement pays initial direct costs. What is the balance in the net investment in the lease account after the first payment? XA. $18,370 O B. $35,011 *C. $30,119 OD. $25,227

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts